AMD ($AMD): Strongly positioned for the next era of AI computing

AMD’s strategy, innovation, valuation signal bullish opportunity.

Introduction

In the rapidly evolving semiconductor industry, Advanced Micro Devices (AMD) has been making strategic moves that set the stage for compelling long-term growth. With their latest AI event unveiling and the advancement of their GPU roadmap, AMD is positioning itself as a formidable competitor in the high-performance computing landscape. Here, I'll delve deeper into AMD’s strategic trajectory, cutting-edge technology, and why the current valuation makes the stock an attractive investment opportunity.

Strategy: Clear vision and aggressive market positioning

AMD’s strategic approach emphasizes three core areas:

Expanding AI Infrastructure: AMD has identified sovereign AI and hyperscale customers as major growth opportunities. This is underscored by new relationships with marquee players like Amazon and continued partnerships with Microsoft and Meta. At their recent AI event, AMD notably highlighted significant engagements with sovereign entities like HUMAIN, illustrating a growing strategic pivot toward diversified international partnerships. Sovereign AI represents a particularly promising niche, driven by the geopolitical imperative for nations to build autonomous computing infrastructure, thereby reducing dependency on single vendors such as Nvidia.

Neocloud Ecosystem Development: AMD is leveraging shifts in the Neocloud market, especially capitalizing on opportunities created by competitor missteps. The controversy surrounding Nvidia’s DGX Lepton Marketplace, aimed at commoditizing AI compute, has opened a window for AMD to cultivate a loyal Neocloud customer base. AMD's proactive approach includes substantial investment in Neocloud partnerships and a strategy that supports GPU rentals back from the clouds, enhancing adoption and reducing barriers for enterprise customers. These strategic investments aim to accelerate adoption rates and build a resilient ecosystem around AMD’s hardware, ensuring sustained demand and brand loyalty.

Investment in Internal R&D and Talent: AMD is undertaking significant internal investments, particularly in engineering talent. Recent initiatives to align compensation with market standards suggest an aggressive move to retain top talent, essential in the hyper-competitive semiconductor environment. This strategic choice demonstrates AMD’s long-term commitment to innovation and product excellence. The ability to attract and retain top talent remains critical to maintaining technological competitiveness and innovation leadership in the semiconductor industry.

Additionally, AMD's acquisition of ZT Systems adds robust system design capabilities, enhancing their rack-scale AI solutions. This acquisition provides AMD with a vertically integrated approach to high-performance computing, allowing better control over the entire product stack from silicon to software and systems.

Technology: Positioned for performance and scale

AMD’s technological developments have consistently targeted performance leadership, particularly in AI inference workloads. The recently launched MI355X GPU positions AMD competitively against Nvidia’s HGX B200 solutions, specifically for small to medium model inferencing. Despite some marketing skepticism, AMD’s technical specifications and real-world performance in cost-per-inference make it highly attractive for customers focused on Total Cost of Ownership (TCO).

The standout advancement is AMD’s MI400 "Helios," set to launch in mid-2026. Helios, a rack-scale solution, significantly elevates AMD’s competitive profile against Nvidia's VR200 NVL144. It boasts:

72 logical GPU scale-up world size utilizing UALink over Ethernet.

Superior memory and bandwidth capabilities, delivering 1.5x more HBM4 capacity and bandwidth compared to Nvidia's solutions.

The technical advantages provided by AMD's differentiated chiplet architecture and hybrid bonding technologies offer distinct performance benefits, especially for large-scale inference workloads and AI model training. AMD's strategic pivot to Ethernet for scaling within racks reflects its flexibility and practical approach to infrastructure challenges, addressing previous constraints around its Infinity Fabric technology.

Furthermore, AMD’s innovation extends to future products, such as the MI500 UAL256, which will feature 256 chips, surpassing Nvidia’s next-generation offerings. These advancements underscore AMD’s robust commitment to technological leadership, which should strongly benefit its market position.

AMD has also invested significantly in enhancing its software ecosystem, recognizing that hardware alone does not guarantee market dominance. Rapid improvements under AMD’s software leadership team aim to optimize and fully leverage hardware capabilities, improving overall efficiency and productivity. This software focus is crucial to attracting and retaining large enterprise customers who demand both performance and seamless integration.

Financials: Compelling valuation with significant upside

AMD’s financial profile offers an appealing entry point for investors. Recent financial performance highlights include:

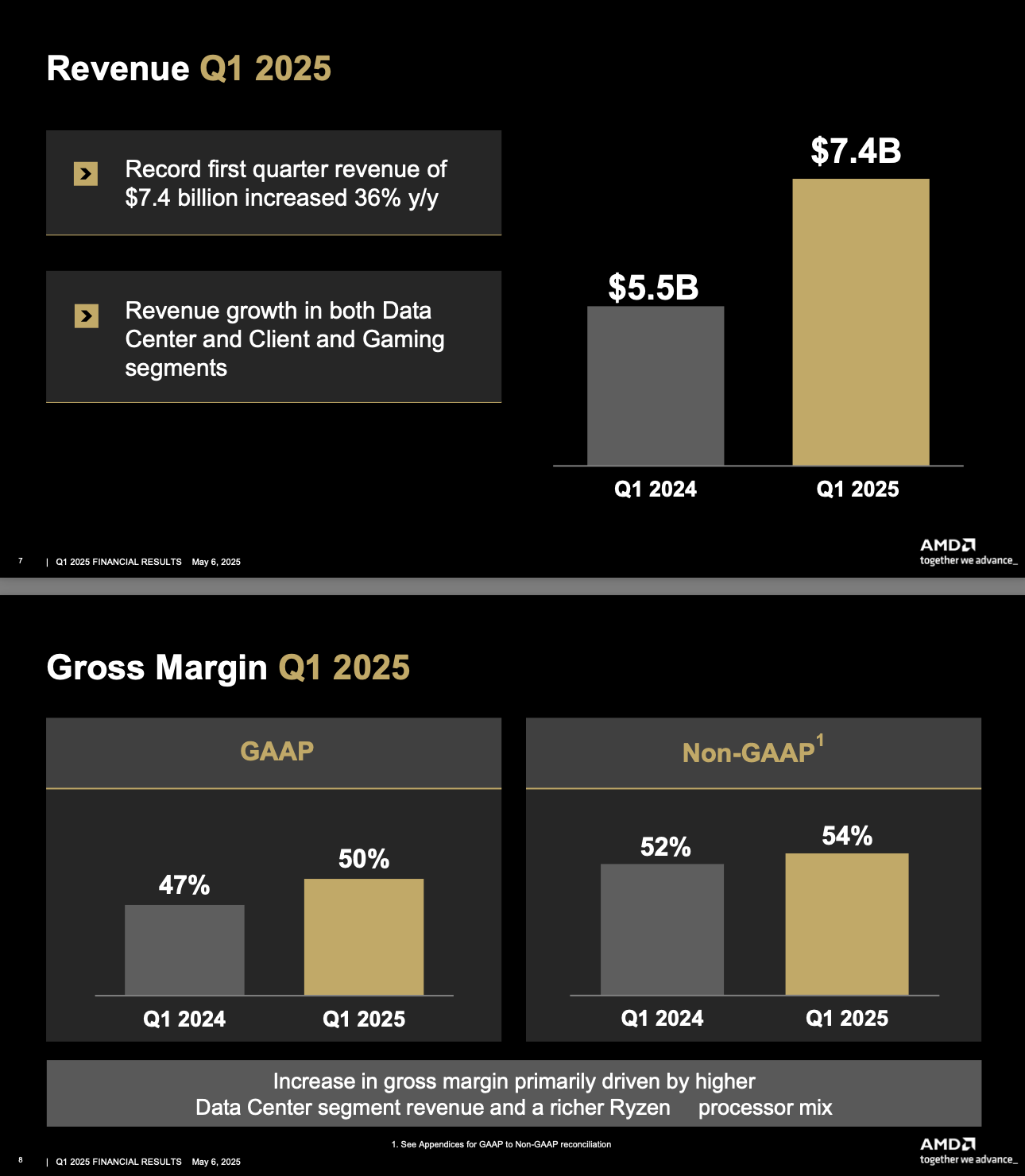

Strong revenue growth: Q1 2025 saw revenue increase by 36% year-over-year, reaching $7.4 billion. This growth is primarily driven by significant momentum in Data Center and Client and Gaming segments, with robust performance expected to continue driven by product launches and expanded customer bases.

Improved profitability: Non-GAAP gross margin expanded to 54%, driven by a richer product mix and robust data center sales. Operating income surged significantly, highlighting efficient operational management and scalability. AMD’s gross margin expansion demonstrates the company's successful execution of its premium product strategy.

Solid Balance Sheet: AMD maintains a strong financial foundation with ample liquidity, reflected by growing cash reserves and a manageable debt profile. This financial flexibility is critical for sustained investment in R&D and strategic acquisitions.

Looking ahead, AMD forecasts substantial earnings growth. For CY2026, the consensus EPS is $5.69, implying a forward P/E ratio of around 20.7x based on the current share price. Given AMD’s technological advances and strategic market expansion, this valuation presents a highly attractive opportunity, especially in a semiconductor industry characterized by cyclicality and intense competition.

By 2029, I firmly believe we will see AMD´s revenue at more than 2x what it is today and nearing $70 billion, while EBIT will surpass $20 billion. NVIDIA’s forward P/E has in the short-term ranged between 25–33x. If we are cautious and apply from the lower end of the range and add 26x to the CY2026 EPS projection of $5.69 we get to $148 by 2026.

Market dynamics and industry trends

The semiconductor market, particularly within the AI and high-performance computing segments, continues to expand rapidly, driven by increasing demand for computational power across diverse industries including healthcare, automotive, financial services, and consumer technology. AMD is strategically positioned to capitalize on these growth trends, given its robust product portfolio and aggressive market positioning.

Industry trends such as the rise of generative AI, increased use of inference in enterprise applications, and heightened geopolitical considerations around technology sovereignty all favor AMD’s open and flexible infrastructure approach. This aligns with enterprise and governmental preferences for vendor neutrality and technological resilience.

Conclusion: A cautiously bullish outlook

AMD is positioned very well, strategically and technologically, for sustained competitive success in AI and high-performance computing. While competitive pressures from the industry giants remain notable, AMD’s long-term approach under Lisa Su, strong product roadmap, and attractive financial fundamentals offer substantial upside potential for investors. The stock, currently trading at compelling valuation multiples relative to its growth prospects, presents a good and cautiously bullish investment opportunity. AMD’s trajectory indicates it is well-equipped to capitalize on market shifts, technological innovations, and strategic opportunities.

I don’t have a position in AMD, however, I do find the current level attractive. While the above is not intended as investment advice, I am strongly considering starting a position in AMD.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Teva Pharmaceuticals ($TEVA): Pivoting to sustainable growth and long-term returns

Teva held its Strategy and Innovation Day on May 29th confirming and expanding on its “Pivot to Growth” strategy as originally launched in May 2023.

I hadn’t gone as deep in my analysis as you did, but I had been considering opening a position for some time. With the current process, the risk, and the potential upside, it’s starting to make sense for me as well. Thanks, as always, for your insights and perspective.