$TEVA: A Strong Case for Recovery Despite Earnings-Driven Overreaction

Introduction

The sharp drop in TEVA’s share price following its Q4 2024 earnings release represents a significant overreaction by the market. While headline numbers may have missed some optimistic expectations, the underlying financials and strategic outlook remain strong. TEVA is on track for sustainable long-term growth, and this short-term dip presents an attractive opportunity for investors. The fundamentals remain intact, with key growth drivers such as AUSTEDO, UZEDY, and an expanding generics business continuing to deliver. Moreover, strategic initiatives like portfolio optimization, debt reduction, and manufacturing efficiencies will drive long-term margin expansion.

Market overreaction to Q4 earnings

Q4 2024 Highlights

TEVA’s Q4 2024 earnings report contained several key takeaways:

• Revenue Growth: TEVA reported $4.23 billion in revenue, down from $4.46 billion in Q4 2023. However, excluding the impact of a one-time $500 million upfront payment from Sanofi in Q4 2023, revenue actually grew by 9% year-over-year .

• Non-GAAP EPS: Came in at $0.71 per share, down from $1.00 in Q4 2023, mainly due to planned reinvestments in growth initiatives.

• Free Cash Flow: TEVA generated $790 million, down from $1.49 billion in Q4 2023. However, this was influenced by temporary working capital adjustments.

• Adjusted EBITDA: Declined to $1.28 billion from $1.66 billion due to increased R&D and OPEX investments.

What Drove the Share Price Drop?

• Margin Contraction Concerns: The decline in operating margins to 25.5% in 2025 (vs. 26.9% expected) triggered concerns.

• API Divestment Impact: It seems that some analysts worried about TEVA’s API divestment leading to increased raw material costs.

• Guidance Caution: TEVA’s management issued conservative guidance, which is typical and largely a positive thing given the recent past that TEVA has been through but this gets misunderstood.

However, these concerns are largely short-term and do not undermine the company’s long-term growth trajectory.

Financial analysis

Profitability Metrics

TEVA’s profitability remains healthy despite short-term fluctuations:

• Gross Profit Margin: 53.3% in 2024, expected to reach 54.3% by 2026.

• EBIT Margin: 26.2% in 2024, forecasted to expand to 28.1% by 2027.

• Return on Invested Capital (ROIC): 18.0% in 2024, rising to 24.2% in 2027, reflecting efficiency improvements.

These metrics demonstrate consistent operational efficiency and the potential for margin expansion despite temporary headwinds.

Valuation and growth potential

TEVA is currently trading at a 7.6x P/E ratio (2025E), which is significantly below its historical average and sector peers. Given its projected EPS CAGR of 9% through 2027, this valuation appears deeply discounted.

• Price Target: Analysts have revised their 12-month price target to $27 (previously $30), still implying a 45% upside from current levels ($18.58).

• Enterprise Value / EBITDA: 7.0x in 2025E, falling to 5.9x by 2027, making TEVA attractively priced relative to its earnings potential.

Debt reduction strategy

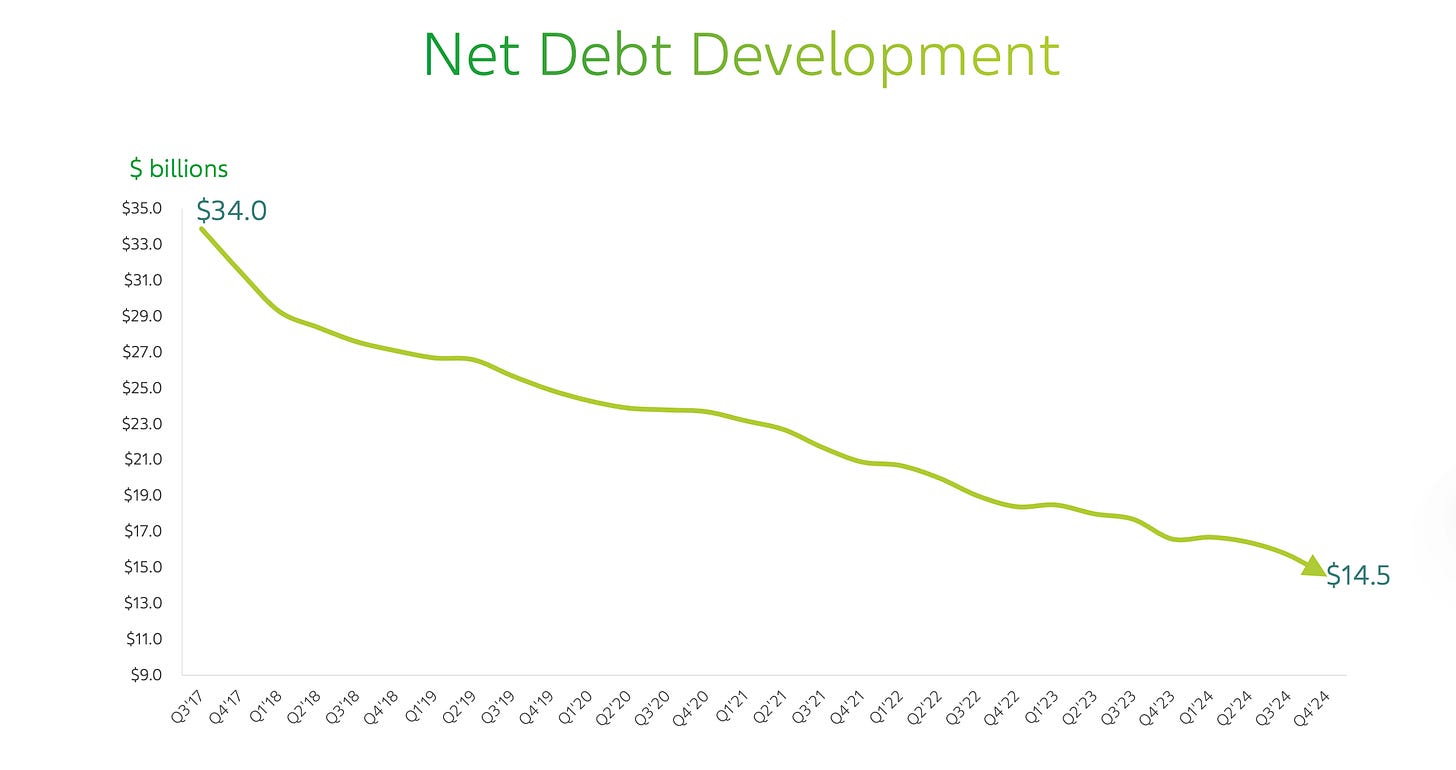

TEVA’s net debt has declined from $18.4 billion in 2022 to $14.7 billion in 2024, and further reductions to $10.3 billion by 2026 are expected . The company’s ability to generate consistent free cash flow will support continued deleveraging, ultimately improving valuation multiples.

I show this chart every time I write about TEVA as it is instrumental to the overall plan of becoming an even stronger company.

Key growth drivers remain intact

Despite near-term market concerns, TEVA’s growth trajectory is solid.

Expanding Specialty Medicines Portfolio

• AUSTEDO®: U.S. sales grew 34% YoY, reaching $1.64 billion in 2024. TEVA expects $1.9-$2.05 billion in 2025, fueled by continued market penetration.

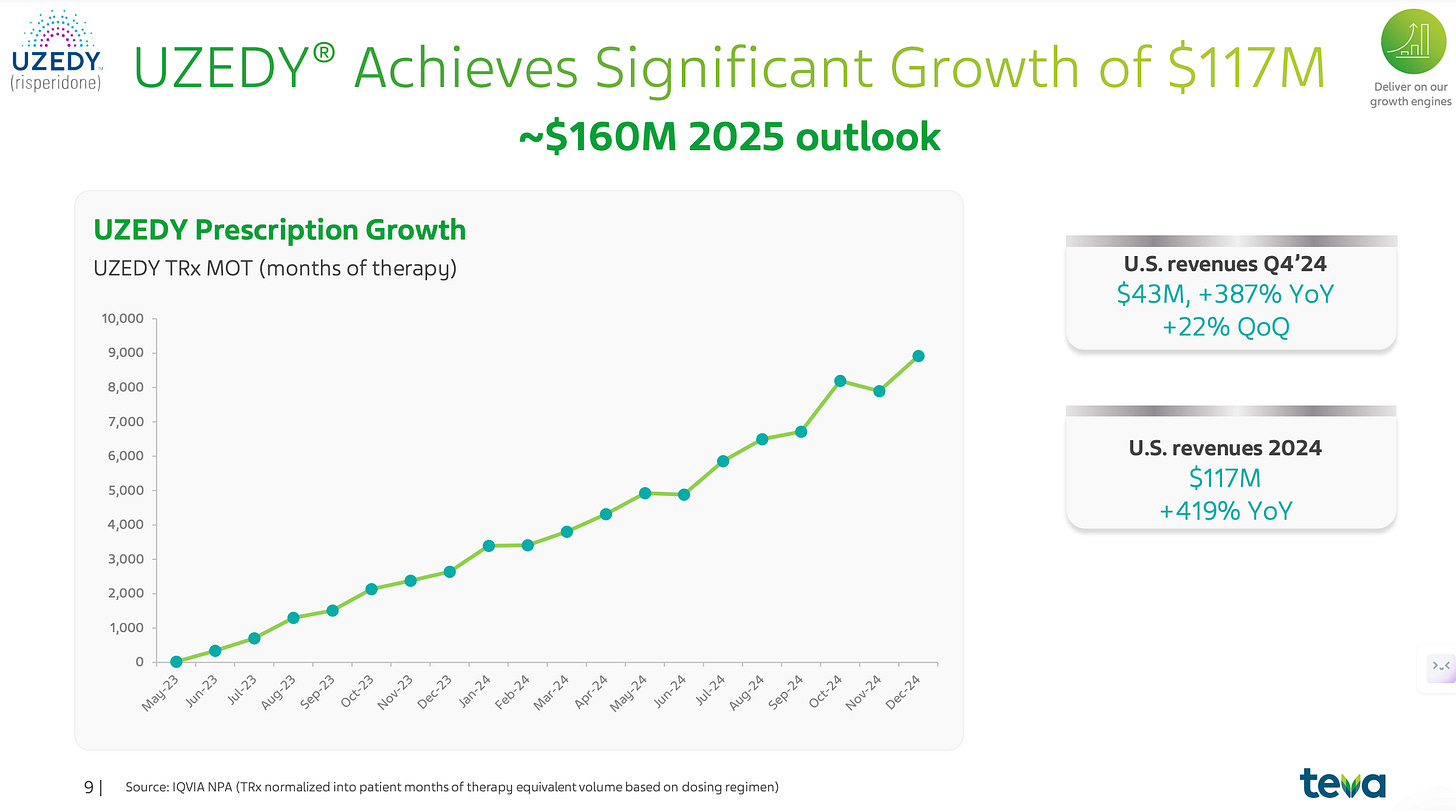

• UZEDY®: Sales surged 419% YoY to $117 million, exceeding expectations and signaling strong demand growth.

• AJOVY®: Global revenue reached $142 million in Q4 2024, up 18% YoY, with #1 market position in 18/19 European markets.

Generics and Biosimilars strength

• Global Generics Revenue: Up 11% YoY to $9.46 billion, reinforcing TEVA’s leadership position.

• Biosimilar Expansion: TEVA is set to launch 7 biosimilar assets between 2025-2027, targeting an $80 billion addressable market.

Margin expansion strategy

• Manufacturing optimisation: TEVA is reducing costs via its Value Acceleration Program, expected to drive gross margin expansion.

• Pipeline Innovation: Multiple late-stage pipeline assets, including Duvakitug (anti-TL1A) and Olanzapine LAI, provide additional revenue streams.

Why the stock will recover

2025 Upside Scenario

TEVA’s management has historically guided conservatively, setting the stage for positive earnings surprises in 2025. Key factors supporting a potential upside include:

• Strong AUSTEDO and UZEDY sales momentum.

• Margin expansion driven by better product mix and manufacturing efficiencies.

• Potential upside from pipeline readouts, especially TL1A phase III results in H2 2025.

Debt reduction and financial flexibility

As net debt/EBITDA improves from 3.0x (2024) to 2.5x (2025), TEVA will regain financial flexibility, allowing for strategic acquisitions or shareholder returns.

Favorable Market Positioning

TEVA remains one of the largest global generics players with a diversified revenue base and a leading position in innovative medicines. The company is well-positioned to capitalize on aging demographics and increasing demand for affordable pharmaceuticals.

Conclusion: Still a strong growth opportunity

The market’s quick reaction to TEVA’s earnings was unwarranted. The fundamentals remain strong, and the stock is undervalued relative to its growth potential.

• Revenue growth, pipeline expansion, and margin improvements remain on track.

• Valuation is still attractive. If we look at the price targets from UBS and Barclay there is then an approximately 45% upside from today´s share price.

• Debt reduction will drive further equity value appreciation.

For long-term investors, this dip presents an opportunity to accumulate shares before the next positive earnings catalyst in 2025. TEVA has moved beyond the pure turnaround story—it’s a growth story that is still unfolding as it develops into a specialty medicine company.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Other readings:

Why Healthcare will be the industry that benefits the most from AI: https://a16z.com/why-will-healthcare-be-the-industry-that-benefits-the-most-from-ai/

New Supercomputer to drive breakthroughs in industry and academia: https://novonordiskfonden.dk/en/news/denmarks-first-ai-supercomputer-is-now-operational/

Recent update on TEVA

Why TEVA soared 28% ($TEVA)

·Teva Pharmaceuticals has made remarkable strides in transforming its business, showcasing resilience and an ability to exceed expectations. As we step into 2025, I am optimistic about Teva’s trajectory, with more room to run over the next 12-18 month the company´s share price could near $30, reflecting the company’s strong fundamentals and strategic pro…