Teva Delivers Strong Q3 Results with Revenue Growth, Pipeline Progress and Upgraded Guidance

Teva Pharmaceuticals has reported a robust performance for Q3 2024, demonstrating significant revenue and earnings growth while making solid progress across its pipeline and core business segments. The results have prompted an upward revision of the company’s full-year guidance, signaling confidence in continued momentum.

Revenue and Earnings Highlights

Teva achieved a 15% year-over-year increase in Q3 revenue, totaling $4.3 billion. This growth was driven by strong sales from both its innovative products and generics portfolio. The company’s adjusted EBITDA rose by 17% to $1.3 billion, while non-GAAP EPS saw a 16% improvement. Free cash flow was particularly strong, reaching $922 million, which enabled Teva to further reduce its net debt, bringing the net debt-to-EBITDA ratio down to 3x.

This is a key chart and has been a bog part of the thesis since Copaxone went off patent: would Teva be able to grow revenue without its key drug. The answer is yes as the company has brought new branded drugs tot he market and keeps developing its pipeline.

Upgraded Full-Year Guidance

Given the solid performance in Q3, Teva has raised its full-year revenue guidance to a range of $16.1 - $16.5 billion, adding $100 million to its previous forecast. The company has also updated its EPS guidance to $2.40 - $2.50 and reaffirmed its free cash flow expectations of $1.7 - $2 billion for the year. The outlook for Q4 suggests continued margin improvement, bolstered by strategic cost optimization and a favorable revenue mix.

Momentum in Key Innovative Products

Teva’s innovative product line has been a key growth driver:

• AUSTEDO (Tardive dyskinesia and Huntington's disease) revenues surged by 28% year-over-year, reaching $435 million in Q3. The company remains confident in achieving its full-year revenue target of $1.6 billion for AUSTEDO.

• AJOVY (Migraine), Teva’s migraine treatment, posted 21% growth globally, underscoring its strong uptake in international markets despite intense competition.

• UZEDY (Schizophrenia), a newer addition to Teva’s portfolio, generated $35 million in Q3 revenues. Due to its strong launch momentum, Teva has raised its full-year guidance for UZEDY to $100 million.

Advancements in R&D and Biosimilars

Teva’s R&D efforts have shown notable progress, particularly in its innovative pipeline:

• TL1A: The company is on track to present data for its TL1A program, targeting ulcerative colitis and Crohn’s disease, by the end of the year. Teva’s management emphasized the importance of the totality of data, including both endoscopic and clinical remission endpoints, in assessing the success of these trials. The endpoint of endoscopic remission was a key question at the conference call and Eric Hughes explained well what Teva is focused on in the trials.

• Olanzapine LAI: Phase III results for Teva’s long-acting injectable olanzapine are expected in the first half of 2025. The company aims to differentiate this treatment through its clinical trial design and expects favorable regulatory feedback.

• Biosimilars: Teva’s filings for biosimilar Prolia have been accepted by both the FDA and EMA. With a potential market launch in the second half of 2025, this product targets a market worth approximately $3 billion. Teva’s growing biosimilars portfolio now includes 17 assets, aiming at a combined brand value of $60 billion.

Sustained Growth in Generics Business

Teva’s global generics segment delivered a 17% growth rate in Q3:

• In the U.S., generics sales jumped by 30%, supported by the success of complex generics like Revlimid and Victoza.

• European generics sales increased by 8%, while international markets posted a 13% rise, benefiting from targeted product launches and enhancements in the supply chain.

• The Teva Active Pharmaceutical Ingredients (TAPI) segment recorded its third consecutive quarter of growth. The ongoing divestment process for TAPI is expected to conclude by the first half of 2025.

Addressing Legal and Currency Headwinds

Teva faced some challenges due to currency fluctuations and legal adjustments:

• Foreign exchange rates negatively impacted revenue by $250 million and gross profit by $190 million.

• Legal provisions included a $600 million goodwill impairment related to TAPI and a $450 million charge for settlements, notably a $350 million provision tied to an EU antitrust investigation regarding COPAXONE, which Teva intends to appeal. This will be a multi-year legal journey, with no clear visibility on outcome in the short-term.

Strengthened Balance Sheet and Credit Rating Improvement

Teva’s commitment to reducing debt has been recognized by credit rating agencies, with Fitch upgrading the company’s rating to BB, the first upgrade in over a decade. Teva repaid $685 million in debt following Q3 and has no further maturities for 2024, advancing its goal of achieving investment-grade status. This is a key activity for Teva, and when the debt reduction is completed the company will be fundamentally better and have new strategic opportunities. The end game for debt reduction is at minimum Net Debt / EBITDA at 2.0, targeted for 2027 (while Kåre Schultz was CEO he talked about going all the way to 1.0).

Investing in Long-Term Growth

Teva remains focused on balancing debt reduction with investments in innovation and pipeline expansion. The company continues to reinvest approximately 45% of incremental gross profit into operating expenses, supporting future growth and enhancing shareholder value.

Looking Ahead

Teva’s strong Q3 performance and the positive outlook for its key product segments and pipeline programs underscore its commitment to delivering sustainable, long-term growth. The upcoming data readouts and the continued momentum in innovative and generic products position the company well to meet its financial targets and drive shareholder value into 2025 and beyond.

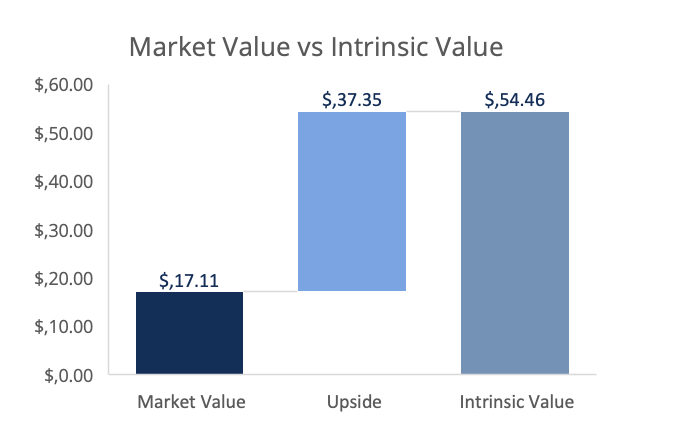

Here is the updated model based on DCF valuation with the implied upside relative to today´s share price. I am still a buyer at this level.

With that, thanks for reading, I really appreciate the interest. Below are links to a few other items that you might find interesting.

Other readings:

Randall Munroe “Thing Explainer: Complicated Stuff in Simple Words” https://amzn.to/4erhzlE

The Winner´s Edge: https://fs.blog/winners-edge/

Invest Like The Best Podcast on Semiconductor