LVMH: A Legacy of Luxury and Financial Resilience ($MC.PA)

High margin, defensive play, with long-term durability.

This is the third of four parts in a series focusing on the Luxury theme. The introduction to the theme can be found here and down below there are also links to articles about Ferrari and Moncler.

https://ditlev.substack.com/p/tis-the-season-to-buy-luxury-stocks

However, this time around we are doing something different, in that this article includes two parts on LVMH. This is the first time where I partner with another author, Antoni Nabzdyk, so please check out his part and also his Substack.

With that, let´s dive into one of the best companies in the world: LVMH.

Background

LVMH Moët Hennessy Louis Vuitton (LVMH) continues to shine as the undisputed leader in the global luxury market. With 75 prestigious brands spanning fashion, leather goods, wines & spirits, perfumes & cosmetics, watches & jewelry, and selective retailing, the conglomerate embodies both diversification and luxury. The iconic Louis Vuitton brand remains at the heart of this empire, contributing over 50% of recurring EBIT and setting the standard in luxury worldwide.

A Rich Portfolio and Strategic Acquisitions

LVMH has mastered the art of blending heritage with modernity. Recent acquisitions, including Tiffany & Co. in 2021 and Christian Dior Couture in 2017, have fortified its position in the luxury market. Operating through a global network of over 6,000 stores, the group maintains a strong physical retail presence that complements its digital strategies.

Luxury is not only the domain of the wealthy; LVMH’s brands resonate globally as aspirational symbols for many. This broad appeal underscores the strength of its portfolio, which includes industry-defining names like Bulgari, Givenchy, and Christian Dior.

The Arnault family continues to hold a majority share, ensuring the group’s strategic vision remains intact.

Resilient Financial Performance: Q3 2024 Highlights

Despite a challenging macroeconomic environment, LVMH demonstrated resilience in its Q3 2024 results. Revenue trends reflect a mixed performance across divisions and geographies:

Key Performance Highlights

• Stable organic revenue over the first nine months of 2024 compared to the same period in 2023, reflecting adaptability amid volatile conditions.

• Fashion & Leather Goods (F&LG), the group’s largest segment, saw a slight decline in organic revenue (-1%) but maintained strong brand equity with robust demand for Louis Vuitton and Christian Dior products.

• Perfumes & Cosmetics reported a 5% organic revenue growth, driven by strong momentum in fragrances and a continued focus on selective retail strategies.

• Watches & Jewelry experienced a 3% dip in organic revenue, as the group doubled down on elevating its Maisons and driving innovation.

• Selective Retailing, led by Sephora, showed impressive growth with a 6% increase in organic revenue, countering challenges faced by DFS due to international travel disruptions.

• Wines & Spirits recorded an 8% decline in organic revenue, reflecting ongoing challenges in the U.S. market, albeit with signs of gradual recovery in cognac sales.

Geographical Insights

LVMH’s balanced revenue mix remains a cornerstone of its resilience:

• Japan exhibited strong momentum, though slightly moderated in Q3.

• The U.S. market showed improvement in specific segments like cognac.

• China’s recovery was steady, bolstering overall Asia-Pacific performance.

Financial Overview

Profitability and growth trends

LVMH’s long-term growth remains strong, with a 25-year average organic sales growth of +9%, augmented by +2% from M&A activity. However, current trends indicate a stabilization phase:

• 2024 YTD Sales growth: Flat overall, with a notable decline in F&LG (-1%) and Wines & Spirits (-8%).

• 2025 Sales growth Projections: A modest rebound to +2%, supported by stabilization in key segments.

Margins and Operating metrics

LVMH’s group EBIT margin is forecasted at 24.1% for 2024, reflecting a slight contraction due to reinvestments and macro pressures:

· Fashion & Leather Goods: EBIT margin of 36.1% remains resilient despite revenue headwinds, The Fashion & Leather Goods division, a primary profitability driver, is projected to grow organically at 2% in 2025, maintaining its EBIT margin of 36.5%, which remains above pre-pandemic levels with 2,6% points.

• Wines & Spirits: Margins declined due to volume pressures in the U.S. and tougher comparables.

• Selective Retailing: Sephora’s growth offsets DFS challenges, maintaining profitability stability.

Cash Flow and Balance Sheet strength

LVMH continues to maintain a strong financial position:

• Net debt to EBITDA: 0.9x

• Free cash flow yield (2024): 4.1%

• M&A optionality: Strong financial position that can be leveraged for M&A, even quite large transactions.

Valuation and Risks

LVMH trades at a forward P/E of ~23x, reflecting confidence in its high-margin portfolio. Risks include:

1. Persistent weakness in Wines & Spirits.

2. Geopolitical and macroeconomic uncertainties.

3. Brand equity challenges due to rising competition.

Commitment to sustainability and culture

LVMH is a leader in sustainability, targeting a 30% reduction in water usage by 2030 across its operations. Cultural and artistic patronage further elevates its brand value, positioning the group as not just a luxury giant but also a steward of heritage and innovation.

The Evolving role of Digital and E-Commerce

In 2024, digital channels have continued to play a transformative role for LVMH. Online sales now account for a significant portion of revenue growth, driven by:

• Seamless integration of physical and digital retail experiences.

• Targeted use of data analytics to enhance customer personalization.

• Strategic partnerships with leading e-commerce platforms to expand reach in untapped markets.

Resilient growth amid challenges

While LVMH faces headwinds in certain divisions, its diversified portfolio and robust financials ensure long-term stability. The group’s strategic focus on innovation, sustainability, and cultural patronage cements its leadership in luxury.

Conclusion

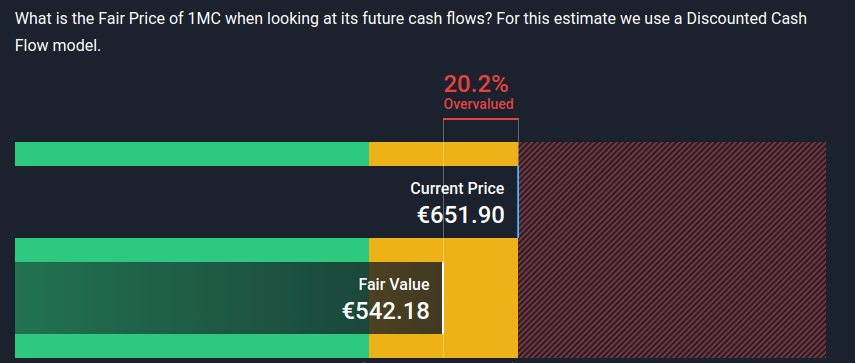

LVMH offers a defensive growth profile in the luxury space, supported by its exposure to staples (20% of sales and profits) and high-margin segments like Fashion & Leather Goods. As the group continues to de-lever and strengthen its balance sheet, future M&A activity could unlock additional value. In my view, this is a good long-term hold, but with limited upside in the short-term. My fair value estimate is €713, representing a 3% upside from today´s price.

While the near-term outlook suggests a period of consolidation, as mentioned, the long-term prospects remain promising, driven by disciplined capital allocation and unparalleled brand strength.

Upcoming articles will include Eli Lilly, ASML, ENEL, TEVA, and more.

With that, thanks for reading this piece, but there is more below. Please also dive into Antoni´s part on LVMH.

Swoosh. The t-shirt you’re wearing is the best one you’ve had for a long time now. The high quality of it makes you happy to have paid a hefty price tag for it. You look at it, and a small text reading Louis Vuitton looks back at you. It’s a company that is a behemoth in the fashion industry, acquiring many different companies all the time. But is it really a great company to invest in? Let's take a look at it!

If YOU also want to collaborate, just let me know - I’m open :)

Stock Information

This compay is a fashion industry monster, doing serial aquisitions, which helped to propell their growth even more. They also own spirits brands, so beverage business is also included, and that’s good, as it offers you a diversification safety net, and also, I like to buy companies which are like ETFs - with many segments, but only the good ones, unlike an ETF!

Many LVMH leather goods, including wallets, are produced in workshops located in France, Italy, and Spain. They put a big emphasis on European craftsmanship, so that’s a big win! While China can compete with them, remember that LVMH owns many brands, and such a state doesn’t make them worried, not a little bit.

LVMH trades under many different symbols, which is an absolute mess, and I had to make some big changes to my stock tool I programmed (Now I can get data from stock exchanges other than the US ones!), here’s a market share chart (LVMH is BIT:1MC):

Note: sometimes my charts aren’t really accurate, as different companies may have the same ticker symbols, which in my opinion should be banned, but nevertheless, LVMH has a 40% market share compared to its luxury competitors, not bad!

Next up, let’s look at the efficiency of the company (how much cash invested yields good returns):

VSO financial efficiency chart (also made using my tool):

We can see LVMH ROIC, ROA and ROE metrics ae above the median for its industry, I like that a lot! Pandora, 1SO and MONC also have very good metrics! Guess you have more stocks to search for.

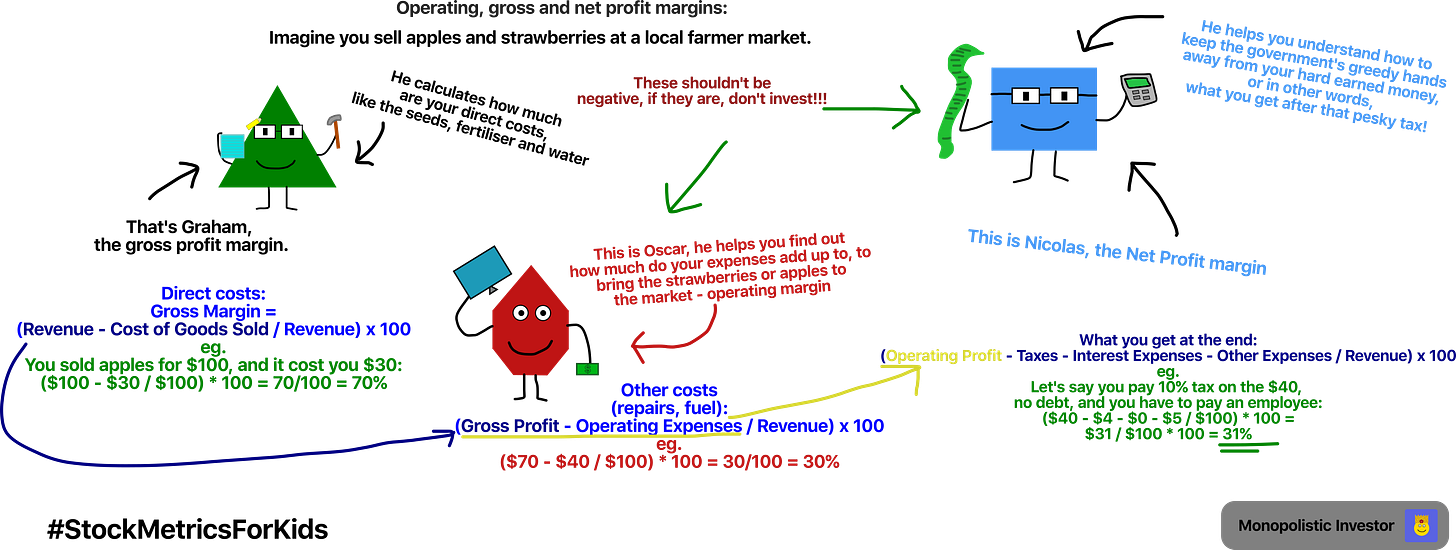

Now let’s get into the profit margins, as we really want the company to have pricing power, and not just barely break even, like some companies:

We can see their massive 68% gross margin, indicating small costs, and big pricing power. Net profit margin is at 16%, so not too bad, but could be better.

But what even are profit margins? Click and zoom in or save:

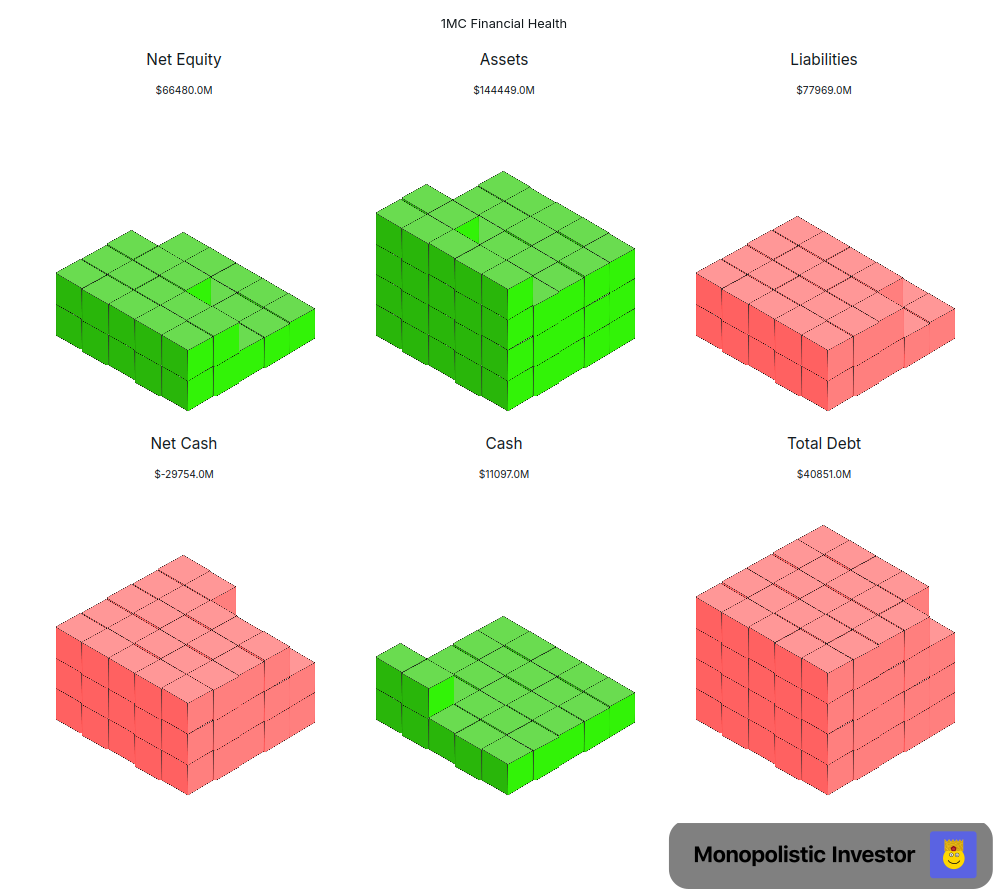

Financial Health

I can’t highlight it more often. This is the most important part of every stock analysis, as if you buy a company whose debt significantly supresses its cash, then say goodbye to your hard-earned money. Don’t get trapped into thinking that only by “buying the next Microsoft - but it’s unprofitable”, you’re going to make more money - no, we investors focus on buying high quality, capital light, businesses with wide moats, with great future outlook.

The financial health cubes, which you are going to see in a moment are made out of 125 blocks, each cube being proportionally divided, and some hidden, so that it reflects the real proportions between the values, red mean negative values, and green positive, and have been made by my tool -which means, you won’t see it anywehre else, and if you do, and it’s not me, it’s a copycat! :)

We can see that LVMH (BIT:1MC), has a minus net cash position, which isn’t good. In fact, it’s absolutely terrible! However, we can calm down, as they have a positive net equity (If you don’t know what net equity is check out my article here on Microstrategy, I go over it in more detail:

Microstrategy.

·

Jan 13

. Phew! Their Debt / EBITDA is at 1.49, which means they would be able to pay off all their debt using their EBITDA earnings in 1.5 years! That’s not too bad! I know EBITDA can’t be equal to earnings, but it just shows you a picture of their financial health.

If you have any ideas on how to show complicated stock metrics easily, let me know, and I’ll try to create it! :]

Alright, let’s move on!

Revenue growth

Their revenue has grown in the past by 40, 30, 20 and 15%, but right now it isn’t - their net income is going down - that might be due to some consumers not buying their items, when it’s a recession?

I don’t like it that their growth is slowing down, but what can I do? At least as a shareholder, you can visit a wine cellar of theirs! :)

similar story here as well:

Apple.

Antoni Nabzdyk and DIY Investor

·

Jan 10

Dividends & Buybacks

A great company is the one which returns capital to its shareholders. Either through buybacks and/ or dividends, with buybacks being the most tax-efficient option, as the money won’t get taxed that way, and we can see that LVMH is focusing on dividends, with a 2.2% yield, that is growing slowly at a rate of $%, with a healthy payout ratio under the 50% mark (46%).

It’s payment frequency is Semi-Annual, with one dividend being larger than the other, and then smaller, and so on. In terms of their buybacks, they have been buying a little bit of their stock every quarter, albeit it’s a small yield of 0.3%.

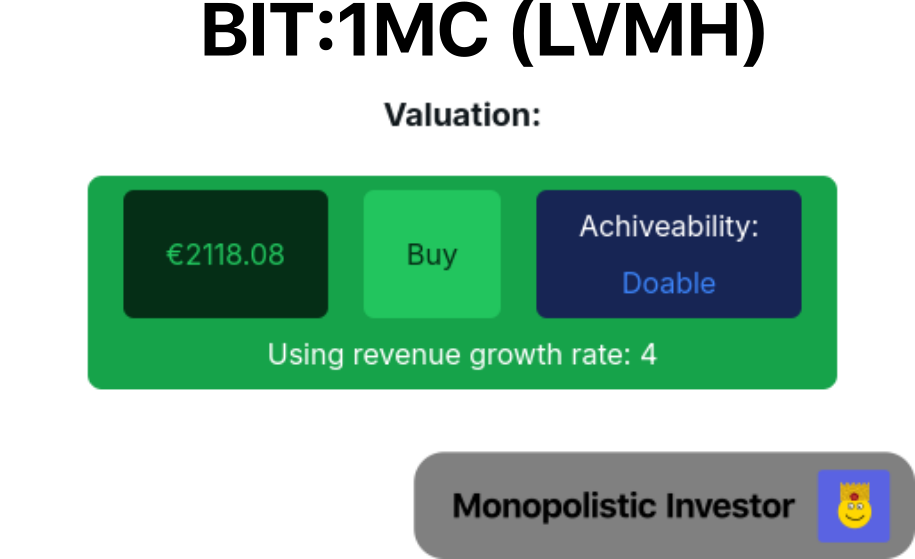

Valuation

We want to get the most value for our money. That’s why we don’t want to overpay for a company, as we want it to be undervalued or at least fair-valued at time of writing. Let’s check LVMH’s condition! :)

My valuation (using my tool) - I set the growth rate to be a conservative 4%, vbarely keeping up with inflation:

Simply Wall.st:

Remember that I always could’ve made a mistake, and simplywall.st could also!

Conclusion

With a wide range of products, LVMH stands at an incredibly high quality proposition, with many opportunities for future growth. Declining revenues, however, showing less and less revenue growth is what worries me, at the same time, they have a huge market position. For the time being, I’m saying it’s a hold, unless I do more research.

This isn’t financial advice.

Thanks for the analysis. With 13% of my portfolio in the brand, I obviously agree with your view (how could I not? 😂). Their leadership in sustainability is a big win for me as an entrepreneur in sustainability consulting. Combined with their unmatched marketing strategies, it solidifies their position in the luxury market. Add to that the undeniable role of consumption and status in society, and you have a perfect long-term game. LVMH’s ability to compound multiple high-end brands with strategic marketing sets them apart as the leader in this space. Looking forward to your next piece together, good job!