Introduction

Ferrari, with the coolest ticker symbol in town ($RACE), has cemented itself as a beacon of luxury and exclusivity in the global automotive sector. Combining innovation, engineering excellence, and brand heritage, Ferrari is not just an automaker—it’s a status symbol, which is also why Ferrari has pricing power to a degree that only few companies can match. With a robust strategy, an evolving product portfolio, and strong financial fundamentals, Ferrari is strongly positioned for sustainable growth.

Here we will dive s into Ferrari’s financial performance, strategy, business model, and future developments, underpinned by insights from its recent Q3 2024 earnings report and guidance for the year. Let´s go!

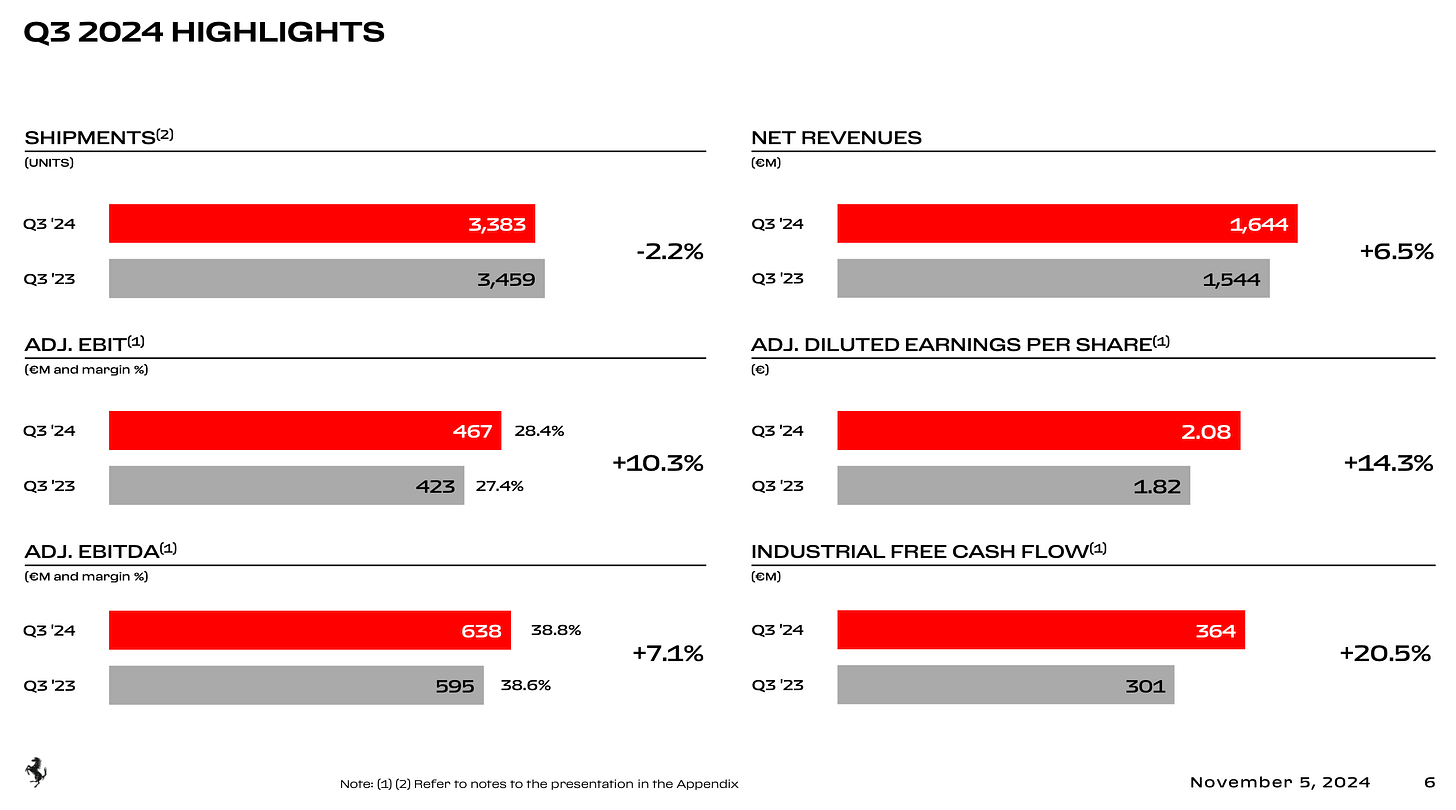

Financial Highlights Q3 2024

1. Key Financial Metrics:

• Revenue Q3: €1.644 billion (+6.5% YoY).

• Adjusted EBIT Q3: €638 million (+7.1% YoY), with a margin of 38.8%.

• Net Profit Q3: €375 million (+13% YoY).

• Free Cash Flow: €364 million for 9M 2024 (+20.5% YoY) .

2. Profitability:

• EBITDA Margin: 38.2%.

• Gross Margin: Approaching 50%, reflecting strong pricing power and operational efficiency.

3. Valuation Metrics:

• P/E Ratio (2024E): 50.8x.

• Net Debt/Adj. EBITDA: A low 0.6x, indicating strong financial leverage and liquidity .

Strategic Insights and Business Model

1. Controlled Growth and Exclusivity:

• Ferrari operates on a controlled growth strategy, limiting production volumes to ensure exclusivity and high residual values. With an order book extending well into 2026, demand consistently exceeds supply.

• Q3 2024 shipments were deliberately limited, reflecting strategic geographic allocations and product lifecycle management .

2. Diversified Revenue Streams:

• Cars and Spare Parts (85% of revenue): Driven by high-margin personalization options and richer product mixes, including the Purosangue and Daytona SP3.

• Sponsorship and Brand Licensing (10%): Benefiting from new sponsorship deals and robust Formula 1 performance, enhancing Ferrari’s brand equity.

• Lifestyle Initiatives: Continued investments in Ferrari-themed experiences and merchandise to diversify revenue and enhance brand engagement.

3. Electrification and Innovation:

• Ferrari is on track to launch its first fully electric model in 2025, complementing its hybrid lineup, which already represents 55% of Q3 2024 shipments.

• Electrification will account for 40% of its portfolio by 2030, ensuring regulatory compliance while maintaining Ferrari’s unique driving experience.

4. Operational Excellence:

• Ferrari’s Q3 2024 EBIT margin of 28.4% reflects an enriched product mix and cost discipline, even amid inflationary pressures. Investments in digital infrastructure and process optimization underpin long-term efficiency.

Future Developments and 2024 Guidance

1. Product Pipeline:

• The unveiling of the F80 supercar—already fully allocated—underscores Ferrari’s continued commitment to engineering excellence and exclusivity.

• Ferrari plans to introduce more special series and hybrid models, catering to its high-net-worth clientele .

2. Sustainability Initiatives:

• Ferrari is advancing its carbon neutrality goals with investments in renewable energy, including the recent shutdown of its trigeneration facility.

3. 2024 Guidance:

• Revenue: Exceeding €6.55 billion, driven by personalization, geographic expansion, and lifestyle contributions.

• Industrial Free Cash Flow: Targeting up to €950 million, supported by disciplined capital expenditures .

Investment Thesis

Ferrari represents a compelling investment case, combining luxury branding, operational efficiency, and strong financial health. Key factors supporting a bullish outlook include:

• High Profitability: Industry-leading margins and robust free cash flow generation.

• Electrification Advantage: A well-executed transition into hybrid and electric vehicles ensures future relevance without diluting the brand’s essence.

• Global Demand: Limited reliance on any single geography, with North America and EMEA providing steady growth.

Risks and Considerations

While Ferrari’s fundamentals are strong, risks include:

• Premium Valuation: At 50.8x P/E, the stock trades at a significant premium, requiring flawless execution of its electrification and growth strategies.

• Macroeconomic Factors: A slowdown in luxury spending or regulatory challenges in key markets could impact growth .

Ferrari’s Strategic Orientation through the lens of Michael Porter

Michael Porter’s generic strategies—Cost Leadership, Differentiation, and Focus—provide a framework for understanding how firms achieve competitive advantage. Ferrari’s success in the luxury automotive industry aligns primarily with Focus Differentiation.

Focus Differentiation: Ferrari’s Core Strategy

1. Target Market

• Ferrari targets a narrow, affluent customer base of high-net-worth individuals (HNWIs) and car enthusiasts who value exclusivity, luxury, and performance. This laser-focused market approach epitomizes Porter’s Focus strategy.

• With production volumes deliberately capped at around 15,000 units annually, Ferrari preserves scarcity, creating demand well in excess of supply. Its order book extends into 2026, demonstrating the efficacy of this focused approach .

2. Unique Value Proposition

• Ferrari’s differentiation centers on unmatched engineering excellence, heritage, and brand prestige. Its association with Formula 1 further reinforces its performance credentials, appealing to the target market’s desire for exclusivity and innovation.

3. Personalization

• High levels of personalization—such as custom finishes, unique configurations, and bespoke models—enhance customer loyalty and profit margins. For instance, personalization accounts for up to 20% of sales in key models .

Why Ferrari Does Not Pursue Cost Leadership

Ferrari deliberately avoids competing on cost:

• The company emphasizes premium pricing, reflecting the value placed on exclusivity, quality, and heritage.

• Cost leadership would conflict with Ferrari’s commitment to luxury and the brand’s scarcity-driven value proposition. Attempts to reduce costs at the expense of quality or exclusivity would erode its market position.

Conclusion

Ferrari’s adherence to Focus Differentiation ensures sustained competitive advantage by reinforcing brand equity and maximizing customer lifetime value. The company’s disciplined production strategy, commitment to personalization, and innovative product portfolio align perfectly with Porter’s model, securing its place as a leader in the luxury automotive segment.

Ferrari’s unique blend of exclusivity, innovation, and financial discipline positions it as a standout in the luxury (automotive) space. While the stock’s valuation reflects its premium status, its strong fundamentals and future growth prospects justify the price for long-term investors. With a well-managed strategy and evolving product portfolio, Ferrari remains a powerful driver of shareholder value. In 12 months from now, it is reasonable to expect Ferrari shares to trade around $520.

This one was excellent! Reinforced by my old passion for super cars 🫡🔥