Teva’s pivot continues - highlights from Jeffries Healthcare conference

Why the anti-TL1a hype is real

The “New” Teva?

At the Jefferies London Healthcare Conference last week, Teva Pharmaceuticals didn’t just present quarterly numbers. They continued to rewrite the identify of the company; from generics to novel pharma. For years, the market has viewed Teva primarily as a generic drug manufacturer burdened by debt - something discussed several times here for the readers that have followed along. But the narrative emerging is different. The talk in London focused on a particular part of the pivot to growth; one specific asset doing some heavy lifting: Duvakitug (TEV-’574).

Is this asset a true valuation multiplier, or just another “me-too” drug in a crowded immunology space?

What is Duvakitug?

Duvakitug is an anti-TL1a antibody. Scientifically, this is significant because TL1a (Tumor Necrosis Factor-like Ligand 1A) is a master regulator of both inflammation and fibrosis (scarring).

Unlike current standard-of-care biologics (like anti-TNFs) that primarily target inflammation, TL1a inhibitors theoretically stop the structural damage that leads to surgeries in IBD patients.

The Current Status (Q4 2025):

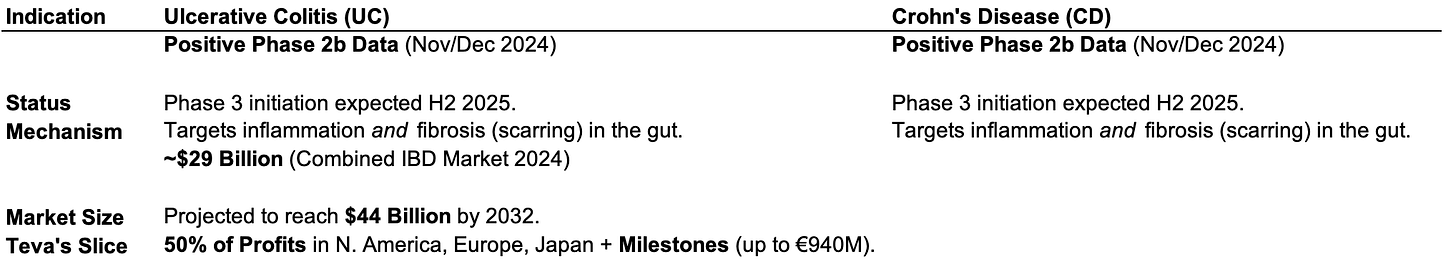

Indication: Ulcerative Colitis (UC) and Crohn’s Disease (CD).

Data: Positive Phase 2b results released late 2024.

Next Step: Phase 3 initiation is imminent (H2 2025).

The Jefferies reveal: “Two New Indications”

The most critical piece of new information from the Jefferies conference was the confirmation that Teva is expanding Duvakitug into two new Phase 2 indications.

The CEO refrained from naming them explicitly in the session, but if we look at the pathophysiology of TL1a and the movements of competitors like Merck (who acquired Prometheus), we can deduce the high-probability targets.

1. Systemic Sclerosis (SSc): The Scientific Fit

The Logic: SSc is characterized by fibrosis of the skin and internal organs. There are very few effective treatments. Since TL1a drives fibrosis, blocking it here is a biologically sound hypothesis.

The Market: While the patient population is smaller (orphan disease territory), the pricing power is high, and the competitive intensity is lower than in IBD.

2. Atopic Dermatitis (AD) or Asthma

The Logic: TL1a is upregulated in allergic skin inflammation.

The Risk: This is a “red ocean” market dominated by Dupixent (Sanofi/Regeneron). For Teva to succeed here, Duvakitug cannot just be “as good as” current options; it must work in non-responders.

Visualizing the opportunity

Below is the breakdown of the market opportunity and the strategic expansion discussed at the conference.

Infographic: The TEVA Anti-TL1a Strategy

Market opportunity and the strategic expansion discussed at the conference:

The grounded view

While the “Total Addressable Markets” (TAM) for expansion indications are huge, Teva’s actual potential is limited by three factors that were glossed over at the conference:

1. The “Follower” penalty

Merck (Prometheus) is ahead in the race with tulisokibart. In the pharmaceutical industry, the second drug to market typically captures only 20% - 30% of the share unless it is significantly superior. We have not yet seen head-to-head data proving Duvakitug is better than Merck’s asset.

2. The Sanofi ceiling

Valuing this asset requires adjusting for the 2023 partnership. Teva only keeps 50% of the profits in major markets.

Investment Implication: This deal de-risks the massive cost of Phase 3 trials, but it also caps the upside. If Duvakitug becomes a blockbuster ($5B+ sales), Teva only sees half of that.

3. The “Fibrosis” Hypothesis Risk

While the anti-fibrotic mechanism looks great in mouse models and early human data, it is notoriously difficult to prove in clinical trials. If the FDA does not allow a specific claim for “reversal of fibrosis” on the label, the drug loses its main differentiator against established therapies like Humira or Stelara.

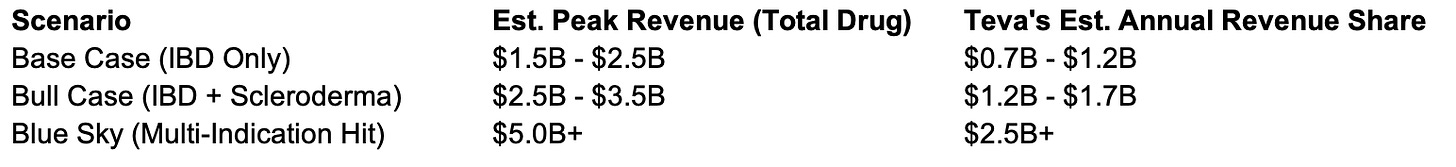

Summary of financial potential

The table below models three revenue scenarios, strictly adjusted for the 50/50 profit-sharing agreement with Sanofi. The Base Case—which assumes a modest market share in the crowded IBD space—generates significant, but not transformative, revenue. The transformative “Blue Sky” scenario ($2.5B+ to Teva) is heavily leveraged to the success of the new expansion indications, which carry a significantly higher clinical risk profile than the core IBD program.

Conclusion

Teva is currently trading at a valuation that largely reflects its generic business and Austedo. The market is assigning very little value to the pipeline. Something that was also highlighted by CEO Richard Francis.

If Duvakitug succeeds in IBD and enters these new indications successfully, it represents a massive call option on the stock. However, let us wait for the Phase 3 initiation details and definitive confirmation of the new indications before modeling this as a guaranteed win.

The asset is promising. The science of TL1a is sound, the commercial upside is very meaningful to Teva but also comes with a battle with Merck.

There is now momentum behind the Teva story, and I find it likely that we will see $29-31 over the next 12 months.

I have a position in Teva, the above is as always not investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Novo Nordisk ($NVO): From messy back to miracle

Thesis in one line: Novo is working through a messy transition year—pricing noise, copycat pressure, pipeline repositioning, and a brutal share-price drawdown—but the long runway in obesity, cardiometabolic health, and next-gen orals remains intact. I see a path to steady re-acceleration from 2026 as pricing clarity, access expansion, oral launches, and…