10 Companies for the next 10 years

Disruptive Innovation in green transformation, Enabling Technology, and Healthcare technology.

Looking ahead to the next decade, it’s clear that technology will continue to drive profound changes across multiple sectors. The companies poised for the greatest success will be those leveraging disruptive technologies to reshape industries and solve some of the world’s most pressing challenges. From Green transformation to healthcare technology, and enabling technologies, especially AI and Internet related, I believe we will see solid returns from these sectors.

These companies are not only riding the wave of innovation but also leading it, with strong structural trends supporting their potential for strong earnings growth. Whether it’s AI safeguarding critical infrastructure or healthcare technology revolutionizing drug development or enriching medical devices, the next decade will favor companies at the forefront of these technological shifts.

Let’s explore 10 companies that are set to perform well the next 10 years. These companies are not the Magnificent 7 that are well covered in many places. The companies in this list comes from 50% from USA, 40% Europe, and 10% Asia. I subscribe to the school of thought that the way to grow wealth is to invest in good companies and let those investments compound over time, so here are some ideas of companies, that I believe will fit that framework.

Alcon 🇨🇭

Alcon is a global leader in eyecare, designing, manufacturing, and distributing a full range of products across two main business segments: Surgical and Vision Care. In the Surgical segment, which makes up 57% of their sales, Alcon offers implantable products like intra-ocular lenses, along with consumables and surgical equipment such as lasers. On the Vision Care side (43% of sales), they focus on contact lenses and over-the-counter ocular health products. Alcon is a top player globally, holding the number one spot in surgical eyecare and the number two spot in vision care.

Headquartered in Geneva, Switzerland, Alcon is positioned in two thriving ophthalmology markets that are projected to grow at a steady mid-single-digit rate in the coming years. The company dominates the global market for intra-ocular lenses, a key component in cataract surgery, and is a major force in the contact lens market. Since its spin-off from Novartis in 2018, Alcon has ramped up investment, which is now starting to pay off with a series of new product launches. These launches are expected to not only grow market share but also improve operating margins.

Upcoming products include the Vinity contact lenses set for launch in China by Q3 2024, the Unity vitreoretinal cataract system in Q4 2024 (initially in the US, followed by international markets), Precision7 soft contact lenses in Q1 2025, and the Belkin Vision glaucoma laser device and AR-15512 dry eye drug later that year. Alcon also maintains low financial gearing, which provides additional stability.

However, like any company, Alcon faces risks. These include the potential failure of pipeline products, rising competition, legal challenges like product liability cases, and changes in regulatory or political environments. Currency fluctuations and interest rates could also impact the company’s financial performance. Despite these risks, Alcon’s strong product lineup and leading market positions suggest a promising future.

Broadcom 🇺🇸

Broadcom, founded in 1961 and based in San Jose, California, is a leader in designing and developing digital and analog semiconductors. The company serves a wide range of markets, from wired infrastructure and wireless communications to enterprise storage and industrial sectors. Its product offerings cover everything from data center networking and smartphone connectivity to telecommunications equipment and displays.

With over 50 years of innovation, starting from its origins as a semiconductor division of Hewlett-Packard, Broadcom has built a strong reputation in semiconductor design. Backed by more than 23,000 patents, the company generates over $35 billion in revenue and maintains a market-leading position. Its fabless manufacturing model enables it to generate robust free cash flow and focus on its core strengths in semiconductor research and development without heavy capital expenditure.

Broadcom is particularly well-positioned to capitalize on the structural demand for 5G-related solutions, data center storage, and industrial applications. Additionally, the growing contribution from its recurring software and service revenue is adding diversity and stability to its overall business. Also, 99.9% of all internet traffic cross at least one Broadcom chip. Read that again!

However, key risks remain. A potential macroeconomic downturn could weaken demand for semiconductors, while increasing competition and execution delays could also present challenges. Despite these risks, Broadcom’s solid market position and diversified portfolio suggest it’s set to continue leading in the semiconductor space.

Enel 🇮🇹

Enel is a major player in the energy sector, with significant operations in Italy and Spain, spanning power generation from both conventional and renewable sources, as well as supply and distribution. Originally a traditional Italian utility, Enel expanded its footprint into Eastern Europe, acquiring assets in Slovakia and Russia in the mid-2000s, and then made a transformative move into Spain and Latin America in 2008 through its acquisition of Endesa. Today, Enel stands as the world’s largest publicly listed renewable energy developer, with nearly 50GW of capacity spread across wind, solar, hydro, and other technologies.

While hydroelectric power currently dominates Enel’s renewable portfolio, the company’s growth will be driven by wind and solar, with plans to increase total renewable capacity to 73GW by 2026, adding 10GW from 2023. Enel is set to invest approximately EUR 35 billion between 2024 and 2026, focusing heavily on its network operations (52% of capex), which offer strong returns thanks to favorable regulatory frameworks. Renewables will receive 34% of total capital expenditures, targeting onshore wind, solar, and battery storage. The geographical focus remains on core markets like Italy, Spain, the US, and Latin America.

Enel also aims to cut costs by EUR +1 billion, which, alongside some asset disposals, is expected to boost EBITDA by around 5% annually and net income by about 6%. The company’s dividend is set at a minimum of EUR 0.43 per share, providing an attractive yield - currently yielding close to 6%.

However, there are risks to consider. Enel’s profitability is exposed to volatility in commodity and power prices, as well as fluctuations in interest rates and currency movements. Changes in political and regulatory environments, particularly around energy policies and taxes, could also impact the business.

Intuitive Surgical 🇺🇸

Intuitive Surgical is at the forefront of the robotic surgery market, designing, manufacturing, and marketing the well-known da Vinci Surgical System, along with related instruments and accessories. The da Vinci system includes a surgeon’s console, a patient-side cart, and a high-performance vision system, enabling minimally invasive surgeries with precision. The company generates revenue across three segments: Instruments and Accessories, Systems, and Services. Headquartered in Sunnyvale, California, Intuitive is well-positioned in a market that’s growing steadily in the mid-teens as robotic techniques are applied to a broader range of procedures.

By Q3 2024 ISRG saw an 18% increase in procedures year over year, and a resulting 15% growth year over year in the installed base of Da Vinci systems, with 379 new systems being placed.

With procedure volumes and system placements rebounding after COVID-19 disruptions, the global penetration of robotic surgery still remains relatively low, leaving plenty of room for growth. The company is in the early stages of creating a fully integrated care delivery modelIntuitive is not only expanding the applications of its da Vinci systems but also rolling out newer, less invasive platforms, which bodes well for future growth. This is also a category that will benefit from implementation of AI in both Instruments and Systems areas. While the stock’s premium valuation may raise some hesistation, I believe it’s justified by the company’s long-term growth potential.

Of course, risks remain. Intuitive faces increasing competition from other medtech companies launching robotic surgery systems, and the extended use of instruments could reduce pull-through sales. However, I’m confident in Intuitive’s structural growth story, which still has ample runway to drive further adoption of robotic-assisted surgery.

Lonza 🇨🇭

Lonza is a pure-play drug manufacturer with a strong foothold in several key areas: Biologics CDMO (around 45% of sales), where it specializes in the contract manufacturing of large molecules like monoclonal antibodies and antibody drug conjugates; Small Molecules CDMO (15%), focused on producing active pharmaceutical ingredients; Capsules and Health Ingredients (25%), which includes hard capsules for both pharmaceutical and nutritional applications; and its growing presence in Cell & Gene Therapy and Bioscience.

As a leader in small molecules, biologics, and the emerging field of cell and gene therapy, Lonza is well-positioned to benefit from high-single-digit industry growth in the coming years. The demand for these services remains strong, with capacity still tight, providing a solid foundation for future growth. Thanks to take-or-pay contracts and the extended product lifecycle of biologics, Lonza’s sales prospects are highly visible, and its critical role in drug manufacturing only reinforces its importance.

While the biotech sector has been under pressure due to a slowdown in financing, which has impacted utilization rates and margins, I expect these challenges to ease in the coming quarters. There are, of course, risks, including pricing and reimbursement challenges, shifting political and regulatory landscapes, new competition, and legal threats like product liability cases. Fluctuations in currency and interest rates, as well as slower R&D spending in pharma and biotech, add further complexity.

Looking ahead, I see Lonza’s medium-term growth being fueled by its strategic investments in biologics, a segment with strong industry growth potential. The assets acquired from Roche should further boost Lonza’s capabilities, and the company stands to gain from the US reshoring trend, thanks to its additional capacity. Despite the challenges, Lonza’s strong market position and forward-thinking investments make it a compelling growth story in the pharmaceutical manufacturing space.

Novonesis 🇩🇰

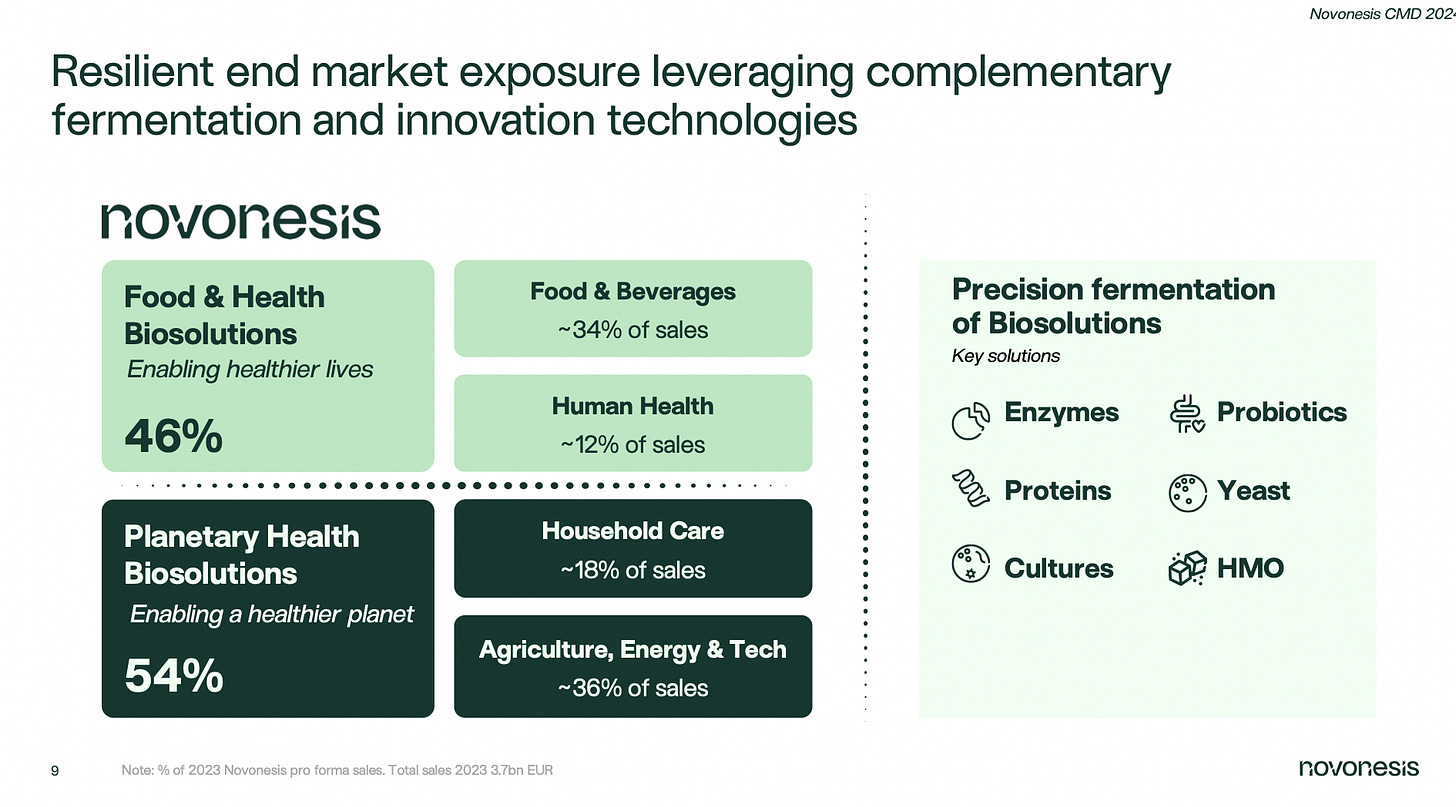

Novonesis emerged as a global leader in biosolutions following the merger of Novozymes and Chr. Hansen in January 2024. The merger brought together Novozymes’ expertise in enzymes and Chr. Hansen’s leadership in cultures and probiotics, creating a powerhouse in the biosolutions industry. Novonesis operates under two divisions: Food & Health Biosolutions, which includes the Food & Beverages (34% of 2023 sales) and Human Health (12%) segments, and Planetary Health Biosolutions, which encompasses Household Care (18%) and Agriculture, Energy & Tech (36%). With more than 10,000 employees globally, Novonesis is well-positioned to capitalize on the growing demand for sustainable solutions across industries.

Novonesis plays an integral role in everyday life, with its products reaching more than half the world’s population. The company’s success is built on strong customer relationships and a deep understanding of their needs, backed by a broad biosolutions toolbox and scalable production capabilities. By combining world-class expertise across the full value chain, Novonesis delivers robust and affordable biosolutions, positioning itself as a global leader in sustainable innovation.

I expect EBITDA to rise solidly at 8-9% CAGR from 2023 to 2028 reflecting a robust profitability outlook for the company. These financial metrics highlight Novonesis’s strong earnings visibility and solid cash flow potential, positioning it as a strong pure play in the biosolutions industry.

Novonesis is well-equipped to continue expanding its global footprint and capitalizing on structural growth trends in sustainability and health-related solutions.

Stryker 🇺🇸

Stryker is a leading player in the medical technology field, known for its innovative products and services across Orthopaedics & Spine as well as MedSurg & Neurotechnology. Most of the company’s revenue comes from the MedSurg & Neurotechnology segment, with the rest generated by its Orthopaedics & Spine business. Headquartered in Kalamazoo, Michigan, Stryker has been steadily gaining market share in its core orthopedic markets, thanks in large part to its leadership in robotic surgery with the Mako system. This momentum has helped the company grow faster than the broader market.

Stryker’s MedSurg and neurological segments have also bounced back strongly as the effects of the pandemic have eased. The acquisition of Vocera, a digital health company, in early 2022 has further boosted Stryker’s long-term growth prospects by enhancing its capabilities in the digital health space.

Like all healthcare companies, Stryker faces risks, including potential failures of new products, increased competition, legal challenges such as product liability claims, and issues related to access, pricing, and reimbursement. Shifts in political and regulatory environments, as well as changes in foreign exchange and interest rates, are also concerns. For Stryker specifically, competition in the robotic surgery space is intensifying, and there’s a potential for elective surgery levels in the US to normalize after a period of strong recovery post-pandemic.

Looking ahead to 2024, Stryker is projecting high single-digit sales growth, and I expect robust volumes to continue driving margin improvements and possible earnings upgrades. With its strong market position and ongoing innovation, Stryker remains well-positioned for future growth.

ServiceNow 🇺🇸

Founded in 2004, ServiceNow has established itself as a leader in IT operations software, with a growing presence in other business areas. Its core offerings span IT service management, operations management, HR, customer service, and security, supported by a highly customizable platform for new application development. In 2023, the company generated $8.97 billion in revenue, marking a 24% year-over-year increase, and currently serves over 8,100 enterprise customers.

ServiceNow’s strong position in IT service management is backed by a large installed base, which includes 80% of Fortune 500 companies, a broad distribution network, and comprehensive workflow automation products. As remote working trends continue to evolve, ServiceNow is well-positioned to benefit from the increased demand for digital transformation services.

With growing interest in AI/ML, workflow automation, cloud solutions, and industry-specific apps—especially in telecom and financial services—ServiceNow has significant opportunities to expand beyond its core segments. The company’s recent launch of a generative AI solution aims to enhance digital workflows by offering more conversational and direct responses to user queries, which could further boost demand.

However, there are risks, including delayed sales cycles, lower sales productivity in certain regions, and potential concentration in specific industries or geographies. Nonetheless, I believe ServiceNow is well-positioned to capture the rising demand for AI-driven solutions and automated workflows, thanks to its robust product ecosystem and continued innovation.

TSMC 🇹🇼

Taiwan Semiconductor Manufacturing (TSMC) is the world’s leading dedicated foundry service provider, with an impressive annual capacity of around 36 million 8-inch equivalent wafers as of the end of 2023. TSMC operates a network of advanced facilities, including four 12-inch wafer fabs, four 8-inch fabs, and one 6-inch fab in Taiwan, alongside additional fabs overseas under its subsidiaries WaferTech in the US and TSMC China and TSMC Nanjing in China.

TSMC is positioned to outpace the broader semiconductor foundry industry for several reasons. First, its technological lead over competitors is substantial, particularly with its advancements in 2nm and 3nm process nodes, which should continue driving market share gains. Second, even in times of industry slowdown, TSMC’s status as a preferred foundry and its reputation for execution excellence mean it is likely to experience fewer order cuts than its peers. Lastly, TSMC is benefiting from growing demand in new areas like high-performance computing and the Internet of Things (IoT), which are becoming significant growth drivers.

Of course, there are risks. Lower-than-expected outsourcing from key clients as they build their own in-house capabilities, a weak macroeconomic environment impacting end-market demand, and intensifying competition could all pose challenges. However, TSMC’s world-leading position in the semiconductor foundry space and its ability to capitalize on the growing demand for IoT and artificial intelligence technologies make it a compelling company to watch.

And then there is the below. If sustainable (meaning not only yield but also volume), then this is very positive for TSMC (and potentially for geo-politics).

Uber 🇺🇸

Uber is a global logistics platform, best known for its ridesharing and food delivery services, connecting users with a vast network of drivers and couriers. In the US, Uber holds the top spot in the rideshare market and continues to gain ground in food delivery. Recently, Uber has expanded its offerings into the delivery of non-restaurant products, which represents a major growth area for the company.

As the leader in transportation-as-a-service, Uber operates the most extensive network of drivers, customers, and food delivery services worldwide. It’s also branching out into emerging areas like autonomous vehicles, multi-modal transport, and logistics freight brokerage. Uber’s technological edge, particularly in demand prediction, pricing, routing, and dispatching—fueled by machine learning—sets it apart from competitors.

Uber has grown to become a very strong brand that has a very meaningful position and have become integral to daily life for millions of users worldwide.

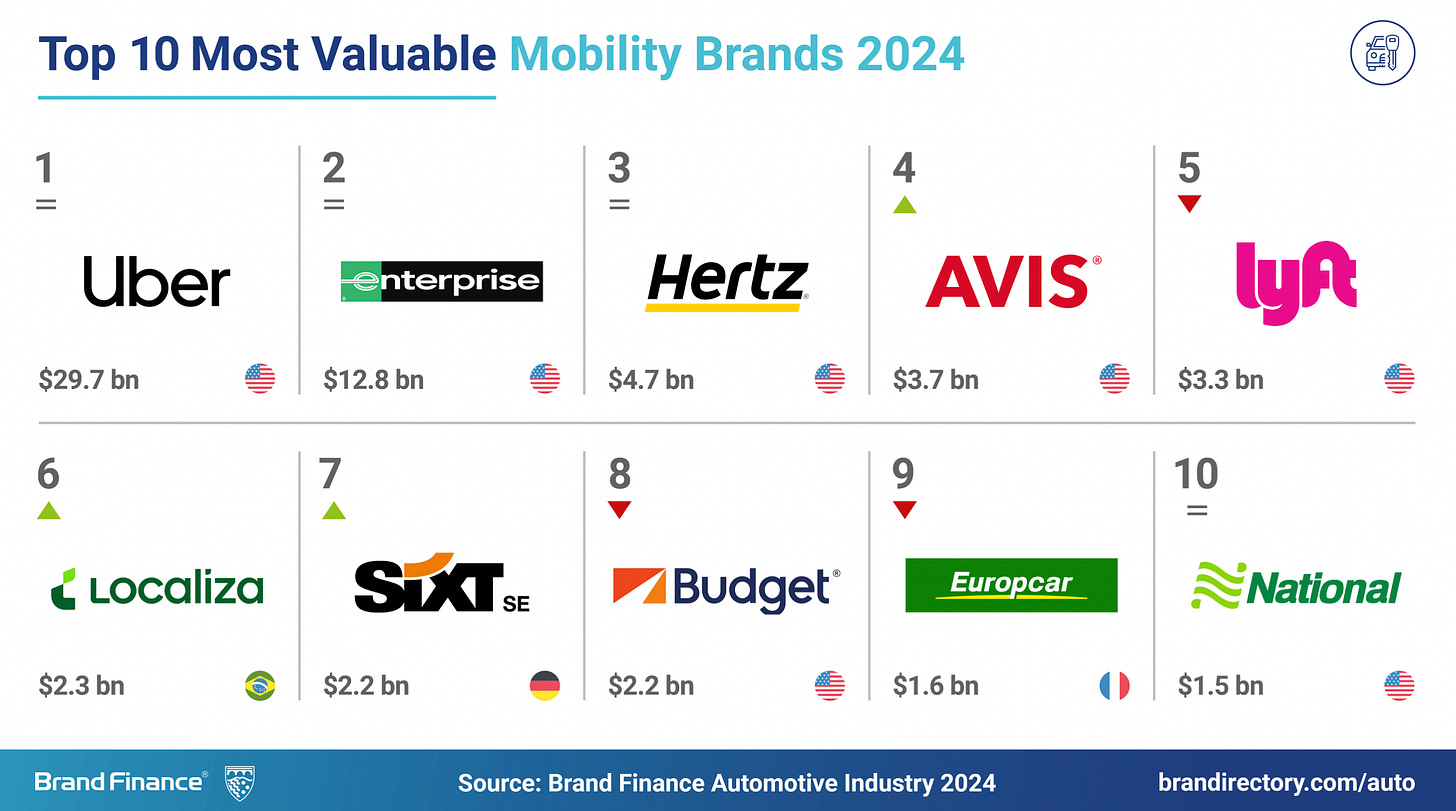

Uber remains the world's most valuable mobility brand. with a 28% increase in brand value to USD 29.7 billion, from 2023. Enterprise and Hertz are in second and third, with Uber more than twice as valuable as Enterprise.

Uber is well-positioned to capitalize on the growing demand for ride-hailing and food delivery across various major markets, thanks to both its core business and its stakes in other key ride-hailing companies. One of Uber’s biggest strengths is its ability to drive synergies between its Mobility and Delivery services, which could help grow its subscription base and strengthen its long-term earnings potential.

However, there are some risks. A prolonged recovery from the pandemic, or a resurgence, could slow its momentum, and intensifying competition might put pressure on pricing. That said, Uber’s resilient gross bookings, strong margins, and continued push for a subscription model should help it maintain earnings visibility. As mobility trends continue to pick up across most markets and pricing stabilizes, I see Uber well-placed for growth. With the rise of 5G and its use of AI to optimize the platform, Uber is in a solid position to enhance its ridesharing and delivery experience globally.

With that, thanks for reading, I really appreciate the interest. Below are links to a few other items that you might find interesting.

Other readings:

Niall Ferguson “The Ascent of Money” - https://amzn.to/4hl7uJZ

Broadcom twitter thread from 2021: https://x.com/ditlevfriis/status/1400074842070790148?s=46

Interview with Ted Weschler from Berkshire Hathaway