Overview

Teva Pharmaceuticals has initiated 2024 with robust momentum, underscored by significant growth across its generics business and flagship pharmaceutical brands such as AUSTEDO® and AJOVY®. The first quarter financial results reflected a solid performance with increased revenue and strategic advancements in product development.

Summary of key branded medicines:

Austedo treats involuntary movements caused by tardive dyskinesia or Huntington's disease.

Ajovy is used to prevent migraine in adults who have migraines at least 4 days a month.

UZEDY is indicated for the treatment of schizophrenia in adults.

Financial Performance Highlights

Revenue Growth: Teva reported a revenue of $3.8 billion in 1Q 2024, marking a 5% increase in local currency terms year-over-year. This growth is mainly attributed to a 9% rise in the generics business globally and a significant 67% increase in U.S. sales of AUSTEDO®.

Net Earnings and Losses: Despite a GAAP loss per share of $0.12, the non-GAAP diluted EPS was $0.48, reflecting adjustments for non-recurring costs and benefits.

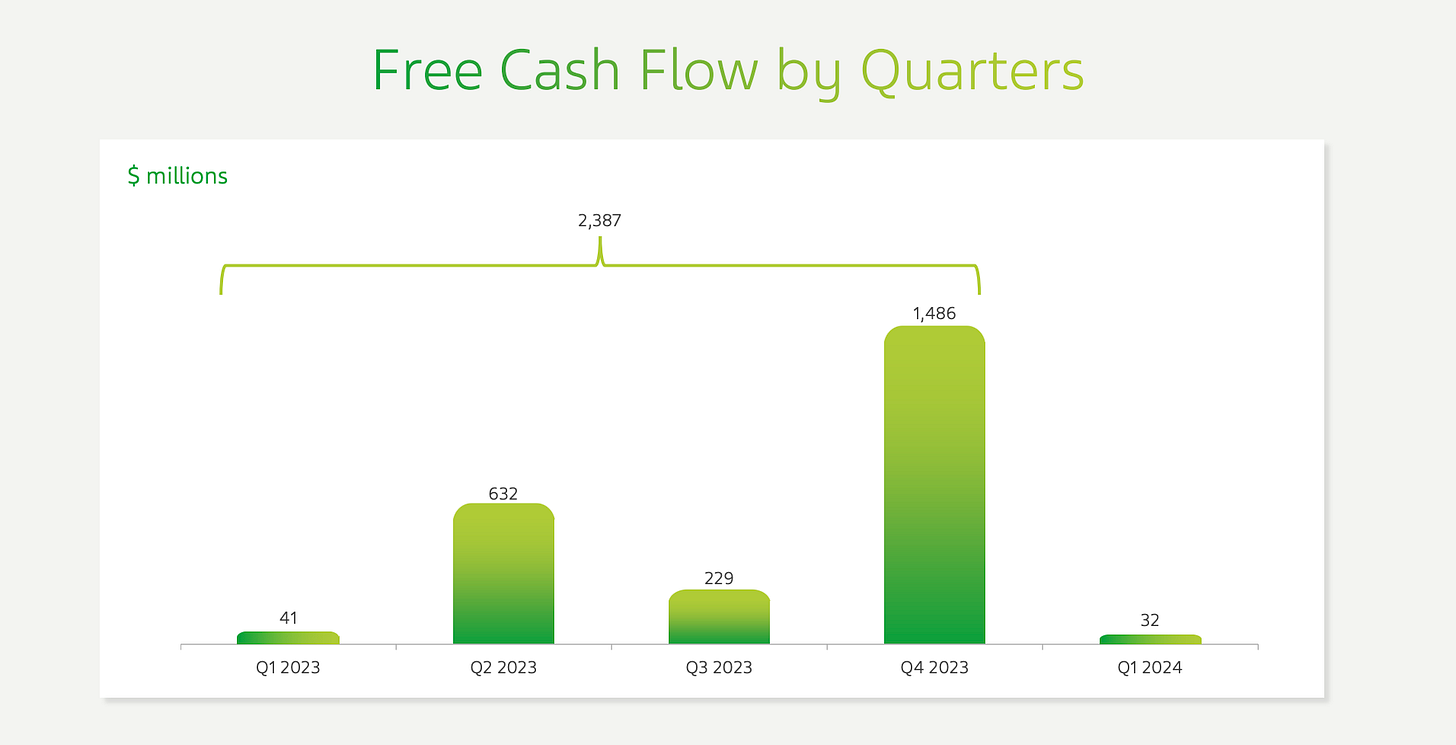

Cash Flow: Operational activities resulted in a cash use of $124 million, yet the company managed a free cash flow (FCF) of $32 million, demonstrating effective capital management and a pathway towards debt reduction. 1Q is normally soft for FCF due to bonus payments, this was also confirmed by Eli Kalif, CFO on the call.

Debt reduction

Debt reduction slowed in 1Q due to soft FCF, which was expected and is normal for Teva. Since 3Q 2017, the debt has now been cut by more than 50%, down from $34 billion to $16.7 billion.

Investment and Market Opportunities

Under-Owned by Long-Only Investors: Despite high activity from hedge funds, Teva remains under-owned by long-only investors, suggesting significant room for growth as the company continues its transformation and capitalizes on its strong business performance and pipeline potential. The Top 15 positions by ownership clearly shows additional potential for larger stakes for the mega-funds.

Generics Business Trends: Teva shows a positive trend in its core U.S. generics pricing with mid-single-digit yearly declines. Combined with new product launches, this points toward a growing generics business, challenging the perception of generics as a declining sector.

Innovative Pipeline Products:

Olanzapine LAI: The medical community is optimistic about this first potentially viable olanzapine injectable for psychiatric use, indicating a strong future market presence and a positive reception for Teva’s advancements in neuropsychiatry. Eric Hughes, CMD spoke to this on the call.

TL1a Development: While TL1a faces competition, its target market suggests substantial revenue possibilities. Financial models currently understate TL1a's potential, which could lead to positive surprises in revenue generation based on historical data and the success of similar drugs.

Strategic Developments

Pivot to Growth Strategy: Launched in May 2023, this strategy focuses on enhancing key growth drivers such as AUSTEDO®, AJOVY®, and the development of biosimilars. It also emphasizes operational efficiency and innovation in its pipeline.

Innovation and R&D: Positive Phase 3 efficacy results for olanzapine LAI enhance Teva’s portfolio in neuropsychiatry, a testament to the company's commitment to addressing complex medical needs that are largely unmet.

Footprint optimisation: Teva Continued its strategic streamlining of its manufacturing operations, significantly reducing the number of sites from 80 in 2017 to a projected 40-42 by 2027. This optimization highlights a shift towards efficiency and better resource allocation, freeing up cash for Teva.

Financial Outlook for 2024

Teva reaffirmed its 2024 financial outlook with projected revenues of $15.7 to $16.3 billion and adjusted EBITDA of $4.5 to $5.0 billion. The anticipated non-GAAP diluted EPS ranges between $2.20 and $2.50, with free cash flow estimates from $1.7 to $2.0 billion, reflecting confidence in continued growth and profitability, with ample cash to continue to drive down debt. On the call, Eli Kalif, CFO presented Teva´s commitments to EBITDA to Debt levels for the coming years.

Reactions following the first quarter report

Jefferies analyst Glen Santangelo, who rates Teva a "buy," said the company has not been getting credit from investors for its pipeline of innovative drugs and is being valued as a straight generic drugmaker:

"We think the market hasn't fully digested the changing DNA at Teva, but we believe today's and upcoming pipeline catalysts could represent a turning point".

The share price rose more than 12% and hit a 5-year high.

Conclusion

Teva´s 1Q 2024 results demonstrate effective execution of its growth strategy, marked by strong generic sales and significant progress in its specialty medication portfolio. With strategic initiatives in place and a focus on operational efficiency and innovation, Teva is well-positioned to sustain and build on its current momentum throughout 2024, promising a favorable year ahead for the company. I remain optimistic about the future of the company and its place in the global pharmaceutical industry. I optimistic that Teva´s share price can move towards $19-$22 during 2024.