Teva Pharmaceuticals ($TEVA): Pivoting to sustainable growth and long-term returns

From generics giant to innovation powerhouse

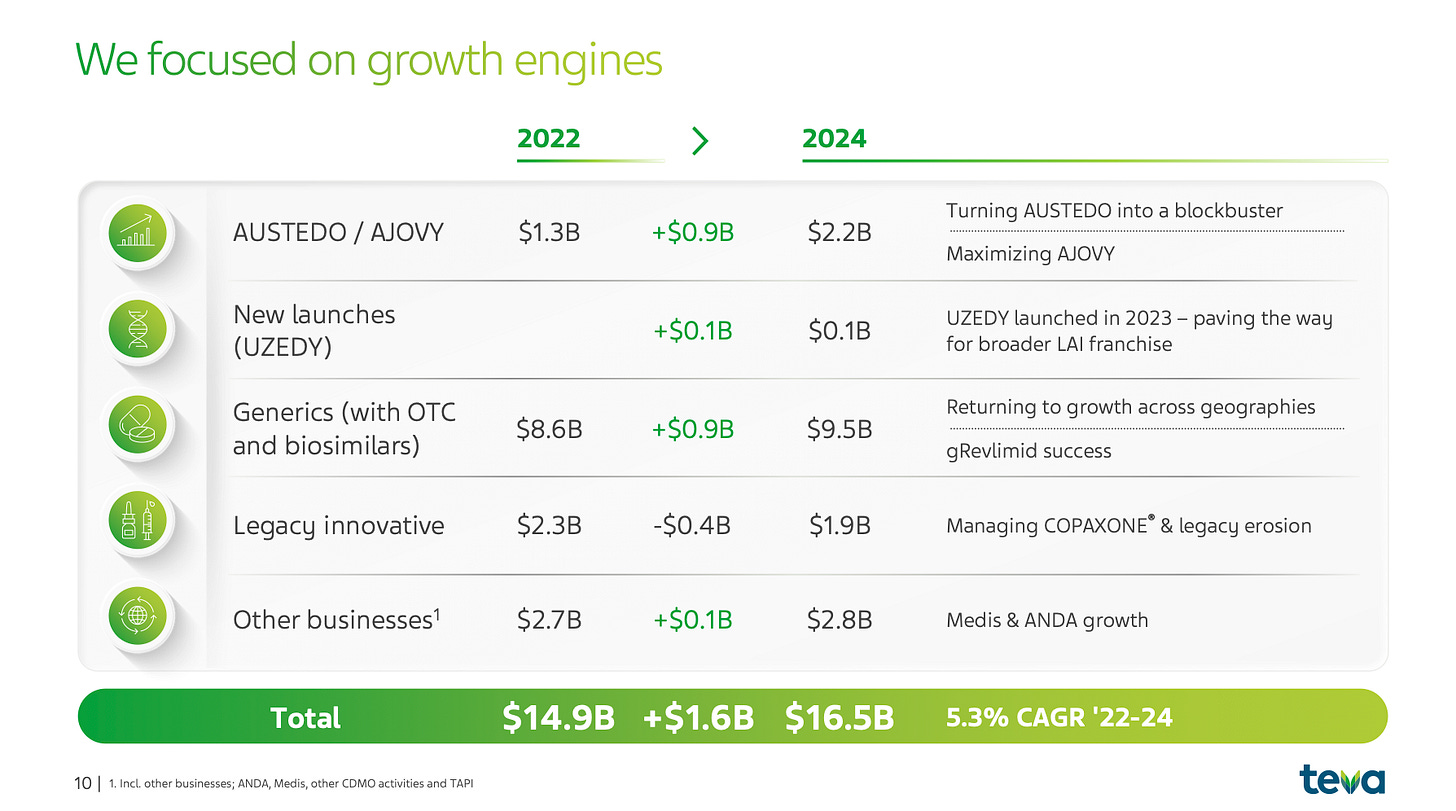

Teva held its Strategy and Innovation Day on May 29th confirming and expanding on its “Pivot to Growth” strategy as originally launched in May 2023.

Teva has long been a cornerstone in the pharmaceutical industry, renowned primarily as a generics powerhouse. However, after the difficult period following debt increase, opioid lawsuits and key patent expiry, Teva is underway with a notable pivot toward innovative pharmaceuticals, making Teva increasingly attractive from an investment standpoint. With an optimistic but grounded perspective, this analysis delves into Teva’s strategic direction, promising pipeline, and compelling valuation dynamics.

Strategic Direction: Pivot to Growth

Teva’s latest strategic shift, aptly named “Pivot to Growth,” is designed to transition the company from primarily a generics-focused entity into a more balanced enterprise with significant revenue from innovative products. The core aspects of this strategy revolve around three pillars:

Driving innovation: Teva aims to accelerate its innovative franchise with an ambitious target of over $5 billion in revenue from this segment by 2030. Key therapeutic areas for innovation include neuroscience, immunology, and respiratory treatments.

Sustaining generics leadership: While expanding into innovation, Teva remains committed to maintaining its position as a generics leader, particularly in the U.S. and European markets. This provides a stable foundation that underpins their financial strength and ensures ongoing cash flow generation.

Operational excellence and efficiency: Teva has embarked on substantial organizational transformation initiatives, targeting significant cost savings and operational improvements. This includes optimizing manufacturing processes, reducing overhead costs, and refocusing resources toward growth-oriented projects.

The pivot appears well-conceived, with Teva’s leadership bringing extensive experience from global giants like Novartis, Biogen, and Merck. CEO Richard Francis, appointed in 2023, brings a robust pharmaceutical background, positioning him well to execute Teva’s ambitious plans effectively.

Pipeline potential: Robust and promising

Teva’s pipeline is one of its most compelling assets, particularly with several promising candidates nearing critical milestones:

Long-Acting Injectable (LAI) Franchise: Teva is positioning itself strongly in treating schizophrenia. Their recently launched UZEDY (risperidone) is already showing excellent real-world outcomes, significantly lowering relapse rates and healthcare resource utilization compared to daily oral alternatives. Additionally, their olanzapine LAI, TEV-’749, is showing promising results, with the recent SOLARIS trial data demonstrating efficacy without significant safety concerns. These LAIs could generate peak sales between $1.5 and $2 billion, underscoring substantial market opportunity. Having a close relative with schizophrenia, I can attest first-hand that this is an area with significant unmet medical needs. Any progress here can have life changing implications for the people with the diagnose and close family and friends.

AUSTEDO Expansion: AUSTEDO, Teva’s flagship product for Tardive Dyskinesia (TD), continues to perform robustly, driven by excellent clinical profiles and strong market presence. Despite concerns regarding the upcoming IRA (Inflation Reduction Act) negotiations, Teva seems relatively well-positioned due to AUSTEDO’s favorable cost-effectiveness compared to peers. Analysts soon to have a consensus forecast for AUSTEDO sales indicating that the drug could exceed $3 billion annually at peak.

Duvakitug for Inflammatory Bowel Disease (IBD): Developed in partnership with Sanofi, duvakitug represents significant market potential, targeting ulcerative colitis and Crohn’s disease. It has blockbuster potential, with estimated peak sales between $2 billion to $5 billion. Phase 3 trials are set to commence by late 2025, marking a significant milestone.

Emrusolmin for Multiple System Atrophy (MSA): This novel candidate is in Phase 2 trials and is targeted to become potentially the first-in-class treatment for MSA. Early indications suggest it could surpass $2 billion in peak sales, making it another significant growth driver in Teva’s pipeline.

DARI in Asthma: Teva’s innovative dual-action asthma rescue inhaler (DARI) combines inhaled corticosteroid (ICS) with short-acting beta-agonist (SABA), offering a unique approach that could address significant unmet needs in asthma treatment, potentially reaching around $1 billion in annual sales.

This pipeline depth positions Teva not merely as a generics supplier but increasingly as an innovative biopharma company capable of substantial long-term revenue growth.

Current Valuation: Undervalued with room for upside

From a valuation perspective, Teva appears notably undervalued. Trading at a forward P/E ratio significantly below peers, the market has not fully priced in Teva’s pivot to higher-margin innovative products.

Teva’s market capitalization, hovering around $20 billion, reflects lingering skepticism regarding legacy issues such as debt burden and potential IRA-driven pricing impacts. However, this perception undervalues the substantial improvements in financial health achieved recently. Notably:

Improved debt profile: Teva has significantly reduced net debt, projecting further improvement with a net debt/EBITDA target of 2.0x by 2027, a stark contrast to historical leverage concerns. This is a topic I have covered consistently in numerous articles as this is so important for Teva. With an improved debt profile also comes expanded strategic opportunities for business development and even M&A. It will certainly also have a positive impact on Teva´s stock performance. A final comment on this is, that we will likely see Teva continue to de-leverage beyond 2.0x and drive towards 1.0x, but this is outside the promise to the market. By 2029, the ratio will likely by in the range of 0.5-0.1x.

Strong Free Cash Flow Generation: The company projects free cash flow that surpasses $3.5 billion annually by 2030, driven by innovative product revenues, generics stability, and operational efficiencies. This is attractive and will also drive share price development.

A metric we haven’t focused much on for Teva is gross profit margin. This is also an unfolding story with steady improvements, and with the strategic shift to more branded drugs, we will see further expansion of GPM.

The upcoming IRA negotiation for AUSTEDO has raised near-term uncertainties. However, given AUSTEDO’s favorable positioning relative to other negotiated drugs and the substantial list price leverage, the actual financial impact could be more manageable than the market anticipates, creating potential upside post-negotiation clarity.

Given these factors, Teva’s valuation metrics suggest notable upside potential, especially if the company successfully executes its strategic shift and pipeline launches. Investors willing to look beyond short-term volatility will likely benefit from significant re-rating as the market begins to reflect Teva’s evolving growth and profit dynamics.

Looking into 2029 based on the new strategy, debt reduction, higher proft margin, and increased free cash flow generation, I get the following from my model:

Conclusion: Optimism remains intact

Considering Teva’s well-defined strategic pivot, robust and promising pipeline, and compelling valuation dynamics, the investment thesis remain optimistic. While short-term headwinds such as IRA negotiations and general market uncertainties remain, Teva’s longer-term prospects are compelling.

As Teva transitions towards a balanced business with a robust innovative portfolio complementing its generics foundation, it is well-positioned to deliver sustainable growth and profitability enhancements. Investors who align with this perspective and remain patient through near-term volatility could see substantial returns as Teva’s growth narrative unfolds.

I have a position in Teva and also find the current level attractive. The above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

30 companies for 2030

In a rapidly evolving world, long-term investing demands an understanding of not just company fundamentals, but also the structural forces shaping the global economy. This list, 30 Companies for 2030, reflects that outlook and conviction on firms best positioned to benefit from transformational trends in technology, healthcare, finance, and sustainabili…