Novo Nordisk: Pioneering the Future of Diabetes and Obesity Treatment.

A long-term quality company with extended runway.

Novo Nordisk has recently crossed the significant milestone of DKK1,000 in share price, signaling strong market confidence in the company’s future. With its leadership in the GLP-1 market and a robust pipeline, Novo Nordisk is well-positioned for sustainable growth beyond the upcoming patent cliffs. This post explores the factors contributing to Novo Nordisk’s market strength and future potential.

Just as a reminder, here is the 5 year share price development:

The stock has retracted around 13% from the top at DKK1008 on June 25th.

Sector-Leading Growth in Diabetes and Obesity

Novo Nordisk’s dominance in the GLP-1 market is underscored by its impressive growth projections. The company is expected to achieve a 22% compound annual growth rate (CAGR) in earnings per share (EPS) from 2023 to 2028, far outpacing the sector average of 10%. This growth is driven by several factors:

1. Next-Generation Products: Novo Nordisk is transitioning to next-generation products such as CagriSema, which shows promise in achieving over 25% weight loss, compared to the current standard tirzepatide at around 22%. Positive Phase 3 data for CagriSema could reinforce Novo’s growth trajectory.

2. Self-Pay Market Development: As obesity treatments become more mainstream, the potential for a self-pay market, especially outside the US, could enhance long-term sustainable growth. Novo Nordisk’s Wegovy is already seeing significant uptake in self-pay markets like Denmark.

3. Capacity Expansion: Novo Nordisk’s acquisition of Catalent sites, pending regulatory approval, is expected to alleviate near-term capacity constraints, enabling the company to scale production efficiently and maintain market leadership.

As part of its capital allocation strategy, and to help improve EPS, Novo Nordisk expects to repurchase B shares for an amount up to DKK 20 billion ($2.92 billion) during a 12-month period beginning 6 February 2024. As of 28 June 2024, Novo Nordisk has since 6 February 2024 repurchased a total of 10,061,625 B shares at an average share price of DKK 873.45 per B share equal to a transaction value of DKK 8,788,370,170.

Competitive Landscape and Market Position

While Novo Nordisk faces competition from companies like Eli Lilly, its strategic investments and broad pipeline provide a competitive edge. The company is expanding its product portfolio with innovative treatments and maintaining its leadership in the GLP-1 market through superior manufacturing capabilities and scalability.

• Manufacturing Advantage: Novo Nordisk’s use of yeast fermentation for semaglutide synthesis offers a significant manufacturing advantage over competitors who rely on solid-phase synthesis. This enables faster scaling in a capacity-constrained market.

• Pipeline Strength: Novo’s pipeline includes promising candidates like amycretin and CB1R, alongside CagriSema, which could drive sustained growth. The company’s commitment to R&D and capacity investment positions it strongly against emerging competition.

Evaluating Novo Nordisk’s Oral GLP-1 Drugs and Competitors

Source: Goldman Sachs

Novo Nordisk’s oral GLP-1 drugs, particularly Oral Wegovy and Amycretin, are showing promising results in the fight against obesity. Oral Wegovy, a GLP-1 peptide, demonstrated significant weight loss in clinical trials, with participants experiencing an average weight reduction of 15.1% by week 68. This drug also had a side effect profile as expected for GLP-1 therapies, with nausea (52%) and vomiting (24%) being the most common.

Amycretin, another promising candidate from Novo Nordisk that combines GLP-1 and amylin, is still in its early stages of development, and detailed side effect data are not yet available. However, its efficacy in weight loss, showing a 13.1% reduction by week 12, highlights its potential as a future treatment option.

Viking Therapeutics’ VK2735, a GLP-1/GIP peptide, is another contender in this space, showing notable efficacy in early trials. Participants in the VK2735 trials achieved a weight loss of 5.3% by week 4. The side effect profile for VK2735 is relatively mild, with nausea reported by 25% of participants and no vomitting reported by test subjects. This makes VK2735 a competitive alternative, especially for patients who may not tolerate the higher nausea rates seen with other GLP-1 therapies.

Pfizer’s Danuglipron, a small molecule GLP-1, has also shown significant potential. In its Phase 2 trials, participants achieved a weight loss of 9.4% by week 26 increasing to 11.7% in week 32, however with side effects of nausea and vomiting much higher than what Novo Nordisk, Eli Lilly and Viking are reporting.

Structure Therapeutics’ GSBR-1290 and Roche’s CT-996 are other small molecule GLP-1s currently in development, with early trials indicating promising efficacy and manageable side effects. These developments highlight the dynamic and competitive landscape of obesity treatments, with multiple players contributing innovative solutions. Roche´s reported weight loss in week 4 at 7.3% stands out and could set a new standard. However, more data is needed in order to draw any real conclusions.

Market Dynamics and Future Outlook

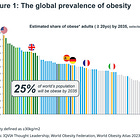

The global market for GLP-1 treatments is vast, with current indications targeting around 1 billion patients for type 2 diabetes and obesity. Ongoing trials in other conditions could expand the addressable market to over 2.2 billion patients. Novo Nordisk’s focus on maintaining a leading-edge efficacy portfolio and developing a self-pay market is crucial to its strategy.

• Efficacy and Pricing: The high efficacy of GLP-1 treatments justifies their continued rollout despite potential payer pushback. Novo Nordisk is well-prepared to navigate pricing pressures through portfolio management and strategic market positioning.

• Regulatory Landscape: The successful expansion of GLP-1 treatments into new indications and markets will depend on regulatory approvals and the ability to demonstrate sustained therapeutic benefits beyond weight loss. The potential of general cardiovascular and alzheimers is vast and would completely change the profile of the outlook for Novo Nordisk and Eli Lilly.

For more details about the Obesity market, have a look at this posts where the topic gets examined in more detail:

Conclusion

Novo Nordisk’s achievement of breaking the DKK1,000 share price barrier is a testament to its robust growth strategy and market leadership in diabetes and obesity treatment. With a strong pipeline, strategic investments in manufacturing, and the development of a self-pay market, Novo Nordisk is poised for continued success. While competition and market dynamics present challenges, Novo’s innovative approach and commitment to sustainable growth make it a standout player in the pharmaceutical industry.

While the obesity market numbers can be difficult to process, it seems relatively easy to at least partially validate it as over-weight and indeed obesity seems omni-present in society today and can be seen anywhere you look be that at work, where you shop, go out to eat etc.

The future looks promising for Novo Nordisk as it continues to innovate and expand its impact on global health and some of the largest therapeutic areas out there. The company’s efforts to address unmet medical needs and enhance patient outcomes through advanced therapeutics position it well for sustained growth and market leadership. UBS recently put a $1.100 price target for Novo Nordisk which seems achievable given the momentum in roll-out of Wegovy, size of market, and Novo Nordisk´s track record in executing.

If you want to learn more about the company and the history behind the GLP-1 class drugs, I highly recommend this episode of Acquired: