Introduction

It has been a busy couple of weeks in global healthcare, predominately with negative news but Teva just quietly delivered its 10th consecutive quarter of growth, raised guidance across its key innovative drugs, slashed debt again, and trades at 6x earnings. The market is still mostly asleep on this one. The setup here? Multiyear transitioning from legacy generics to an innovation-driven cash machine—with a pipeline that could blow expectations wide open. If you’re not looking at Teva, you’re missing one of the cleanest turnaround stories in global pharma. Let´s dive in!

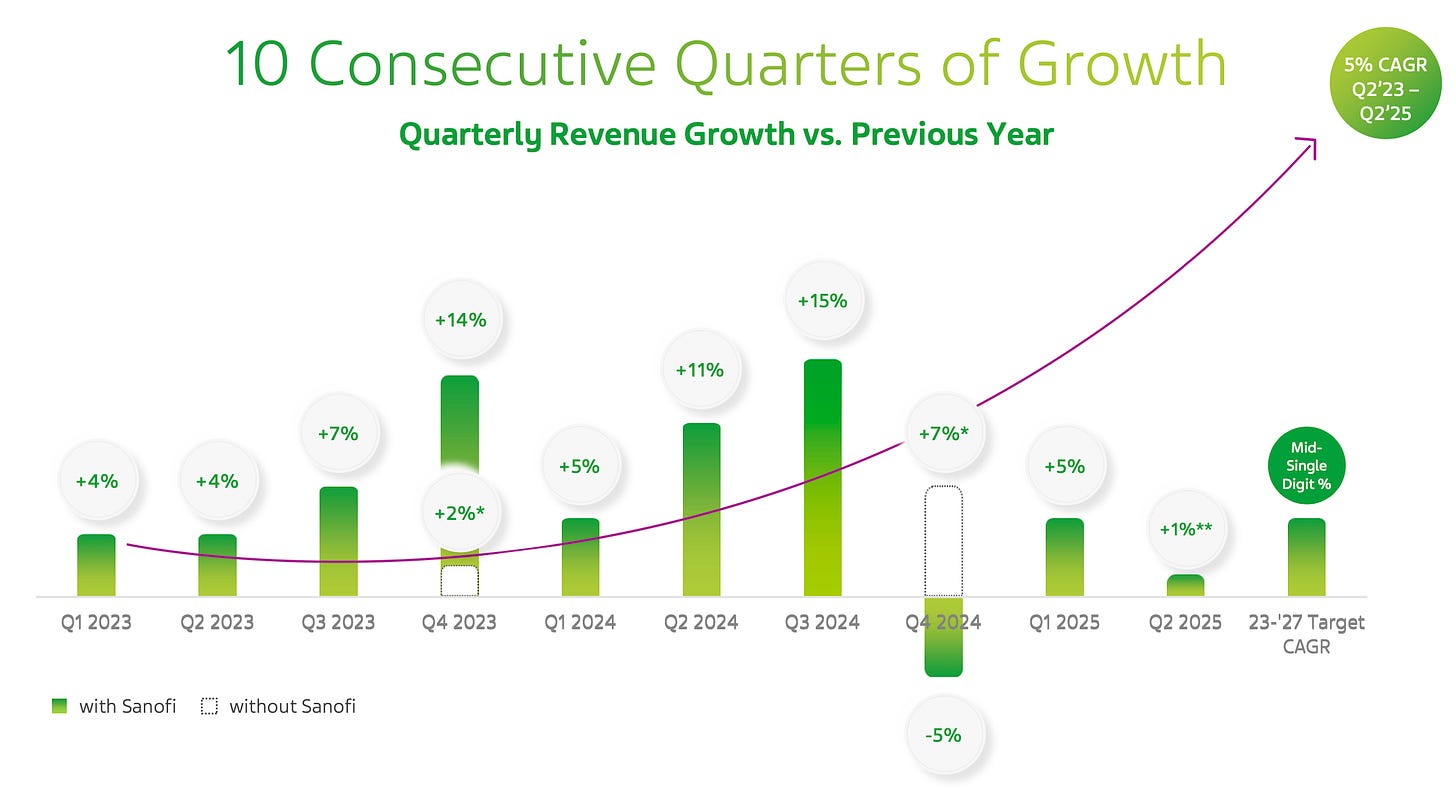

Consistently growing the business

In a powerful demonstration of its successful turnaround, Teva Pharmaceutical Industries has delivered its 10th consecutive quarter of growth in the second quarter of 2025. This landmark achievement is accompanied by an increased 2025 revenue outlook for its key innovative products and a raised earnings per share forecast, with all other financial guidance reaffirmed. This isn't a momentary upswing; it's the tangible result of a well-defined and rigorously executed "Pivot to Growth" strategy. Teva is not just back on its feet; it is striding into a new era of sustained expansion, innovation, and profitability.

The signals are clear and compelling. Teva's innovative drug portfolio is thriving, its foundational generics business remains stable, and its late-stage pipeline is rich with potential. The company’s CMO - Eric Hughes - gets lots of airtime whenever there are investor and analysts meetings to talk about the pipeline and trial results. The company's internal transformation is creating a leaner, more focused, and financially robust enterprise. This is the story of a pharmaceutical giant successfully re-engineering its future, and it presents a compelling investment idea.

The "Pivot to Growth" strategy - blueprint for success

At the centre of Teva's revival is the "Pivot to Growth" strategy, a comprehensive four-pillar plan designed to unlock the company's full potential. This isn't just a corporate slogan; it's an actual strategic framework that is actively guiding resource allocation and operational focus.

Deliver on Growth Engines: The first pillar focuses on maximizing the potential of key innovative products. As evidenced by the stellar results of Austedo, AJOVY, and UZEDY, this part of the strategy is firing on all cylinders. These products are the primary drivers of current revenue growth and are laying the groundwork for future market leadership through multi-blockbuster products.

Step Up Innovation: Teva is reigniting its R&D engine, focusing on developing a high-value pipeline in neuroscience and immunology. The goal is to deliver truly innovative therapies that address significant unmet patient needs, with assets like olanzapine LAI and duvakitug representing the next wave of potential blockbusters. The company is leveraging partnerships, as seen with Sanofi and Fosun Pharma, to accelerate development and capitalize on global opportunities.

Sustain Generics Powerhouse: While innovation is the growth engine, the generics business remains a vital and stable foundation. This pillar focuses on maintaining Teva's leadership in the global generics market through a focused portfolio and operational excellence. The strategy also includes doubling biosimilar revenues between 2025 and 2027, tapping into a high-growth segment of the market.

Focus Our Business: The final pillar involves creating a leaner, more agile organization. This includes divesting non-core assets, such as the planned sale of its API business, TAPI. This strategic focus allows management to concentrate resources on the areas with the highest potential for growth and profitability, while a comprehensive transformation program is on track to deliver approximately $700 million in net savings by 2027.

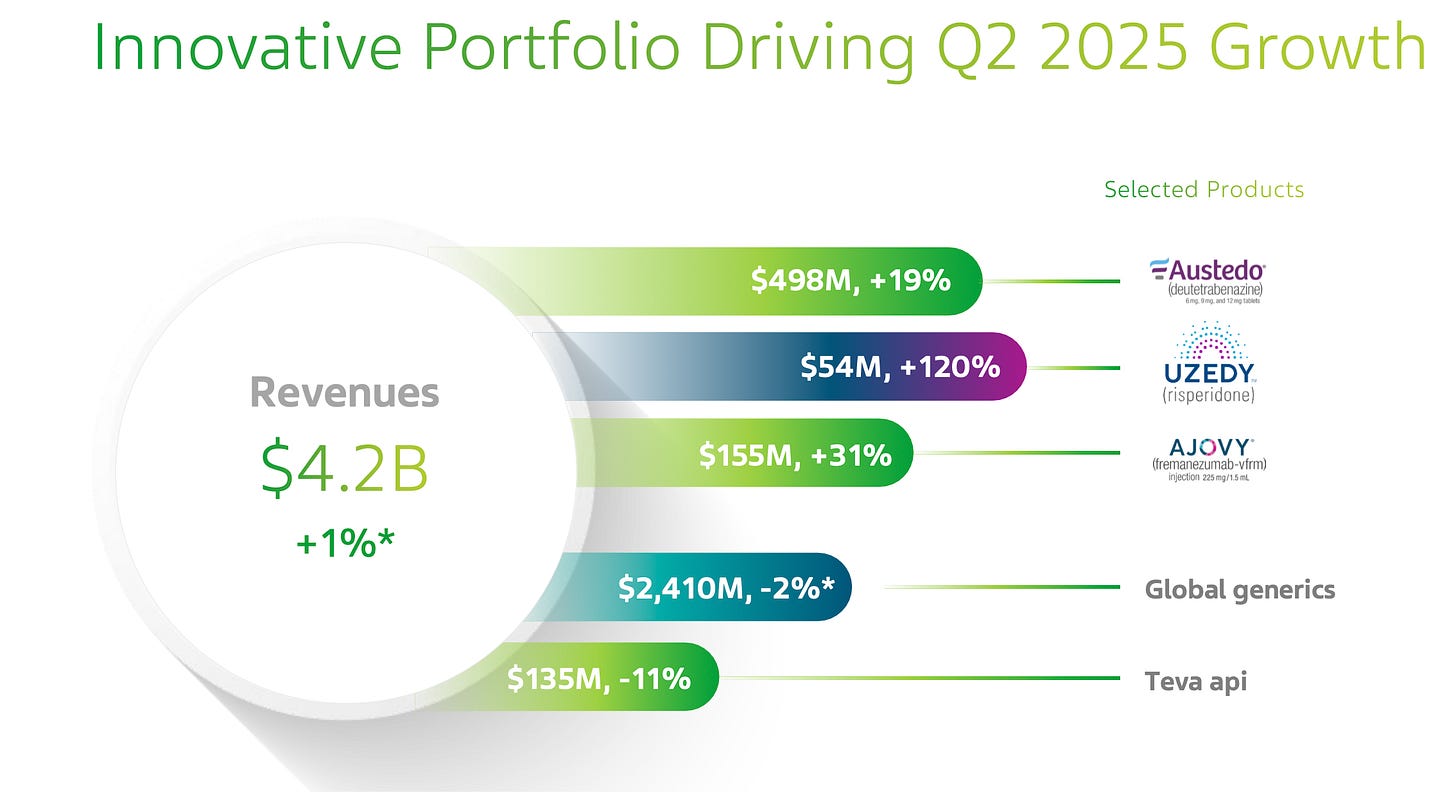

The Engine of Growth: A Powerhouse Innovative Portfolio

The primary driver behind Teva's resurgence is the stellar performance of its innovative medicines. The second quarter of 2025 saw the company's focused innovative portfolio grow by an impressive 27%. This growth is spearheaded by three key products: Austedo, UZEDY, and AJOVY.

Austedo has been a standout performer, with global revenues reaching $498 million in Q2 2025, a 19% increase year-over-year. This growth is fueled by an increase in prescriptions and the successful transition to Austedo XR, a once-daily formulation now used by over 60% of new patients. Teva has raised its full-year 2025 revenue outlook for Austedo to $2.0 billion - $2.05 billion.

UZEDY, a long-acting injectable for schizophrenia, is rapidly gaining traction, generating $54 million in Q2 2025, a 120% increase from the prior year. This success led to an increased 2025 revenue guidance of $190 million - $200 million.

AJOVY, for migraine prevention, continues its strong global growth. Q2 revenues hit $155 million, up 31% year-over-year. AJOVY's 2025 revenue outlook has been raised to $630 million - $640 million.

Teva projects that the revenue contribution from these key products, along with future launches, will grow from $2.3 billion in 2024 to over $5.0 billion by 2030.

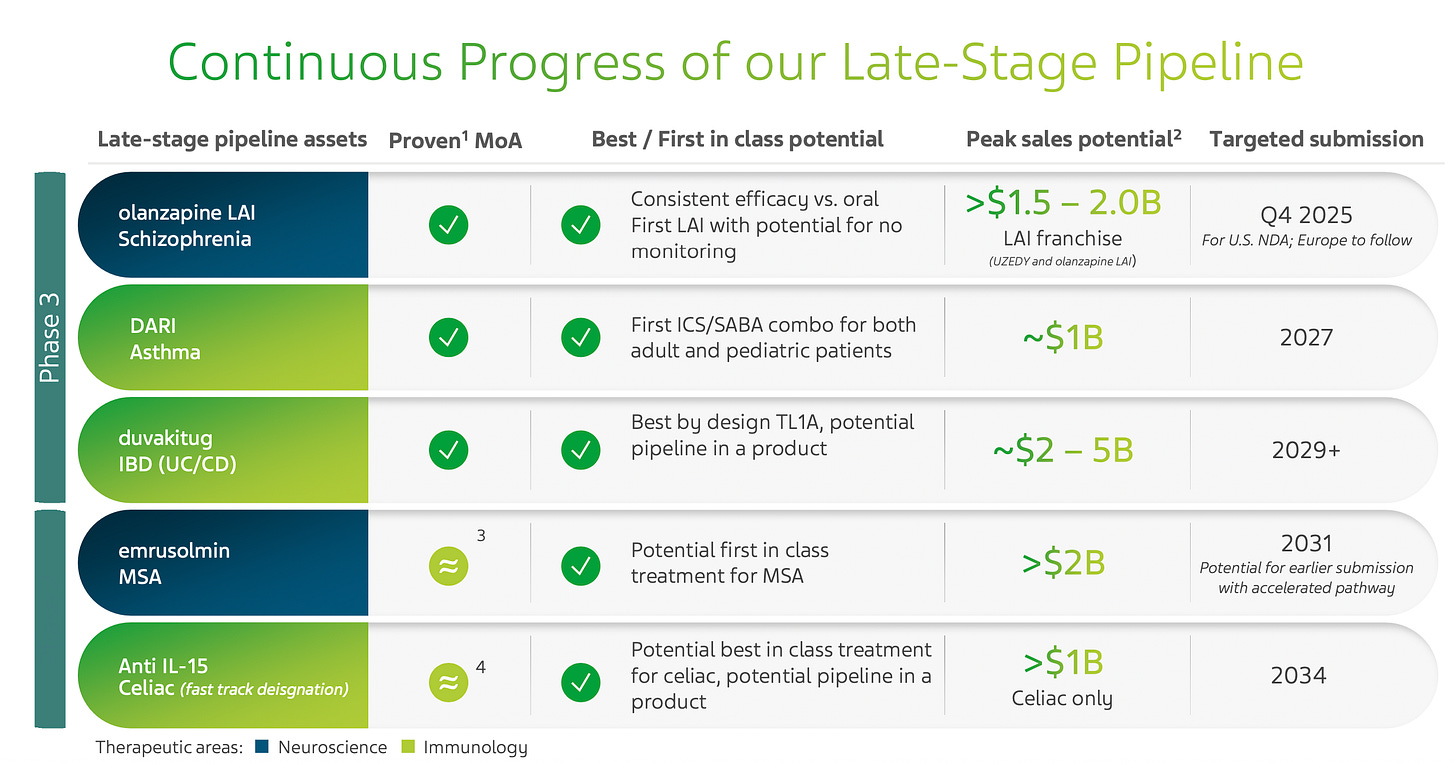

A solid pipeline brimming with potential

Beyond its current commercial successes, Teva's late-stage pipeline is poised to deliver the next wave of growth. The company is advancing several promising assets with blockbuster potential. A key near-term catalyst is

olanzapine LAI, targeting a U.S. submission in Q4 2025. This asset is a cornerstone of Teva's strategy to build a best-in-class LAI franchise with peak sales potential estimated at $1.5 to $2.0 billion. Another significant asset is

duvakitug, a novel therapy for IBD with peak sales potential estimated between $2 and $5 billion.

Debt reduction is forging a path to financial flexibility

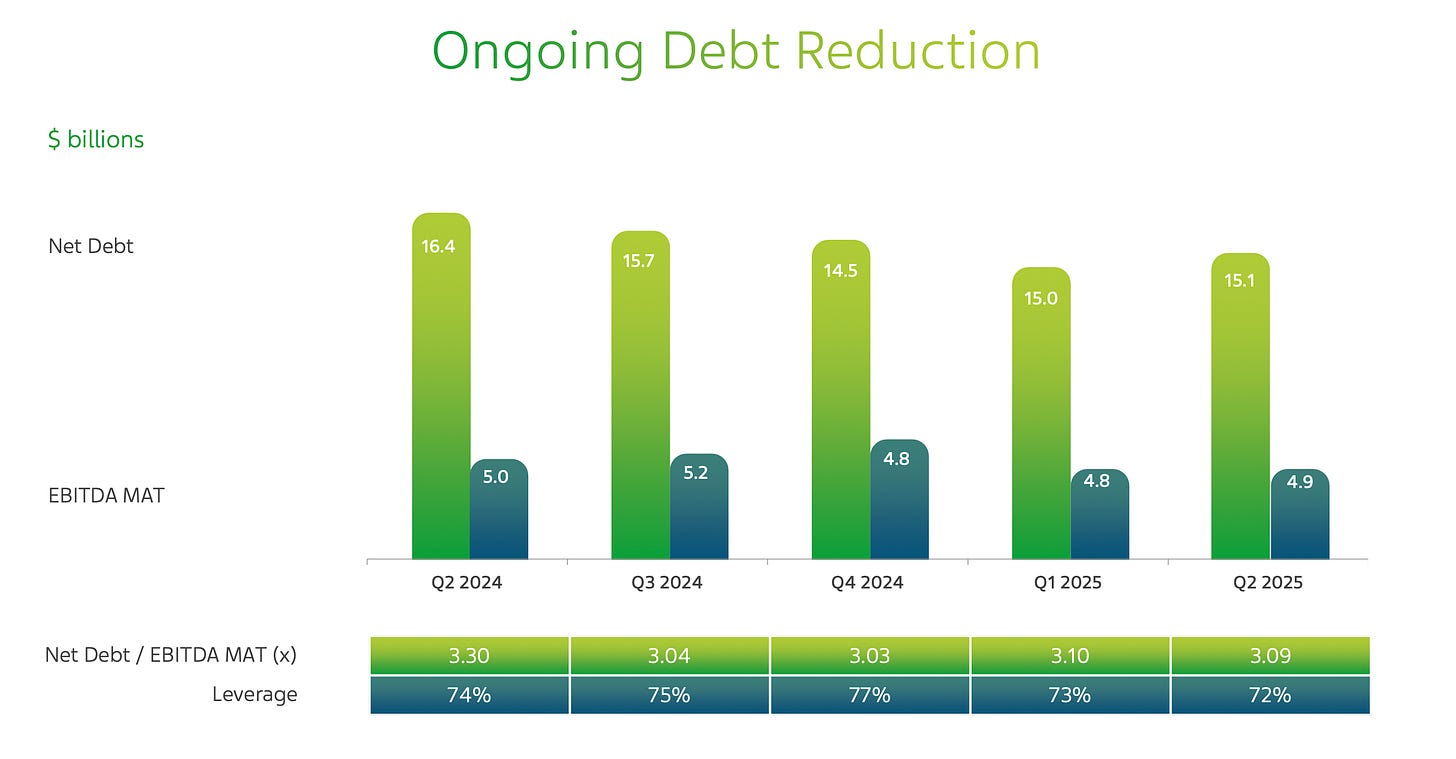

A critical component of Teva's turnaround has been its disciplined and strong focus on strengthening the balance sheet. I have been focusing on this point for several years now, but it is crucially important as it will open up even more opportunities for the company in its transformation. The company has made remarkable progress in reducing its significant debt load, which peaked at $34.0 billion in the third quarter of 2017. Through consistent free cash flow generation and strategic financial management, Teva has systematically paid down its obligations.

As of the end of the second quarter of 2025, net debt stood at $15.1 billion, a reduction of nearly $19 billion from its peak. This deleveraging is not slowing down. The company's Net Debt to adjusted EBITDA ratio has improved to 3.09x as of Q2 2025 , and Teva is firmly on track to achieve its 2027 target of 2.0x. Recent refinancing activities have successfully extended debt maturities, better aligning them with future free cash flow generation at a similar cost. This proactive liability management, coupled with improving financial results, has been recognized by credit rating agencies, with Moody's, Fitch, and S&P all upgrading Teva's rating in late 2024 and early 2025. This deleveraging journey is crucial as it enhances financial stability and creates the capacity to reinvest in the business and ultimately return capital to shareholders post-2027.

Valuation is still a compelling proposition

From a valuation perspective, there is a compelling case to be made that the market has not yet fully appreciated the extent of Teva's transformation and future growth prospects.

Teva currently trades at a forward P/E ratio of about 6.1x, with an expected 2025 EPS in the $2.42–$2.53 range—well below typical industry valuation multiples. Looking ahead, consensus projections estimate Teva’s EPS rising to $4.47 by 2028 and potentially surpassing $5 by 2030, assuming the company’s growth trajectory continues. If Teva simply maintains its current stock price, its 2028 P/E would drop to a strikingly low 3.6x. However, if the market regains confidence and re-rates Teva closer to peer multiples of 8–12x, the stock price could more than double from current levels, reflecting underlying earnings growth and pipeline progress. While risks remain and market caution keeps valuation suppressed for now, successful execution on innovative drug launches and operational improvements could bring substantial re-rating upside in the years ahead.

The significant short interest in the stock, which is at a 5-year high, indicates lingering bearish sentiment focused on headline risks like IRA price negotiations for Austedo. However, according to management Austedo can absorb a significant discount and still continue to grow, making these fears valid yet appear overblown.

Conclusion

Teva's "Pivot to Growth" strategy is not just a plan; it is a reality unfolding in its financial results and operational achievements. The company is delivering consistent growth, powered by a robust portfolio of innovative drugs. The late-stage pipeline holds the promise of multiple blockbuster launches, and a comprehensive transformation program is enhancing profitability and efficiency. The aggressive and successful reduction of its debt has fortified its financial foundation.

The recent string of positive results and the upwardly revised guidance for 2025 signal a company that has definitively turned a corner. The 10th consecutive quarter of growth is more than just a data point; it's a testament to a successful turnaround that is still accelerating. The current valuation does not appear to reflect this positive trajectory, offering an opportunity to participate in a major pharmaceutical company's resurgence with a clear path to creating significant upside.

I have a position in Teva and also find the current levels attractive, however, the above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Why Apple ($AAPL) could pay $140 billion for Perplexity AI and still call it a bargain

How much is Perplexity AI really worth to Apple?

Love your articles on TEVA!