NVIDIA: A Journey from Innovation to Market Leadership

Currently the highest quality company in the world

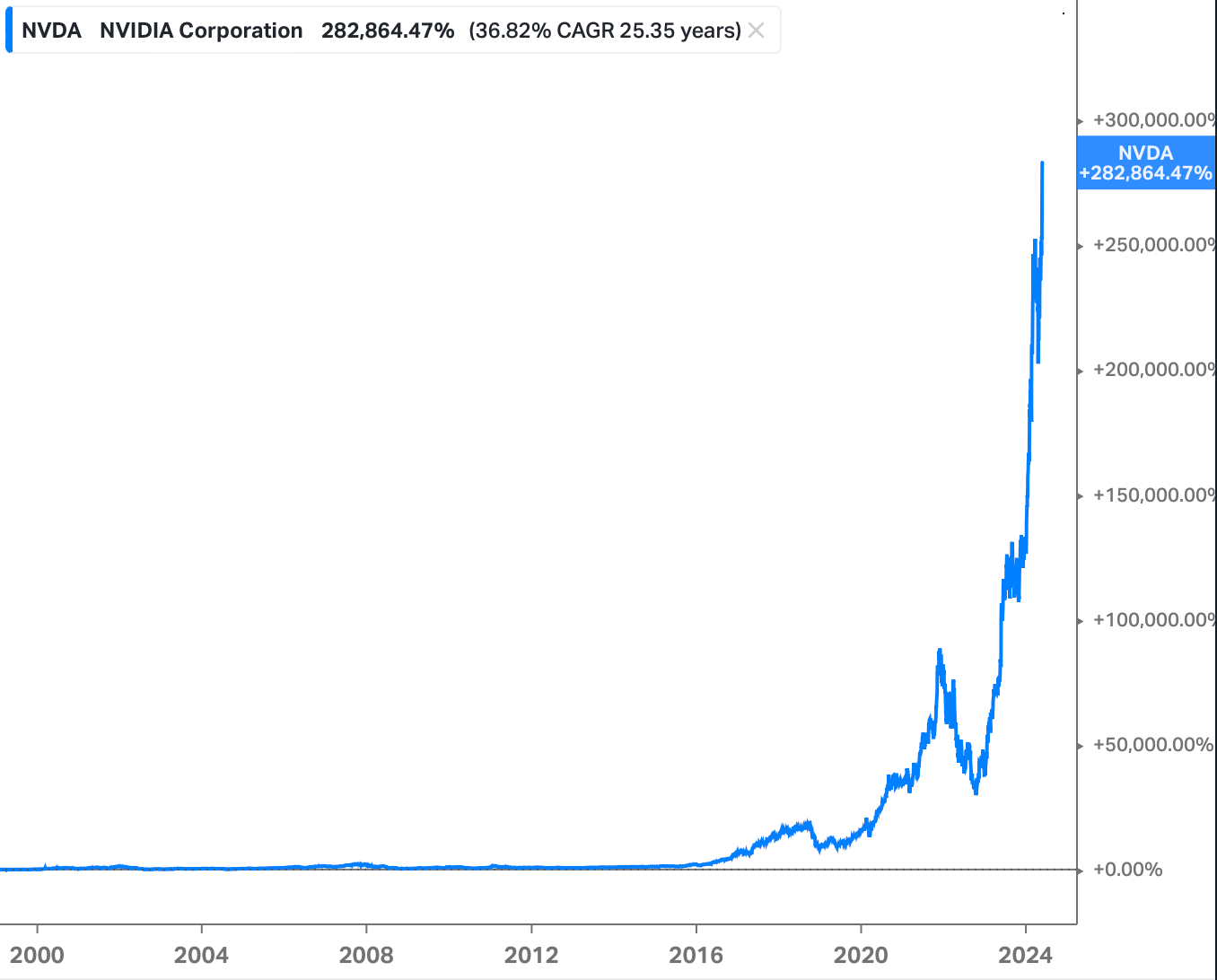

NVIDIA, founded in 1993, has carved an exceptional path in the technology industry. Starting as a modest player in 3D graphics for gaming, it has transformed into a market leader known for its cutting-edge GPUs and pioneering advancements in AI and machine learning. This post explores NVIDIA's historical milestones, financial performance, and future prospects, highlighting the factors that have made it a quality company. First, a quick look at the meteoric rise in NVIDIA´s share price:

That is a 37% CAGR for 25 years. Absolutely incredible numbers. Take a pause and reflect on that number. It is something that is very, very rare.

The Genesis of Innovation

NVIDIA's journey began with a vision to revolutionize 3D graphics. In 1999, the company introduced the world's first GPU, fundamentally altering the computing landscape. The launch of the CUDA Toolkit in 2006 enabled parallel processing capabilities, which significantly enhanced the computational power of GPUs. This was a game-changer for various industries, particularly in scientific research and AI.

Fast forward to 2012, the development of the AlexNet neural network showcased the potential of deep learning, propelling NVIDIA to the forefront of AI advancements. The introduction of the RTX platform in 2018 brought real-time ray tracing to the market, offering unprecedented realism in computer graphics. These innovations not only cemented NVIDIA's leadership in the GPU market but also set the stage for its dominance in AI and machine learning.

Financial Milestones and Growth Trajectory

NVIDIA's financial journey reflects its strategic foresight and adaptability. The company's revenue grew from $3.4 billion in FY09 to a staggering $60.9 billion in FY24. This growth was driven by the booming gaming industry, the rise of Bitcoin mining, and the explosion of AI technologies like ChatGPT. Projections indicate that NVIDIA's revenue could reach $143.2 billion by FY26.

A significant factor behind this growth has been NVIDIA's commitment to R&D. The company has consistently invested around 25% of its revenue in R&D, leading to significant technological advancements and has so far ensured that the company has been future proof. This intense focus on innovation has positioned NVIDIA ahead of its competitors and ensured sustained growth.

Q1 2024 Financial Performance

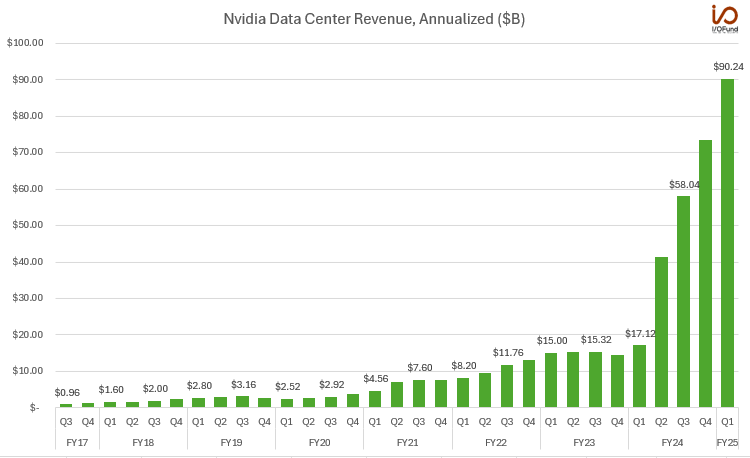

NVIDIA's Q1 2024 results highlight its robust performance:

Revenue: NVIDIA reported Q1 revenue of $26.04 billion, exceeding both UBS and Street estimates.

Earnings: The company's non-GAAP EPS was $6.12, surpassing expectations.

Data Center Segment: The data center segment was the primary revenue driver, with year-over-year growth of 426.7%, driven by high demand for AI and machine learning applications.

Source: IO Fund, Beth Kinding

NVIDIA's guidance for Q2 2024 projects revenue of $28 billion, indicating sustained demand and market confidence. This robust performance underscores NVIDIA's strong market position and operational efficiency.

Strategic Positioning and Competitive Edge

NVIDIA's success can be attributed to several strategic moves:

Outsourced Manufacturing: By leveraging Taiwan Semiconductor Manufacturing Company (TSMC) for manufacturing, NVIDIA has minimized its capital expenditures (CAPEX) while focusing on design and development. This strategy has resulted in high returns on invested capital and robust free cash flow generation.

Software Ecosystem: NVIDIA's CUDA Toolkit and other software developments have created a deep moat around its GPU technology. The CUDA platform, in particular, has become a critical tool for researchers and developers, making it difficult for competitors to replicate NVIDIA's success.

The low CAPEX needs are one of NVIDIA's secret sauces. By outsourcing the capital-intensive manufacturing process to TSMC, NVIDIA has been able to focus on innovation and maintain high ROIC. Over the past 15 years, NVIDIA has only invested $8.2 billion in CAPEX, excluding the cumulative R&D spending of $42.5 billion. These investments have propelled the company to a revenue level above $100 billion per year, with free cash flows to shareholders estimated at $57 billion this year. Also on this parameter, NVIDIA enters the absolute elite of cash generating companies.

Market Insights and Commentary

NVIDIA's market performance is nothing short of extraordinary. As highlighted by Lyn Alden, NVIDIA has outperformed Bitcoin over a 10-year period, a remarkable feat considering the cryptocurrency's explosive growth.

NVIDIA's Q1 2024 earnings reveal significant beats across multiple metrics:

Revenue exceeded estimates by 5.5%.

Data center revenue surpassed estimates by 6.6%.

EBIT beat estimates by 10.8%.

GAAP EPS outperformed estimates by $0.80.

These results reflect NVIDIA's strong market position and operational efficiency.

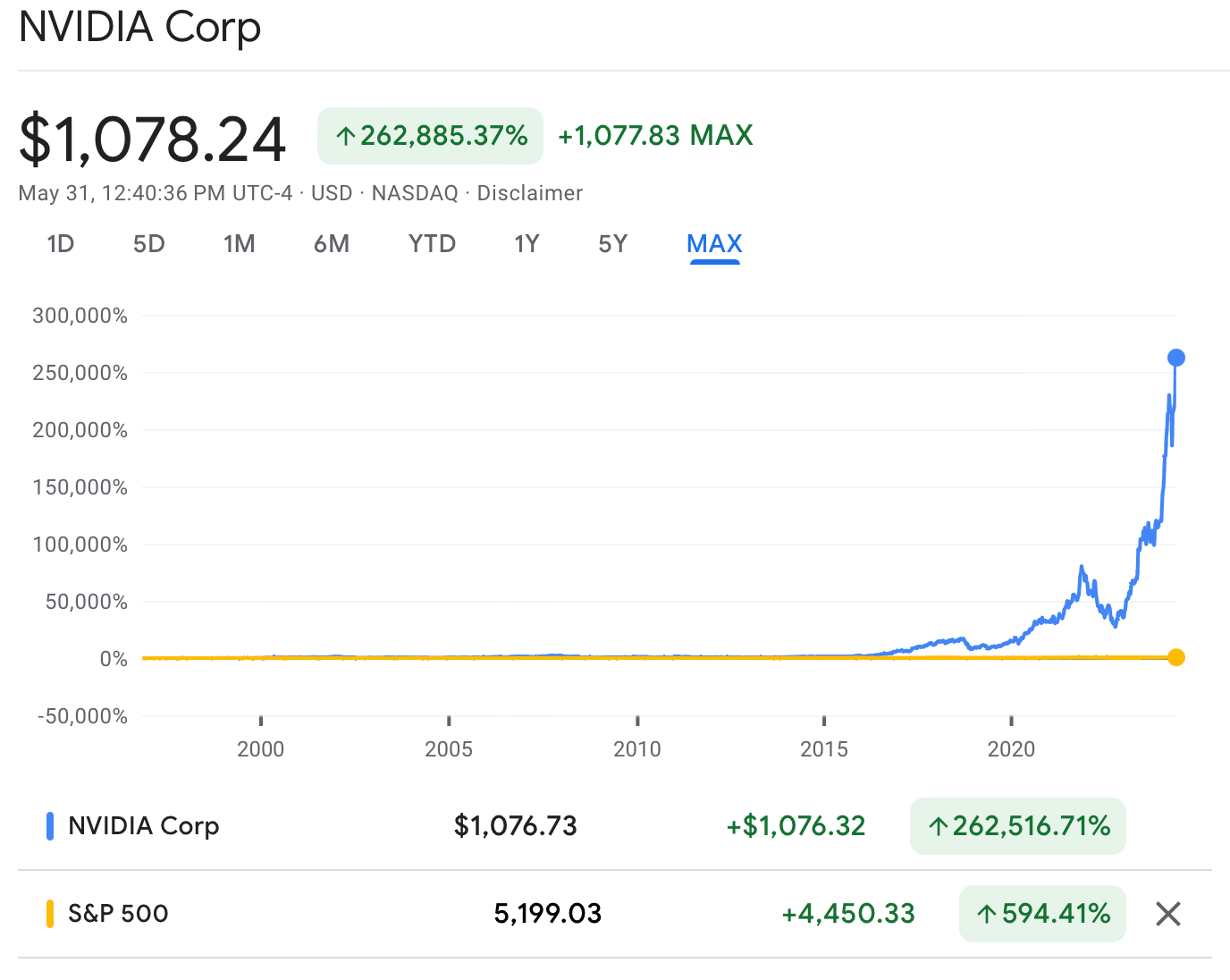

However, the rapid rise in NVIDIA's stock price has led to discussions about sustainability. The chart shared by Minsky Moment highlights the parabolic nature of NVIDIA's stock movement, suggesting potential psychological resistance around the $1000 mark and indicating possible market corrections.

Conversely, Larry Tentarelli emphasizes NVIDIA's forward P/E of 30.32, with projected EPS growth of 107.18% this year. Compared to the S&P 500, NVIDIA's valuation appears justified given its growth prospects, suggesting that the stock may not be overvalued.

Risks and Challenges

Despite its strengths, NVIDIA faces several risks:

Supply Chain Disruptions: The global supply chain for GPU manufacturing is complex and vulnerable to geopolitical tensions, natural disasters, and other disruptions that could impact production and costs.

Market Competition: With major players like AMD, Intel, and new entrants continuously innovating, NVIDIA must stay ahead of technological advancements to maintain its market share.

Regulatory Challenges: As GPUs become central to the technology arms race, particularly between the US and China, NVIDIA could face export controls and antitrust regulations that impact its business operations.

Future Outlook

NVIDIA's future looks bright, driven by strategic investments in AI and machine learning, an expanding customer base, and continued innovation. The company's ability to maintain high ROIC while minimizing CAPEX needs, positions it for sustained growth and shareholder returns. With projected revenues of $143.2 billion by FY26 and a strong market presence, NVIDIA is well-equipped to navigate the competitive landscape and regulatory challenges ahead.

Concentration of Revenue

NVIDIA's revenue distribution is notably influenced by its geographic and customer concentration. For the first quarters of fiscal years 2024 and 2025, 67% and 48% of NVIDIA's revenue, respectively, came from customers outside the United States. The company distinguishes between direct customers, such as OEMs and system integrators, and indirect customers, including public cloud providers and consumer internet companies. Notably, in fiscal year 2025, one direct customer accounted for 13% of total revenue, and another for 11%, both within the Compute & Networking segment. Additionally, two indirect customers each contributed over 10% of the total revenue, purchasing primarily through one of the significant direct customers.

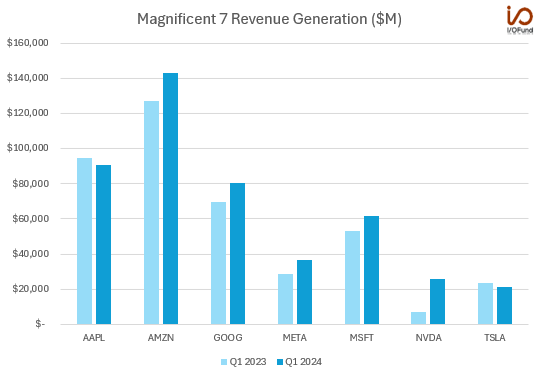

There is No Growth Like NVIDIA Growth

In the landscape of tech giants, NVIDIA stands out with a remarkable growth trajectory that few can match. The "Magnificent 7" revenue generation chart clearly showcases NVIDIA's impressive leap in Q1 2024 compared to Q1 2023. While the other giants Amazon, Google, and Microsoft exhibit steady growth, NVIDIA's revenue surge is just incredible. This exceptional growth underscores the company's strategic foresight and innovative prowess, right now fuelled by the boom in AI and Capex ramp in datacenters. However, NVIDIA also has a strong track record in positioning itself well ahead of new markets.

Source: IO Fund, Beth Kinding

The Secret Sauce of NVIDIA's Success

NVIDIA's story is one of relentless innovation and strategic foresight. The company's success can be attributed to its ability to see the future of computing and invest heavily in R&D to stay ahead of the curve. By developing a strong software ecosystem with the CUDA Toolkit and outsourcing manufacturing to TSMC, NVIDIA has created a business model that combines high returns with low capital intensity.

The ultimate indicator of NVIDIA's success has been its share price performance. NVIDIA's total return has been 35.6% annualized since December 2003, compared to 7.9% for the MSCI World over the same period. The semiconductor industry group has delivered 13% annualized in the same period, highlighting NVIDIA's exceptional outperformance.

Source: Google Finance

The Road Ahead

The main question for investors is whether NVIDIA will continue to fend off competition and maintain its market leadership. While no company remains at the top forever, NVIDIA's deep technological moats and strategic positioning give it a strong chance of enduring success. The company must navigate potential risks and stay ahead of technological advancements to maintain its edge.

As Jeff Bezos once said, "your margin is my opportunity." This sentiment is particularly relevant in the GPU industry, where many US technology companies are pursuing their own AI chips to reduce reliance on suppliers like NVIDIA. However, the strength of NVIDIA's software ecosystem, particularly the CUDA Toolkit, creates significant barriers for competitors.

Conclusion

NVIDIA exemplifies what it means to be a quality company. Currently the highest quality company in the world. Achieved through relentless innovation, strategic investments, and a strong focus on R&D, NVIDIA has established itself as a market leader in future markets of computing. While the company faces potential risks, its deep moats and competitive advantages position it well for continued growth. As of this writing, NVIDIA is the third largest company in the world by market cap. I think there is high probability that Nvidia moves past both Apple and Microsoft, to eventually claim the top spot. Whether it goes all the way to $10 Trillion or 3.5X from here, remains to be seen.