ASML: The beating Heart of the AI hardware revolution ($ASML)

The world can’t build AI without ASML — and the market still doesn’t (fully) get it.

Introduction to a quarter of resilience and momentum

ASML’s third-quarter 2025 results reaffirm the company’s unmatched position at the center of the semiconductor value chain. Further down we will see the impact on valuation and outlook for ASML and why the company is a long-term winner.

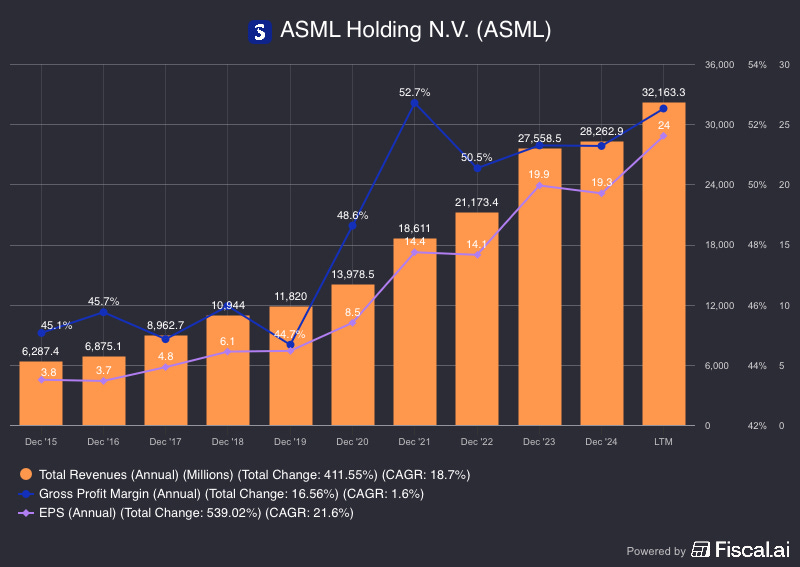

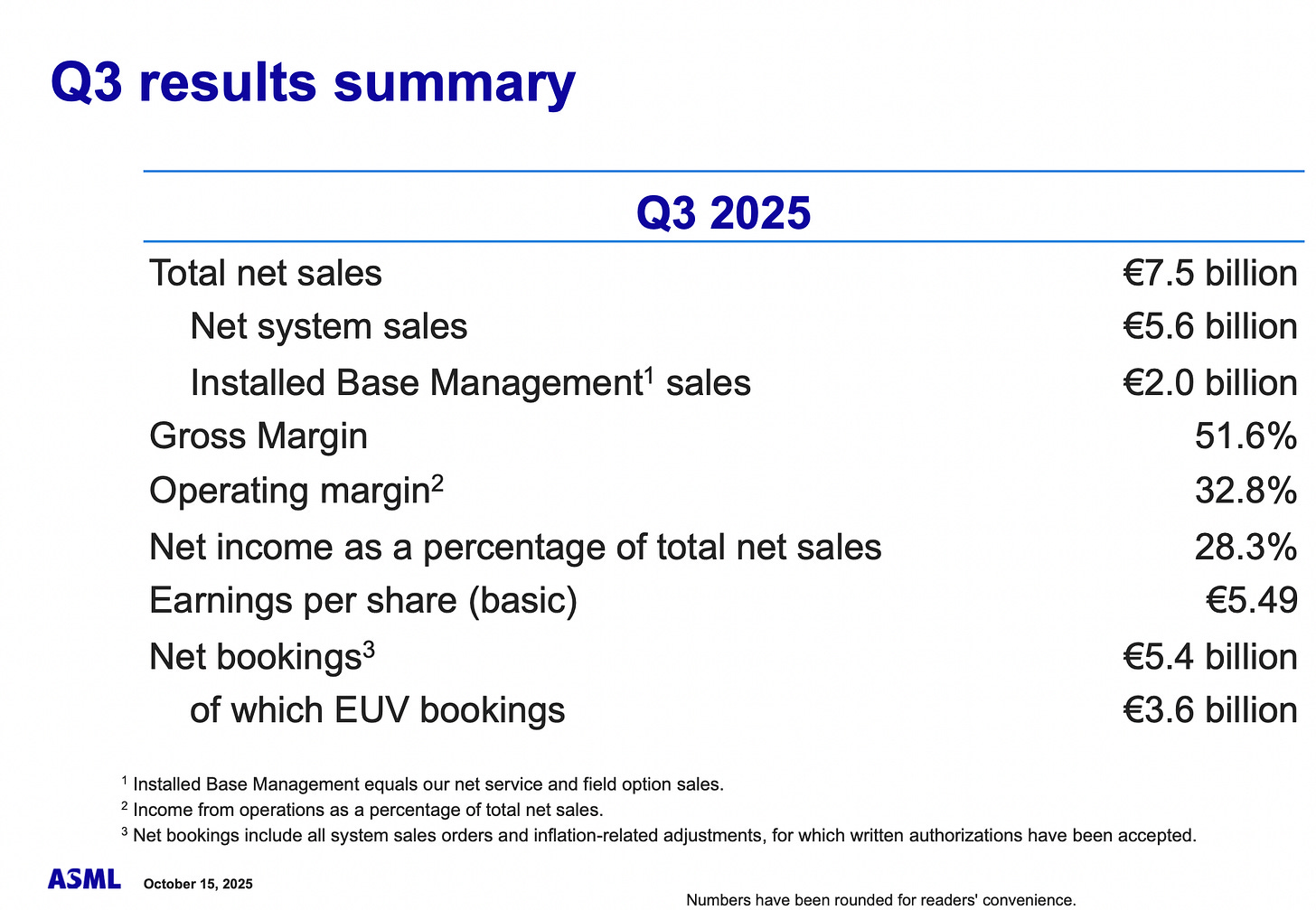

Revenue came in at €7.5 billion, with net income of €2.1 billion and a gross margin of 51.6 %. While sequentially flat versus Q2, the composition of growth and bookings underscores a resilient demand profile driven by AI, memory recovery, and advanced logic nodes. For context, here is ASML´s track record for revenues, gross profit margin, and EPS.

System sales reached €5.6 billion, complemented by €2.0 billion from Installed Base Management (IBM) — ASML’s recurring revenue engine that continues to compound steadily. Logic accounted for roughly 69 % of system sales and memory for 31 %, showing that advanced foundries remain in full investment mode ahead of the 2 nm and high-NA lithography transitions.

Bookings totaled €5.4 billion, with EUV systems representing €3.6 billion, signaling sustained demand for the company’s highest-margin tools. Even amid export-control constraints in China, regional diversification remains healthy: Taiwan accounted for 35 % of system shipments, China 27 %, and South Korea 19 %.

Operating margin reached 32.8 %, net margin 28.3 %, and earnings per share €5.49 — a level that keeps ASML comfortably on track for full-year EPS above €24. Management reaffirmed ~15 % full-year revenue growth with a gross margin near 52 %, and expects Q4 sales between €9.2 billion and €9.8 billion, supported by higher EUV mix and stronger memory orders.

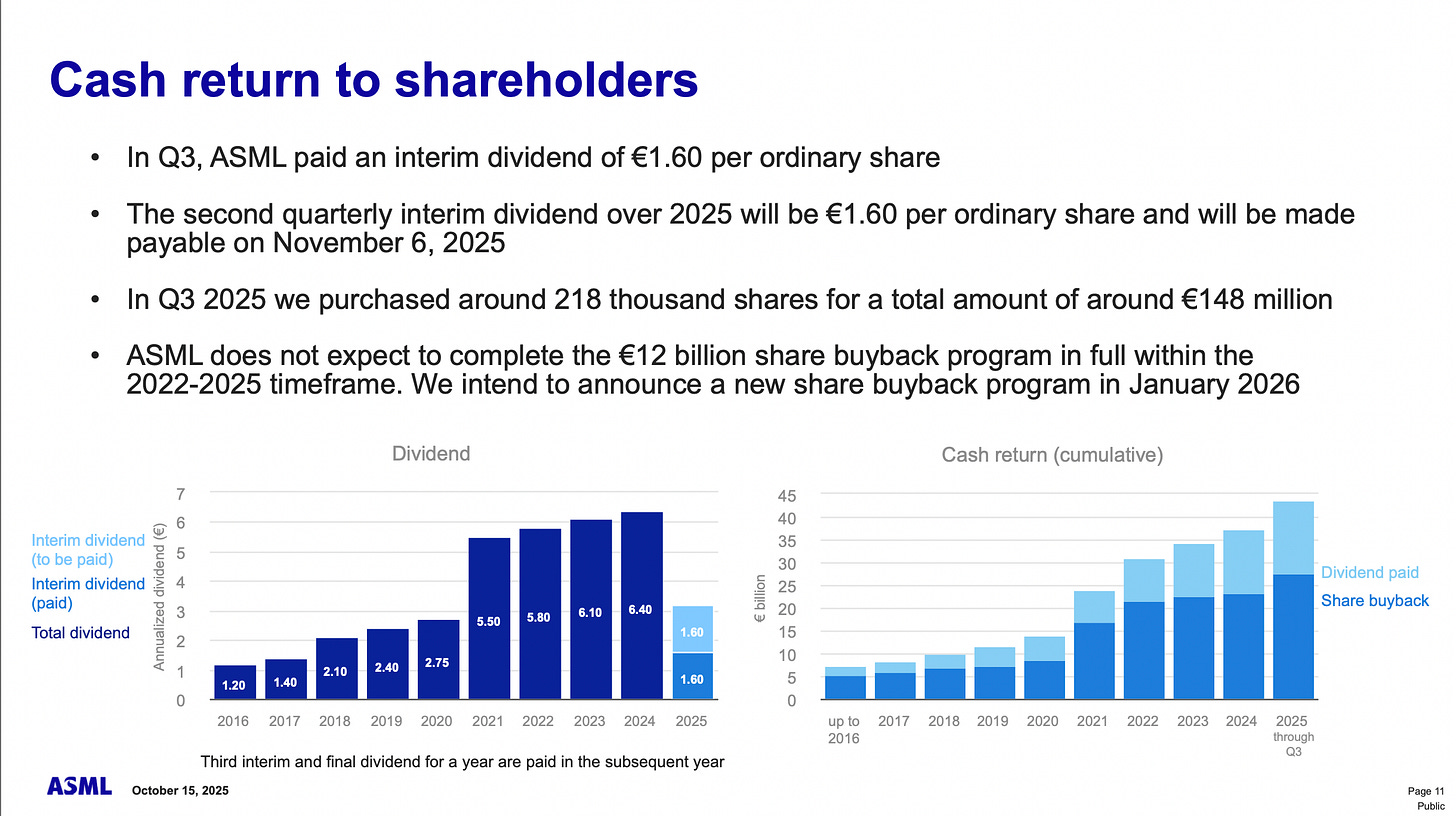

The company continues to return cash aggressively: an interim dividend of €1.60 per share was paid in Q3, with another tranche to follow in November. Although the current €12 billion buyback will not be fully completed by year-end, ASML plans to launch a new repurchase program in January 2026 — reinforcing its long-term commitment to shareholder returns.

Strategy – lithography at the core of the AI era

Few companies are as central to the next computing paradigm as ASML. As artificial intelligence expands from hyperscale training into inference at the edge, the semiconductor industry faces the dual challenge of power efficiency and scaling cost. ASML’s entire strategy — from deep-UV through extreme-UV to the coming high-NA EUV generation — is built precisely around enabling that transition.

Keep reading with a 7-day free trial

Subscribe to Kontra Investments to keep reading this post and get 7 days of free access to the full post archives.