Palantir: Insights into Growth, Valuation, and Competition

Happy New Year to everyone reading, I hope you have arrived safely in to 2025. I did a poll towards the end of 2024, asking the community which company should make it to the top of the pipeline, and to my surprise Palantir came in on a shared #2, beaten by Novo Nordisk. I thought Palantir would win be a landslide. Just shows that the market sometimes has a different opinion on matters.

Palantir is probably the hottest company and stock right now and it feels the company has de-throned both NVIDIA and Tesla in interest, at least on social media (however in terms of trading and overall search interest, Palantir is still a niche compared to the other two).

Introduction

Palantir Technologies has become a cornerstone in the AI and data integration space, capturing the imagination of investors and enterprises alike. From its origins in U.S. government contracts to its aggressive expansion into commercial markets, Palantir’s trajectory is one of innovation and ambition. However, as these two sides of the business develop, questions about valuation and competitive positioning loom large. This article dives into Palantir’s recent growth, valuation challenges, and unique positioning in the competitive landscape.

Palantir’s Growth Trajectory: The Commercial Expansion

Palantir’s growth story is characterized by the rapid expansion of its commercial segment alongside its government roots. In Q3 2024, U.S. revenue grew 44% year-over-year to $499 million, supported by robust performance across commercial and government verticals. Key highlights from Q3 2024 include:

• U.S. Commercial Revenue: Grew 54% year-over-year to $179 million, showcasing the momentum in Palantir’s commercial segment.

• U.S. Government Revenue: Increased by 40% year-over-year to $320 million, highlighting the strength of Palantir’s legacy business.

• Customer Growth: Palantir closed 104 deals worth over $1 million and achieved a 39% year-over-year increase in customer count, reaching 6% growth quarter-over-quarter.

Revenue for Q3 2024 reached $726 million, marking a 30% year-over-year increase. This was bolstered by high profitability metrics:

• GAAP net income stood at $144 million, representing a 20% margin.

• Adjusted income from operations was $276 million, reflecting a 38% margin.

• Cash flow metrics were strong, with cash from operations hitting $420 million (58% margin) and adjusted free cash flow reaching $435 million (60% margin).

Financial Analysis: Valuation wall and profitability metrics

Palantir’s valuation continues to polarize investors. Despite impressive growth metrics, its premium valuation raises questions. The company has achieved remarkable profitability metrics, as evident in its Rule of 40 score of 68%, blending growth and profitability effectively. Highlights include:

• GAAP Earnings Per Share (EPS): Grew 100% year-over-year to $0.06.

• Adjusted EPS: Increased 43% year-over-year to $0.10.

• Cash Reserves: With $4.6 billion in cash, cash equivalents, and short-term U.S. Treasury securities, Palantir is well-positioned to reinvest in its growth initiatives.

Outlook for Q4 2024 remains optimistic, with revenue expected between $767 million and $771 million and adjusted income from operations forecasted between $298 million and $302 million. For the full year, revenue guidance has been raised to $2.805–$2.809 billion, driven by U.S. commercial revenue expected to exceed $687 million.

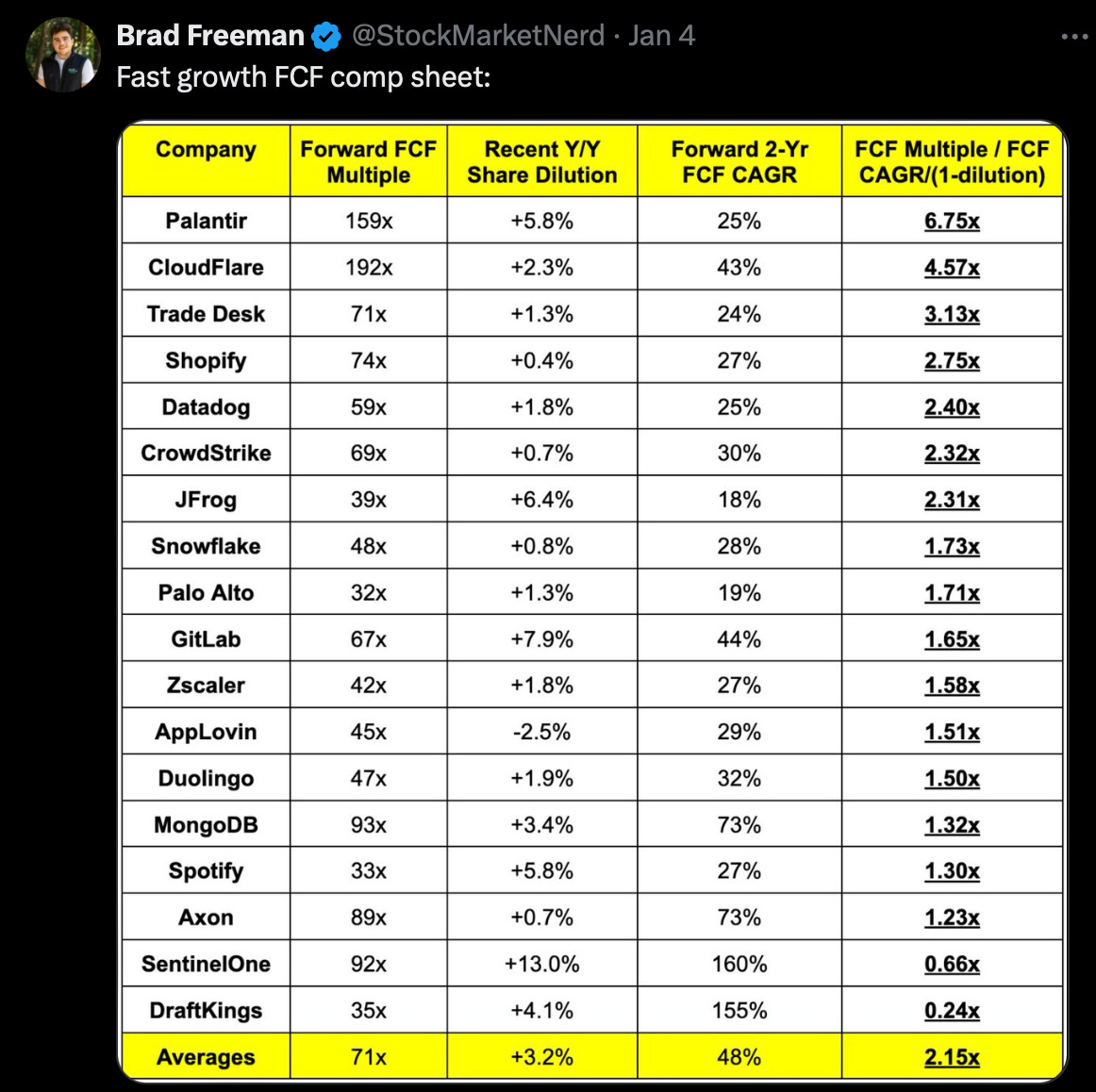

However, valuation remains a high wall. Forward multiples (P/E and FCF) suggest the stock is priced for perfection, with implied growth and profitability that leave little margin for error.

Brad put together an overview that compares and also highlights the valuation wall.

Competition: A fragmented landscape

Palantir operates in a unique competitive environment that spans multiple domains:

1. Data Platforms: Competitors like Snowflake and Databricks focus on data storage and analysis. While these platforms excel in creating data lakes, Palantir’s operational focus gives it an edge in translating data into actionable insights.

2. AI/ML Solutions: Platforms like C3.ai challenge Palantir in AI/ML workflows but lack its integrated approach to operational use cases.

3. Government Contracts: Palantir’s government business benefits from its unmatched data security and governance capabilities, though hyperscalers like Microsoft Azure and AWS are gradually gaining traction.

4. Consulting and Integration: With its forward-deployed engineers, Palantir competes with consulting giants like Deloitte and Accenture. Its differentiation lies in providing bespoke, end-to-end solutions.

Despite these challenges, Palantir’s competitive moat lies in its ability to integrate and operationalize complex data environments, especially in industries like manufacturing, logistics, and government. However, concerns about vendor lock-in and high costs continue to be barriers for broader adoption.

While the above is interesting to try to understand in ever better details, the most pressing question is: Who are Palantir competing with?

It turns out, this is not an easy question to answer. My research on this is not done as I don’t have conclusive answers. Is it Microsoft? Is it Databricks? Is it Accenture? Is it Salesforce? The fact that this question is difficult to answer, points to Palantir having a strong moat.

Key Takeaways for investors:

1. Growth Momentum: Palantir’s U.S. commercial revenue growth of 54% year-over-year signals a strong future.

2. Profitability Metrics: Strong free cash flow and EPS growth highlight operational efficiency.

3. Valuation Risks: High multiples demand perfection in execution.

4. Competitive Landscape: Palantir’s success lies in its ability to address high-complexity use cases while mitigating customer concerns about cost and vendor lock-in.

Palantir’s journey reflects a compelling blend of innovation and ambition. As it continues to evolve, it remains a critical player in shaping the future of AI and data integration. High profile CEO Alex Karp, has created a momentum for the company that resembles Amazon, Tesla, and NVIDIA. Further more there is a cult-like following which previously has boded well for a company with such a following.

Conclusion: Palantir is part of the future.

Palantir’s dual strengths in AI-driven operational platforms and high-security data management have established it as a leader in the data integration space. The company’s robust growth, especially in the U.S. commercial segment, underscores its potential to scale. However, valuation concerns and the complexity of its competitive landscape warrant cautious optimism.

I think we must weigh Palantir’s unique capabilities and potential lack of competition against its premium valuation. The company’s success hinges on its ability to sustain growth while addressing customer concerns about cost and ecosystem openness.

Palantir deserves a premium valuation on FCF basis. Just note that 2025 estimates showing a valuation of 49x revenue and 124x free cash flow, meaning the market seems to be factoring in a sustained growth trajectory of 30% or more, along with ongoing margin expansion.

I am intruiged by the company and am considering getting in, but find it hard to construct a model that justifies a price above $80. Things could get volatile for a period, but the most compelling argument for getting in is not valuation or financials. It is the fact that Palantir doesn’t seem to have much competition, and this makes me think of Stan Druckenmiller saying:

“Visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today. Never, ever invest in the present. It doesn’t matter what a company's earning, what they have earned."

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Other Readings:

a16z, Big ideas in 2025: https://a16z.com/big-ideas-in-tech-2025/

Palantir CEO Alex Karp on his upcoming book: