Teva Pharmaceuticals: The pivot to Specialty Pharma is in full swing

De-risked, deleveraged, and undervalued signals a new bull market for Teva.

Introduction

Teva is rapidly shedding its skin as a legacy generics manufacturer. The market is beginning to wake up to a new reality: Teva is evolving into a large-cap Biopharma compounder. With the IRA pricing risk for Austedo significantly de-risked and a clear path to balance sheet pristineness, the stock is poised to detach from its historical generics multiple and re-rate significantly higher. We are starting to see analyst (UBS, Piper Sandler) come around to this fact with price target of $37-40 per share as the market digests this transformation.

The pivot point - 2028 revenue mix shift

For years, the “generics overhang” has suppressed Teva’s valuation. However, the data indicates we are approaching a watershed moment.

By 2028, we will see that generics will no longer be the largest contributor to Teva’s revenue.

This shift is driven by the divergence in growth rates between the mature generics business and the innovative franchise. While the generics business stabilizes, the branded portfolio, led by Austedo, is accelerating.

Austedo de-risked: The recent IRA price determination has removed a major overhang, solidifying the brand’s long-term growth trajectory. We will see Austedo sales climbing toward more than $3 billion by 2028, representing a double-digit CAGR.

Pipeline contribution: We are looking at a “long tail” of pipeline catalysts that the market currently underappreciates - CEO Richard Franchis believes these to be fully disregarded by most - including Olanzapine LAI in the second half of 2026 and critical readouts for Duvakitug (TL1a).

As branded products climb from ~17% of revenue in 2025 to over 35% by 2030, the quality of Teva’s revenue improves dramatically.

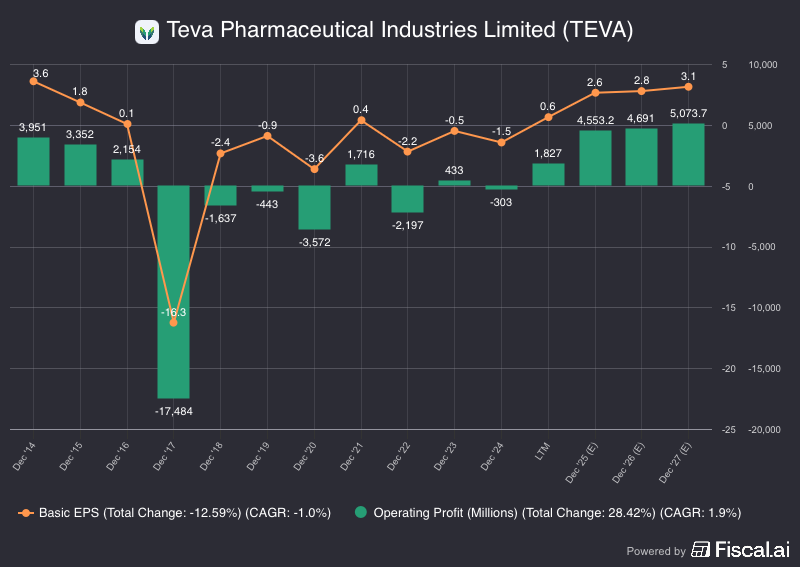

The margin expansion story

This revenue mix shift is not just about top-line optics; it fundamentally alters the margin profile. Innovative medicines command higher pricing power than commoditized generics. As the mix shifts toward innovative brands, I expect a solid uplift in profitability metrics:

Gross margin: Will expand as high-margin brand sales replace lower-margin generic volume.

Operating margin & EBITDA: We will see a robust expansion here. Based on Piper Sandler and UBS targets, we will see 10% EBITDA CAGR moving forward. By 2029, forecasted EBITDA margins expanding to 33.0% (up from 27.5% in 2025).

Consequently, earnings quality is improving. 3-year forward EPS CAGR of 10%, a growth rate that outpaces the current consensus of ~8%.

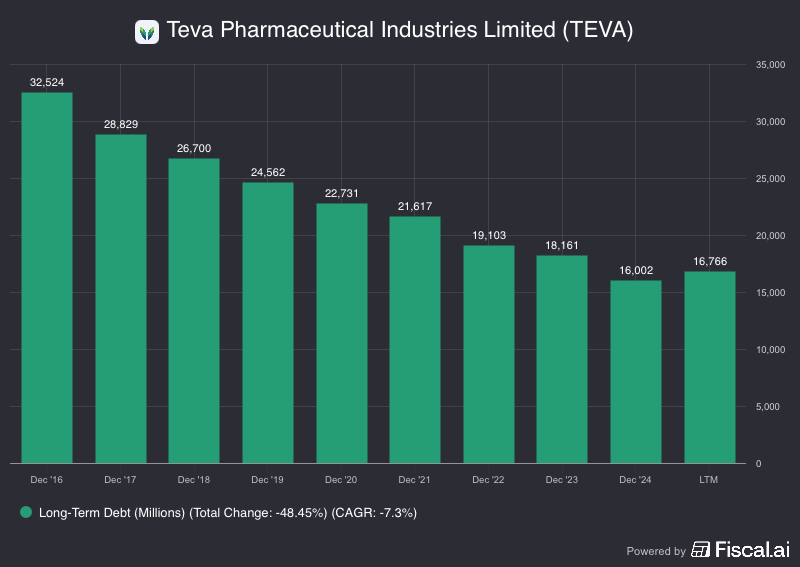

The balance sheet transformation

Perhaps the most underreported story is the speed of Teva’s deleveraging. The “debt wall” that once terrified investors is being dismantled brick by brick.

Sub-$10 Billion by 2028: I project Long Term Debt falling to $9.4 billion by the end of 2028, down from nearly $16 billion in 2025.

Net Debt: The trajectory for Net Debt is even more aggressive, dropping from $11.3 billion in 2025 to effectively zero (and potentially net cash positive) by 2029.

This trajectory suggests Teva could be completely debt-free by 2032. While the company may choose to maintain some level of gearing for capital efficiency or M&A, the optionality of a debt-free balance sheet warrants a significant premium compared to its levered past.

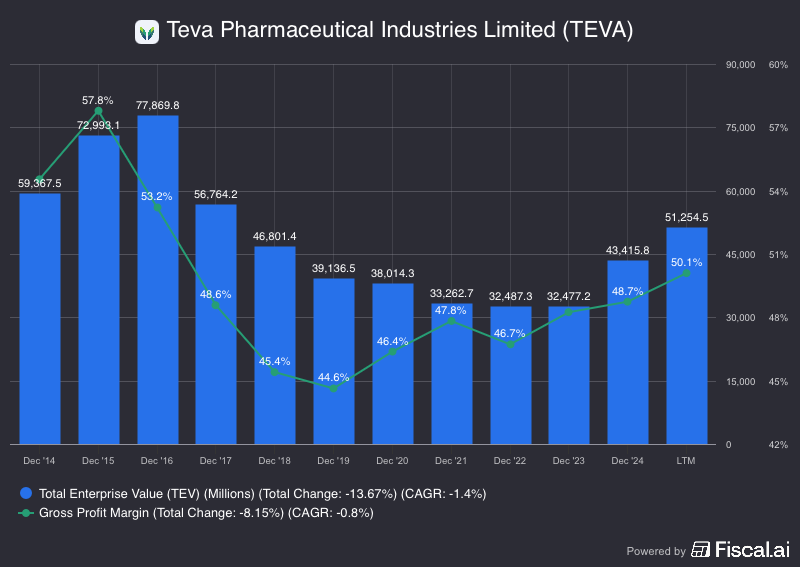

Valuation re-rating is a big opportunity

The market is still valuing Teva like a generics manufacturer, but the fundamentals scream “Specialty Pharma.”

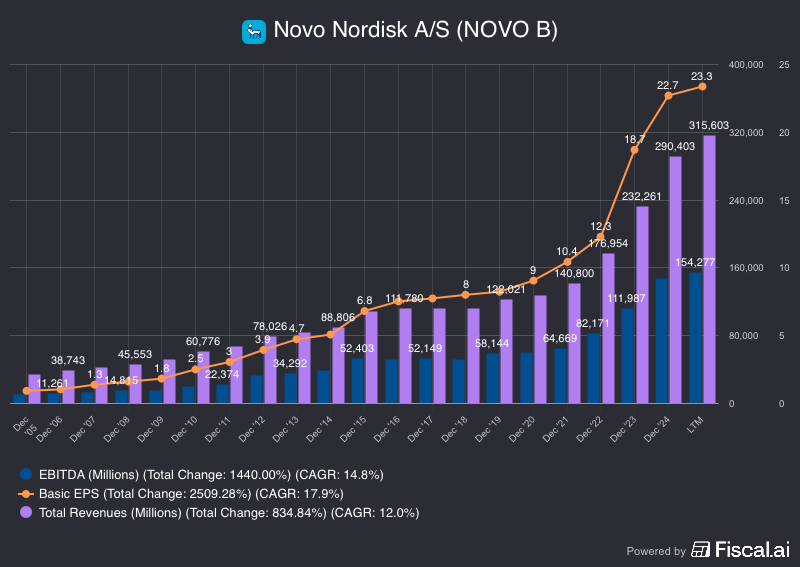

Multiple Expansion: As the revenue mix crosses that critical 2028 threshold, Teva stock should disconnet from the low generics multiples (typically ~6-8x) and trade closer to large-cap Biopharma peers.

Valuation Methodology: UBS and Piper Sandler appears to be applying a 7.0x sales multiple to the 2030 branded revenue estimates and a 6.0x EBITDA multiple to the mature business which then yields a Sum-of-the-Parts (SOTP) valuation of $37 and up to $40. .

Conclusion

Teva is joining the rare field of de-risked biopharma names. The combination of the Austedo de-risking, a 10% EPS growth path, and a rapidly clearing balance sheet creates a compelling setup. I am seeing a way to a share price beyond the recently updated price targets set by UBS and Piper Sandler, and have my eyes on the continued execution.

I have a position in Teva, the above is as always not investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.