Recent development for Novo Nordisk ($NVO $HIMS): ADA findings boost outlook, Hims & Hers partnership terminated

Introduction

Novo Nordisk continues to reshape the landscape of obesity treatment, recently showcasing compelling results from groundbreaking clinical trials at the American Diabetes Association (ADA) Scientific Sessions. As the company pushes the boundaries with innovative therapies like CagriSema, promising unprecedented levels of patient success, it simultaneously takes a firm stance on regulatory compliance, demonstrated through its abrupt termination of the partnership with telehealth provider Hims & Hers. But could this rigorous commitment to quality and safety pose unexpected challenges for the broader telehealth industry?

ADA 2025: Promising results for Novo Nordisk

At the recent American Diabetes Association (ADA) Scientific Sessions, Novo Nordisk reinforced its position as a leader in obesity treatment through the presentation of impressive clinical data from the REDEFINE trials involving its promising new combination treatment, CagriSema.

The REDEFINE 1 trial, recently published in the prestigious New England Journal of Medicine, demonstrated a mean weight loss of 22.7% in participants who adhered to the treatment at 68 weeks, positioning CagriSema at the upper band of weight-loss medications. Further strengthening its clinical value, a noteable 60.2% of patients achieved over 20% weight loss, with over 23% exceeding a 30% reduction — figures unprecedented in the obesity medication landscape.

Crucially, these trials showed not only efficacy but also a reassuring safety profile, with discontinuation rates due to adverse events notably low (6% in REDEFINE 1), primarily consisting of mild-to-moderate gastrointestinal issues.

Novo's innovative pipeline also includes amycretin, a novel GLP-1 and amylin receptor agonist, demonstrating substantial dose-dependent weight loss potential. Early phase clinical trials highlight amycretin's ability to drive sustained weight loss, further diversifying Novo’s obesity portfolio and underscoring its leadership in metabolic health innovation.

Partnership termination with Hims & Hers - Novo Nordisk upholds compliance standards

In stark contrast to its clinical and strategic strengths, Novo Nordisk yesterday terminated its relationship with telehealth platform Hims & Hers. The partnership unravelled quickly amid significant compliance concerns over Hims & Hers' practices related to compounded medications. Specifically, Novo Nordisk highlighted issues around Hims & Hers' use of mass-scale 503A compounding and unauthorized importation of unapproved active pharmaceutical ingredients (APIs).

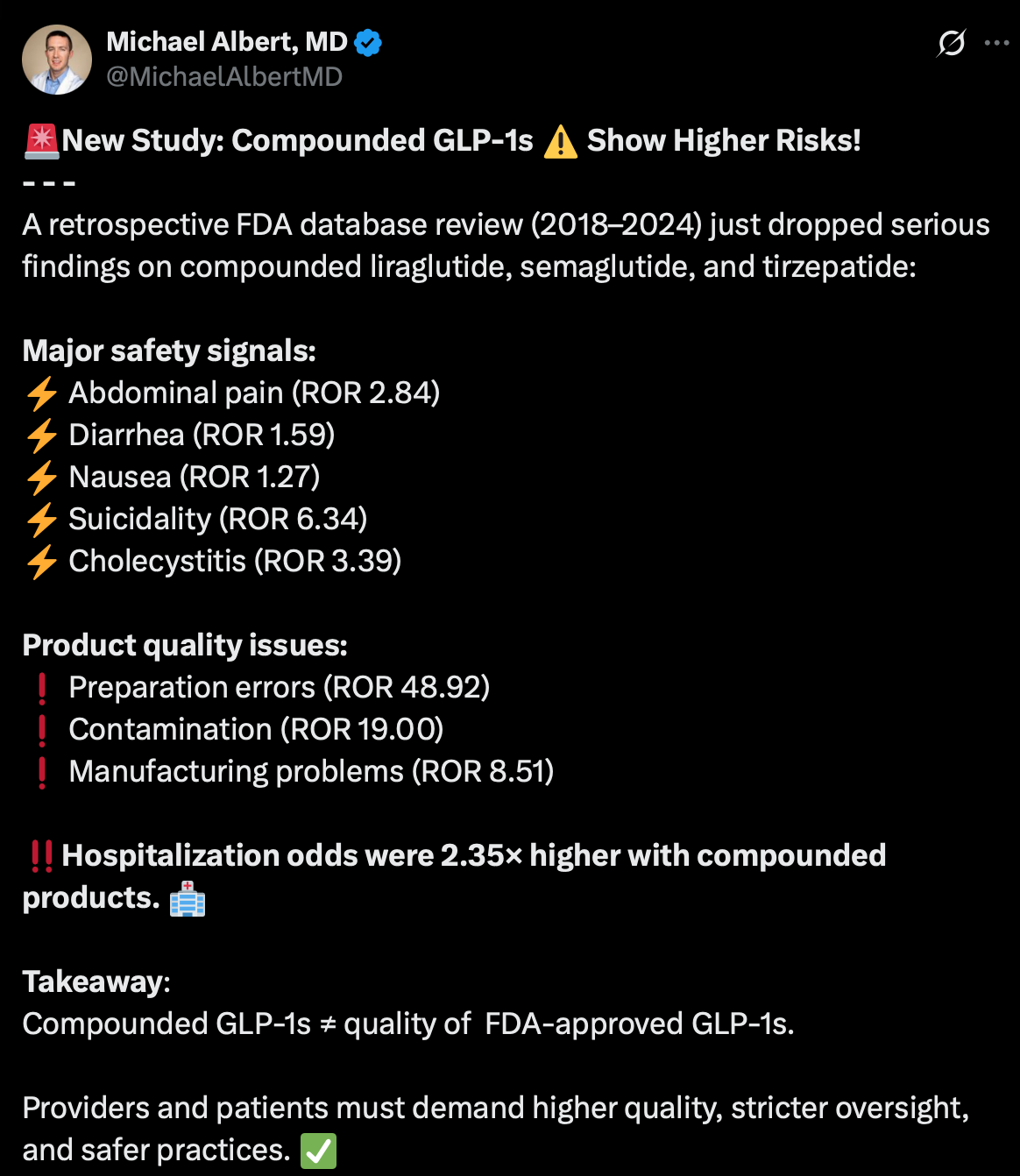

Compounded GLP-1 medications linked to increased safety risks, study warns

A recent study analyzed safety reports of compounded GLP-1 medications versus FDA-approved versions used to treat diabetes and obesity. Findings showed compounded versions carried higher risks of side effects such as abdominal pain, nausea, diarrhea, gallbladder inflammation, and even suicidality. Errors in prescribing and preparation were more common, and compounded medications were associated more frequently with hospitalizations. These results suggest significant quality and dosing concerns with compounded GLP-1 drugs, emphasizing the need for careful monitoring, stricter quality standards enforcement, and informed patient education about potential risks.

Novo Nordisk's decisive action to cut ties demonstrates its natural commitment to strict regulatory compliance and patient safety. Such actions underscore the inherent risks within telehealth providers engaging in questionable practices. Investors should view the development negatively for Hims & Hers, whose credibility and long-term viability in highly regulated medical treatments appear substantially compromised. I consider this a major red flag for Hims & Hers management. It is also reasonable to expect that Hims & Hers could face lawsuits due to this.

Novo Nordisk's financial strength and attractive valuation

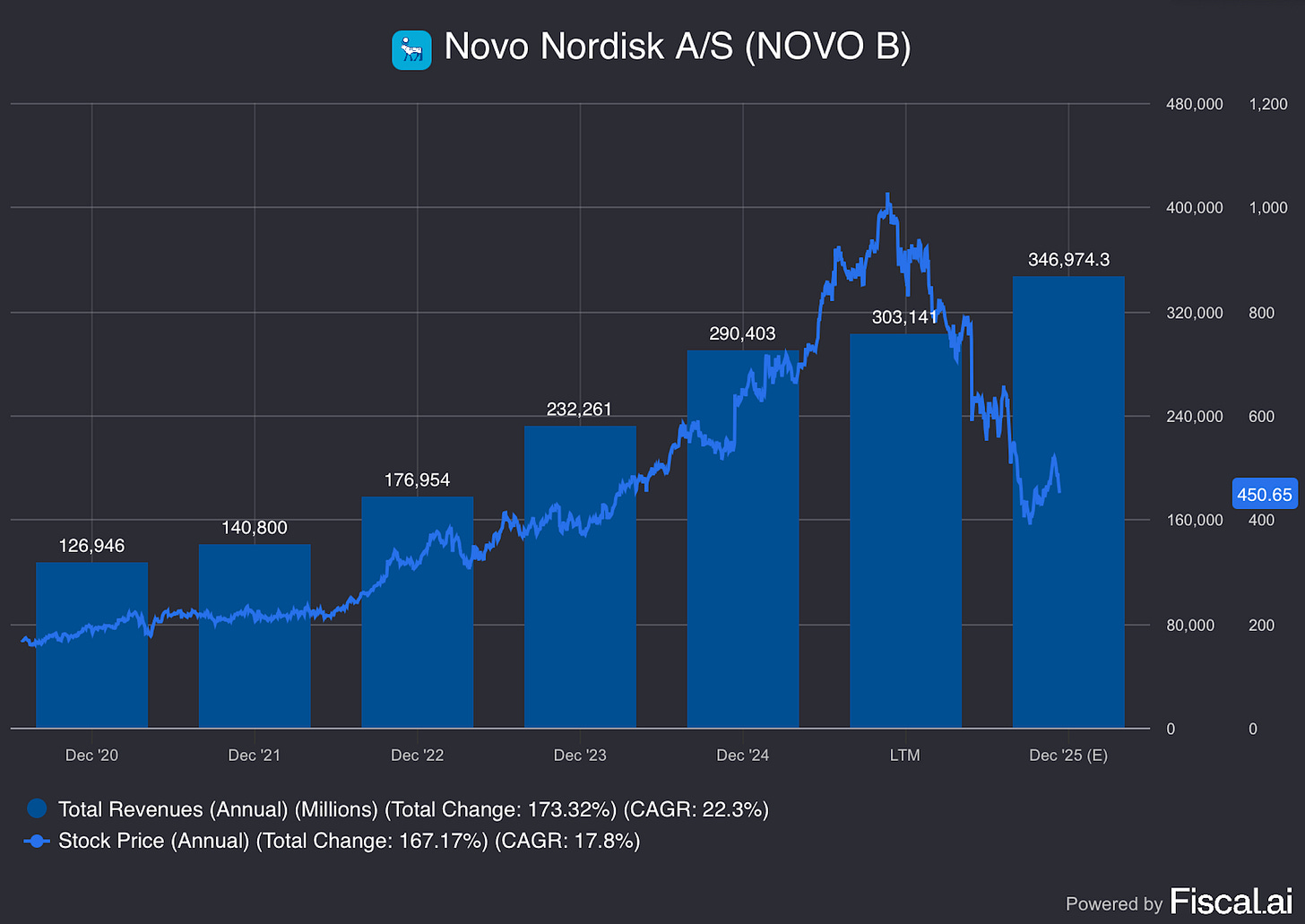

Financially, Novo Nordisk remains exceptionally robust, demonstrating consistent growth and profitability. Revenues have grown significantly, forecasted to rise from estimated DKK 330 billion in 2025 to approximately DKK 520 billion by 2029, translating to strong and sustainable CAGR. EBIT margins remain solid, projected around an impressive 50% by 2029.

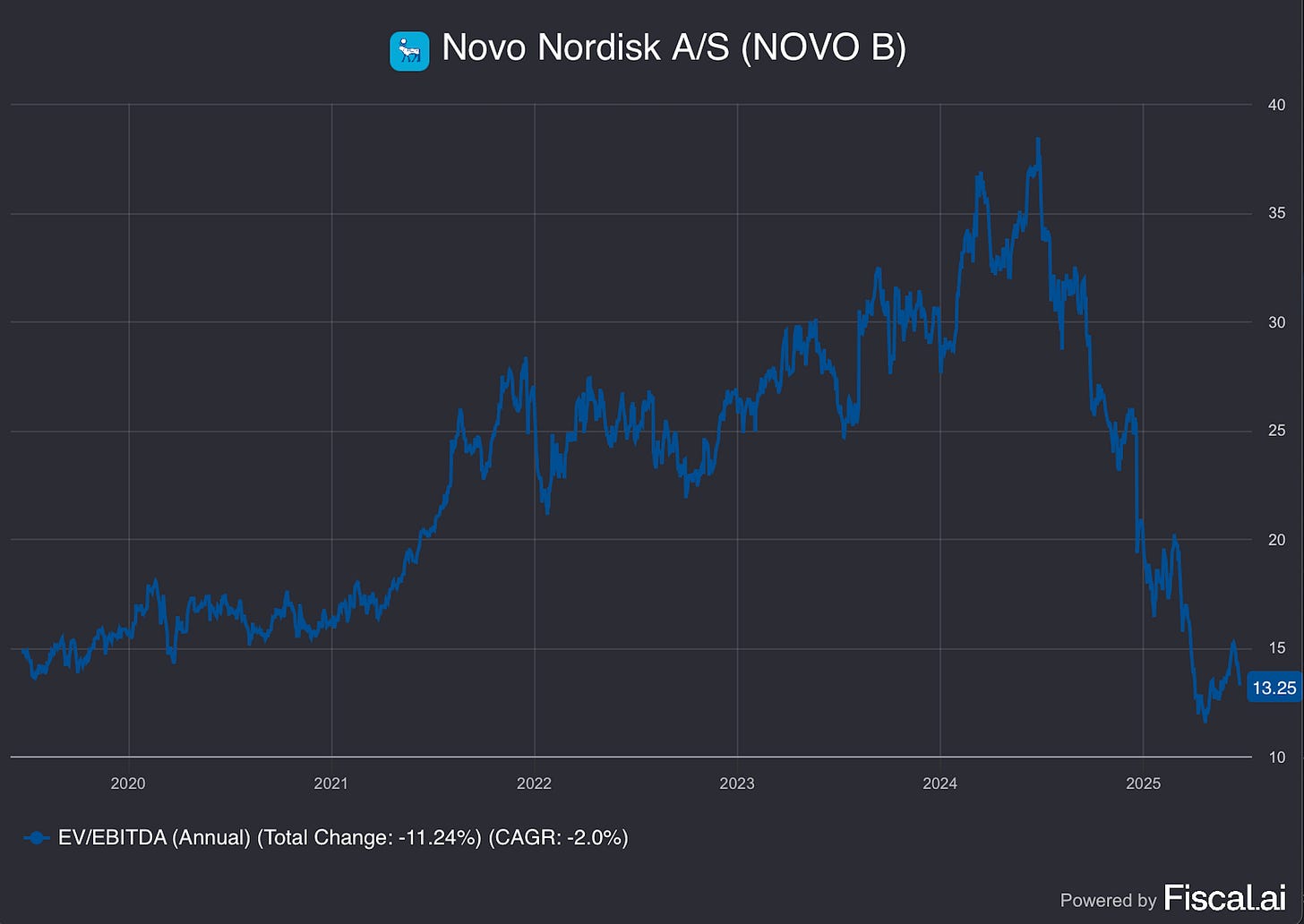

Key valuation metrics continue to underscore Novo Nordisk's attractiveness:

Forward P/E of 17.0x for 2025, expected to decline to below 10x by 2029, highlighting significant earnings acceleration.

EV/EBITDA ratio forecast to decrease sharply from 12.6x in 2025 to a very attractive 6.6x by 2029, demonstrating improving efficiency and valuation appeal.

Dividend yields expected to progressively improve from 3.0% to 5.3% over the same period, providing investors with compelling total-return potential.

Moreover, Novo Nordisk’s robust free cash flow generation, expected to rise to DKK 174 billion by 2029, ensures continued financial flexibility to invest in innovation, share repurchases, and dividend growth.

Above all, Novo Nordisk´s is growing revenues at a solid clip and historically there has been a reasonable relationship between revenues and share price, with the exception during 2024 where expectations for share price got out of hand.

Conclusion: Novo Nordisk positioned for continued excellence

With breakthrough obesity treatments, unwavering compliance standards, and compelling financial metrics, Novo Nordisk remains strongly positioned for sustained growth. The company's swift action regarding compliance concerns with Hims & Hers further demonstrates its commitment to integrity and long-term strategic vision.

Investors looking for quality growth, industry leadership, and a prudent risk profile should continue to view Novo Nordisk as a core holding in healthcare portfolios. The combination of groundbreaking scientific developments and disciplined corporate governance makes Novo Nordisk not only a frontrunner in tackling global obesity but also a compelling long-term investment.

I have a position in Novo Nordisk and also find the current level attractive. The above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Neat and precise! Thank you for your analysis, opinion and comments! 🤙