Introduction

Amazon continues to demonstrate its dominance across e-commerce and cloud computing, and the Q4 2024 earnings report confirmed this yet again. The company posted robust revenue growth, improved operating margins, and substantial cash flow generation, reinforcing its position as a megacap technology leader. However, the increased CAPEX for 2025 suggests a long-term strategy that demands careful financial scrutiny. The hyper-scalers are estimating a combined $320 billion CAPEX commitment for 2025.

Let´s look into the financial performance, the strategic initiatives, and the outlook for both the business and stock.

Strategic Focus: Balancing Growth and Investment

Amazon’s management is focused on long-term investment in key areas, including AWS, e-commerce fulfillment infrastructure, and Project Kuiper, its satellite internet initiative.

• The company expects CAPEX to reach approximately $100 billion in 2025, up from prior estimates of $92 billion. It is estimated that 70% of this budget will be allocated to AWS, with the remainder directed toward expanding its retail logistics network and content investments.

• Amazon is prioritizing one-day and same-day Prime delivery services, aiming to improve customer conversion rates and increase basket sizes. This is an integral part of the famous Amazon flywheel.

• The advertising business is growing, with Prime Video introducing an ad-supported tier internationally, which could provide incremental revenue and profitability. The Amazon ad business is running at a 21% CAGR over the last three years. See graph from Quatr below.

• Project Kuiper, Amazon’s satellite internet project, remains a wildcard. While it has the potential to be a major growth driver in the future, it requires heavy upfront investment.

Amazon is always chasing new and meaningfully revenue streams and Amazon is doubling down on its infrastructure, positioning itself for sustained future profitability.

Q4 2024 Earnings Performance: Beating Expectations

Amazon reported Q4 2024 revenue of $187.8 billion, a 10% year-over-year increase, exceeding most expectations.

• North America sales rose 10% YoY to $115.6 billion, with strong demand across retail categories.

• International sales increased 8% YoY to $43.4 billion.

• AWS revenue leaped 19% YoY to $28.8 billion, reflecting strong enterprise cloud adoption despite ongoing supply constraints .

Amazon also delivered a record $21.2 billion in operating income, significantly above its Q4 2023 figure of $13.2 billion. This was fueled by improving unit economics, as Amazon’s cost of shipping grew by just 4% while unit volume expanded by 11%, a clear indication of better efficiency in logistics .

The net income doubled to $20.0 billion ($1.86 per share), compared to $10.6 billion ($1.00 per share) a year ago . This solid growth was driven by robust margins in AWS and improvements in the international segment, which swung to a $1.3 billion operating profit from a $0.4 billion loss in Q4 2023.

Financial Analysis

1. Revenue Growth & Profitability

Amazon’s annual revenue grew by 11% in 2024 to $638.0 billion ($3 Bn more than my projection - see below), with all segments contributing positively . However, the critical driver remains AWS, which grew 19% YoY to $107.6 billion for the year. AWS now accounts for 16.8% of total revenue but generates 58% of total operating income, underscoring its role as Amazon’s most profitable segment.

https://x.com/KontraInvest/status/1843395030385603005

The company’s operating margin expanded to 11.3% in 2024, up from 6.4% in 2023, largely due to cost efficiencies and higher-margin businesses such as AWS and advertising .

2. Free Cash Flow & CapEx Trends

• Operating cash flow rose 36% to $115.9 billion in 2024, demonstrating Amazon’s strong cash generation ability.

• Free cash flow increased to $38.2 billion, up from $36.8 billion in 2023 .

• However, the planned CapEx of $100 billion in 2025 will compress near-term free cash flow, and this usually results in some negative short term share price moves .

Amazon’s return on invested capital improved to 24%, reflecting the company’s ability to generate high returns from its asset base .

3. Valuation Metrics

• Price-to-earnings (P/E) ratio: Amazon trades at ~41x its 2024 earnings, in line with other high-growth tech stocks.

• Enterprise value-to-EBITDA (EV/EBITDA) multiple: Currently at 14.2x, which is within its historical range but below its five-year average of 23.6x to 87.9x .

• Price-to-free-cash-flow (P/FCF) ratio: Currently at ~30x, which seems conservative given Amazon’s growth trajectory.

4. Risk Factors

While Amazon’s financials are strong, there are several risks:

• AWS capacity constraints: The company faces supply chain issues, particularly in semiconductor availability, which could impact AWS growth in 2025.

• Foreign exchange headwinds: Amazon expects a $2.1 billion impact from FX fluctuations in Q1 2025.

• Higher CAPEX commitments: While investment is crucial for long-term growth, increased spending could pressure free cash flow and near-term margins .

Outlook for 2025 and Beyond

Amazon’s Q1 2025 guidance was slightly below Wall Street expectations, with projected revenue between $151 billion and $155.5 billion versus the consensus of $158.6 billion. However, the company remains well-positioned for long-term gains.

1. Business Prospects

• AWS remains the key driver, with continued demand from large enterprises transitioning to cloud solutions. New innovations like Trainium2 AI chips and Amazon Nova foundation models are expected to drive further adoption.

• Advertising growth is accelerating, thanks to the monetization of Prime Video through ads.

• E-commerce remains resilient, with Amazon leveraging faster delivery and competitive pricing to maintain market share.

2. Long-Term Competitive Edge

Amazon’s investments in AI, cloud, and logistics infrastructure provide a formidable moat against competitors. The company’s ability to generate high returns on capital and maintain strong margins in AWS and advertising positions it as one of the most attractive long-term investments in the tech sector.

Conclusion: A Strong Investment Opportunity with Near-Term Risks

Amazon’s Q4 2024 results reaffirm its status as a tech behemoth with strong growth drivers. While higher CAPEX spending in 2025 may weigh on free cash flow, the long-term investments in AWS, e-commerce, and AI-driven services should deliver substantial value over the next several years.

We need to monitor AWS capacity expansion, advertising growth, and CAPEX efficiency as key indicators of Amazon’s financial health. The company remains a compelling company for long-term investors.

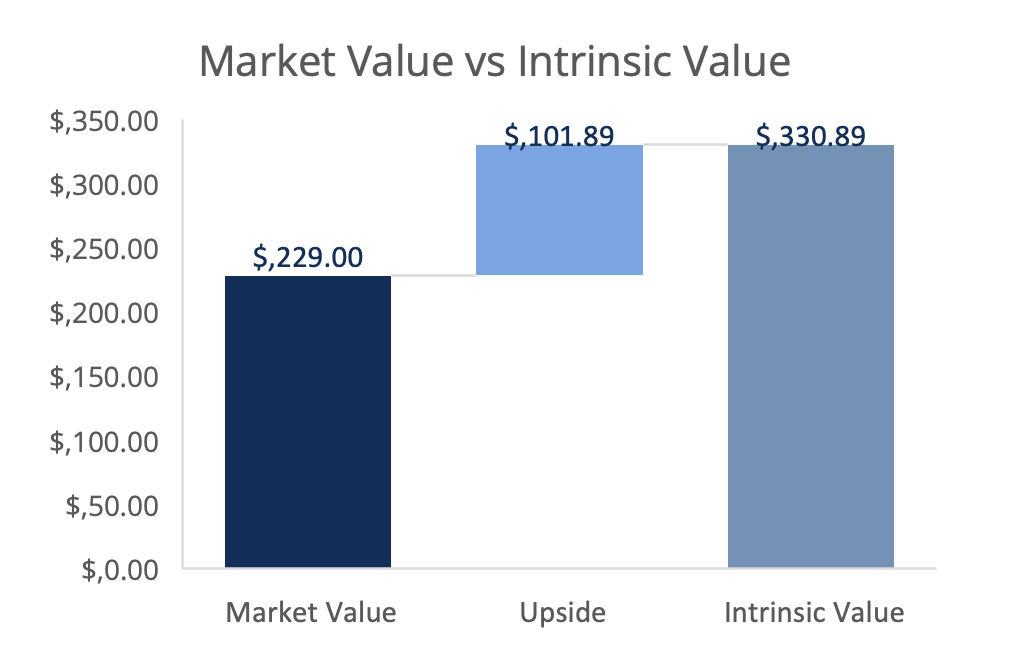

My bullish / positive model gives the following Intrinsiv value:

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.