Netflix ($NFLX) Q4 2024: A Record-Breaking Quarter Propels Growth Momentum

Turns out Netflix and Chill, is also very sound investment advice.

Netflix delivered a stellar performance in Q4 2024, surpassing even the most optimistic projections and setting new benchmarks for subscriber growth, revenue, and profitability. The quarter underscored Netflix’s growing dominance in the streaming space, driven by strategic initiatives and an unparalleled content lineup.

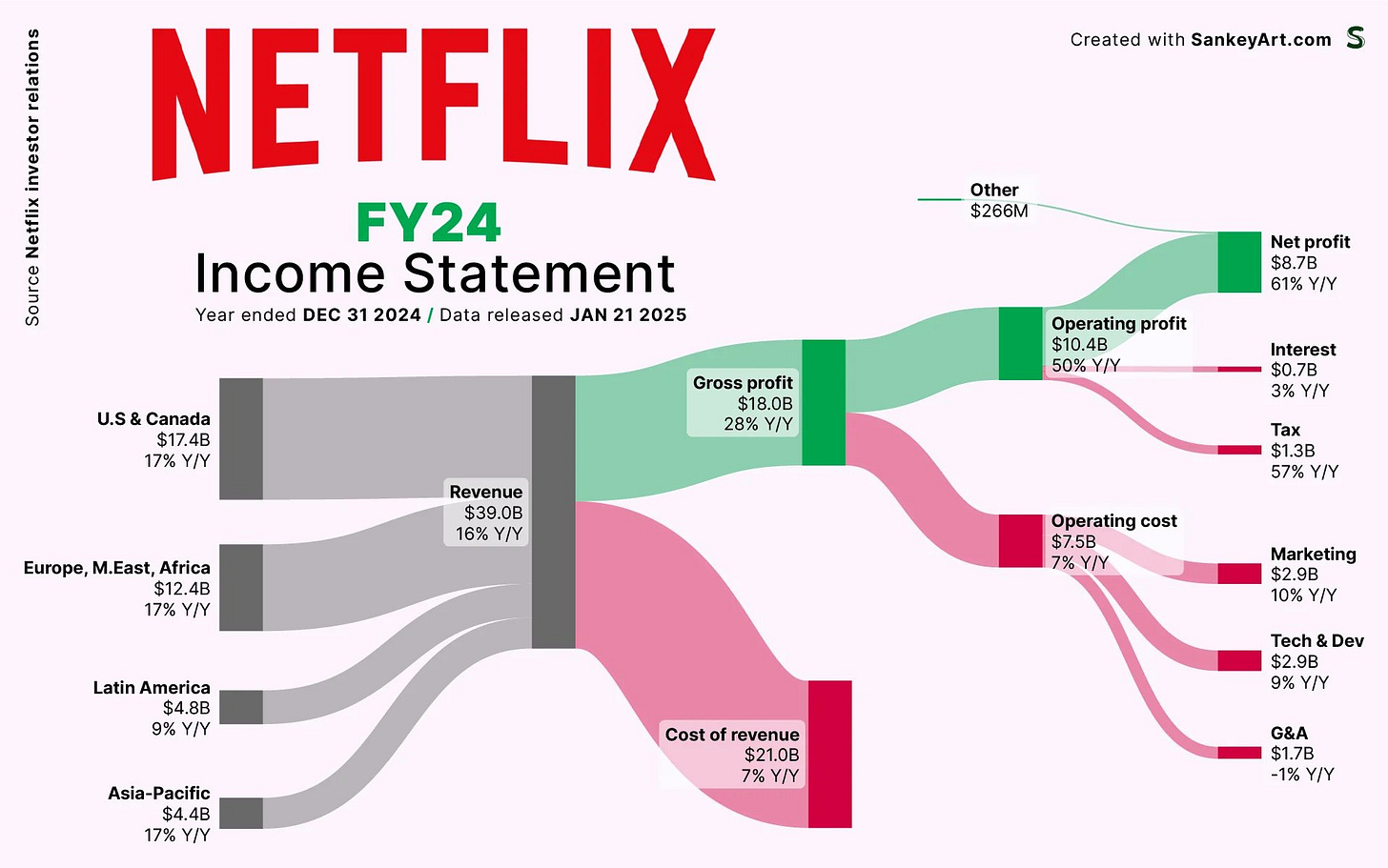

Before we get started, this chart says a lot about the phenomenal business that is Netflix. The company´s annual revenue now equal the combines revenues for the period 2005 - 2016. Staggering!

Key Highlights from Q4 2024

1. Membership Surge: Netflix added a record-breaking 19 million paid memberships in Q4, bringing the total to 302 million memberships globally. This marks a significant acceleration compared to the 13 million additions in Q4 2023.

2. Revenue Growth: Quarterly revenue increased by 16% year-over-year to $10.2 billion, with growth driven by higher memberships and increasing revenue per user. On a foreign exchange (F/X) neutral basis, revenue grew by an even more impressive 19%.

3. Operating Income and Margins: Operating income surged 52% year-over-year to $2.3 billion, while operating margins expanded to 22%, compared to 17% in the previous year. This highlights Netflix’s ability to balance growth with efficiency.

4. Content and Engagement: The return of high-profile series such as Squid Game Season 2, blockbuster originals like Carry-On, and live programming (e.g., Jake Paul vs. Mike Tyson) were instrumental in driving engagement.

Financial Analysis

1. Profitability Metrics:

• Netflix’s operating margin expanded six percentage points in 2024 to 27%, reflecting the scalability of its business model and disciplined cost management.

• Net income for Q4 2024 stood at $1.87 billion, representing a 102% increase year-over-year, supported by robust operating performance and effective cost controls.

2. Valuation and Free Cash Flow:

• Free cash flow (FCF) reached $6.9 billion in 2024, consistent with the prior year, despite increased content investments of $18 billion.

• Netflix’s enterprise value (EV) to EBITDA ratio of 29.3x underscores its premium valuation, supported by strong growth expectations.

3. Subscriber Economics:

• Average revenue per membership (ARM) grew 3% on an F/X neutral basis, with significant contributions from ad-supported tiers. Over 55% of new sign-ups in ad markets opted for the ad-supported plan, showcasing the success of Netflix’s pricing diversification strategy.

4. Capital Allocation:

• Netflix returned $6.2 billion to shareholders through buybacks in 2024 and announced an additional $15 billion authorization for 2025. This reflects a shareholder-friendly capital allocation policy while maintaining a net debt-to-EBITDA ratio of 0.4x.

My revenue projection for Netflix looks like this:

2025 = $44 billion

2026 = $50 billion

2027 = $57 billion

2028 = $64 billion

2029 = $72 billion (that is 72x revenue growth in 23 years)

Strategic Initiatives Driving Growth

1. Ad-Supported Model: The ad tier continues to gain traction, with plans to double advertising revenue in 2025. The rollout of in-house ad tech platforms in Canada and the U.S. is expected to enhance targeting and monetization.

2. Content Leadership: With blockbuster franchises (Stranger Things, Squid Game, Wednesday) and new live programming, Netflix is solidifying its position as the premier destination for diverse entertainment.

3. International Expansion: Netflix’s global strategy remains a critical growth lever, with robust subscriber gains across regions. APAC, in particular, posted strong double-digit growth, benefiting from localized content investments.

Ben Thompson, the founder of the technology and media analysis site Stratechery.has written extensively about how many businesses, especially in the digital era, gravitate towards advertising as a revenue model due to the vast scale and user data they amass. His writing and comments often points to companies like Google, Facebook, and increasingly other platforms, as examples of businesses that started with a different primary offering (search, social networking) but ultimately became advertising-driven companies. This is also relevant to consider for Netflix and its future development as a company.

Outlook for 2025: Continued Momentum

Netflix has raised its 2025 revenue guidance to $43.5–$44.5 billion, equating to 12–14% year-over-year growth (14–17% F/X neutral). The company also expects operating margins to improve to 29%, driven by scale efficiencies and revenue growth from ads and price increases in key markets.

As streaming adoption continues to rise globally, Netflix remains well-positioned to capture market share, underpinned by its innovative business model, content investments, and expanding monetization avenues.

Netflix’s Q4 2024 results reaffirm its status as a growth juggernaut in the entertainment industry. The company’s ability to deliver on subscriber growth, profitability, and innovation creates a compelling investment narrative heading into 2025 and beyond.

My model provides the following target price:

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

The growth numbers are undeniably impressive—302M subscribers 🚀—but trading at 29.3x EV/EBITDA seems a bit rich for me. With $18B in content spending and intensifying competition, I wonder if the $72B revenue target for 2029 might be overly ambitious. Considering that the advertising-media-entertainment space isn't an area I know deeply, I really appreciate your insights. Thanks for sharing 🤙