Obesity - the other type of hyper scaling.

Obesity medication market poised for explosive growth: A deep dive into industry dynamics and key players

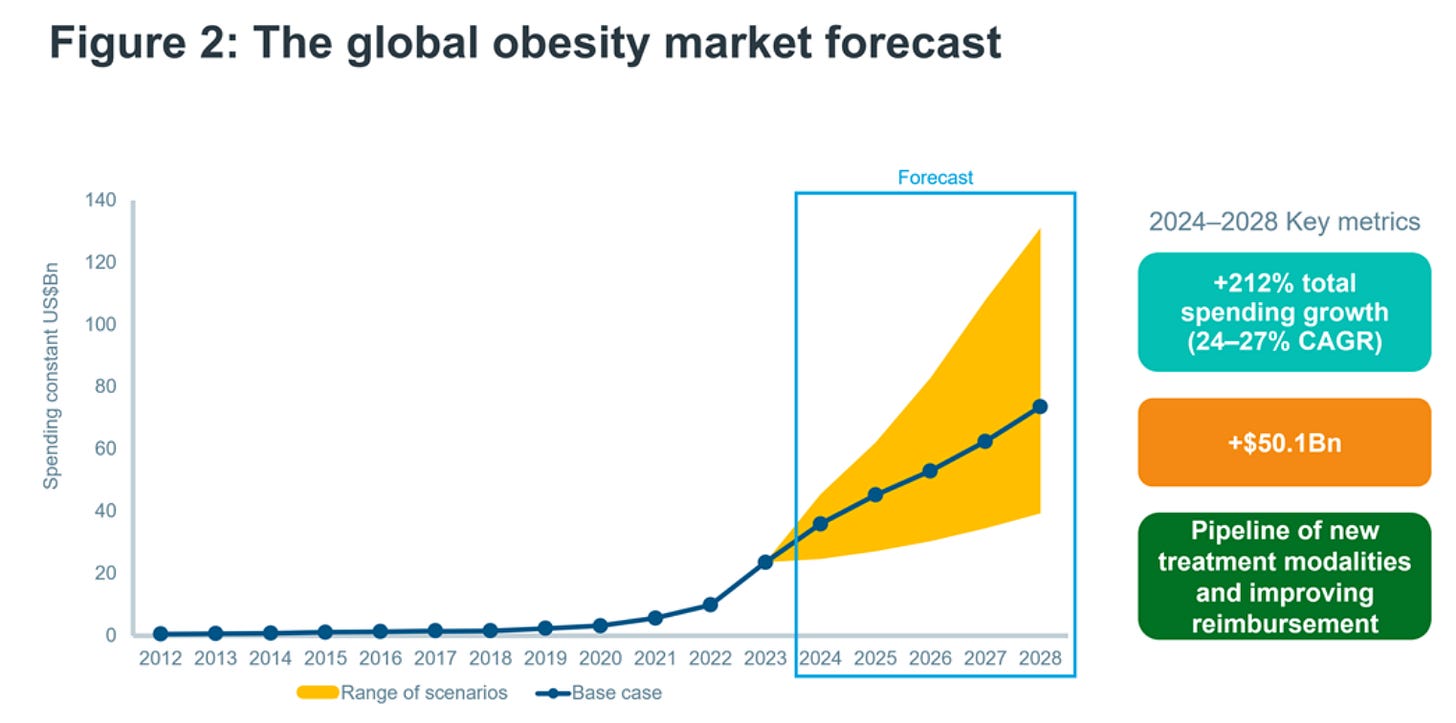

While all investing eyes are on Data center spend from the hyper scalers, another sector is undergoing hyper scale like growth, arguably with as long a growth run-rate as in Data centers. The global market for obesity medications is set to experience unprecedented growth, with Novo Nordisk, Eli Lilly, Zealand Pharma, and Viking Therapeutics expected to play significant roles. Industry analysts are lining up to revise market estimates upwards.

Market overview

By 2030, the market for obesity medications are predicted to have surged over fifteenfold, reaching a staggering $93 billion, up from around $6 billion last year.

Novo Nordisk and Eli Lilly will dominate the obesity medication market sitting on dominating market, the two companies likely with commanding a combined market share of 80%. Despite their dominance, there will still be significant opportunities for challengers, including Denmark's Zealand Pharma and Viking Therapeutics.

The main thing you need to know about the Obesity market is that 25% of the world´s population will be obese by 2035 - that is 2.2 billion people that will be obese by then. That is a staggering number, making the category one of the larger addressable markets you can go find and go after.

Obviously, there are also uncertainties about the market outcomes but commercialisation and market access is under strong development and the potential is very apparent, and both Novo Nordisk and Eli Lilly has transcended commercial impact and have achieved cultural impact. Novo Nordisk´s last generation GLP-1 Wegovy is as searched for in the United States as Nvidia. That surprised me big time, but is evidence of the huge impact these drugs are having.

Assessing the challenge

The global prevalence of obesity, defined as having a body mass index (BMI) of 30 kg/m² or higher, is projected to increase from 14% of the world's population in 2020 to 25% by 2035, affecting 2.2 billion people. When considering the overweight population, defined as those with a BMI between 25 kg/m² and 30 kg/m², the total number reaches more than 4 billion individuals. This trend carries significant economic repercussions, with costs estimated to reach $4 trillion by 2035, equivalent to 2.9% of the global GDP, due to increased healthcare expenses and lost economic productivity.

Now, let´s have a closer look at some of the players that are and will continue to play a key role in the obesity market for the foreseeable future.

Novo Nordisk's Wegovy and future prospects

Bloomberg Intelligence forecasts that sales of Novo Nordisk's obesity drug Wegovy could hit $9 billion this year, nearly doubling from $4.5 billion last year. By 2029, Wegovy's sales might climb to $23 billion. To put it into perspective, AbbVie's Humira peaked of $21.2 billion U.S. dollars in 2022, the most for any drug in history. However, sales growth for Wegovy is expected to slow down in 2027/28 as its successor, Cagrisema, enters the market. Cagrisema is projected to generate sales of $8.6 billion by 2030.

About Novo Nordisk

Novo Nordisk has been transforming unmet medical needs into innovative treatments for over 100 years. Known for their insulin pens, Novo Nordisk's treatments benefit millions with diabetes, obesity, and rare blood and endocrine diseases. The company produces 50% of the world’s insulin supply and is committed to advancing medical devices and digital health solutions. Novo Nordisk's recently secured approval of Wegovy in China, more on this later.

Eli Lilly's Zepbound: The future market leader

The big(gest) winner, likely will be Eli Lilly's weight loss drug Zepbound. Expected to generate $28.5 billion in sales by 2030 and $4.6 billion this year, Zepbound is set to become the market leader.

Recent advances by Eli Lilly

Eli Lilly has recently achieved a significant milestone with the approval of Kisunla, a drug for treating early symptoms of Alzheimer’s disease, by the U.S. health authorities. In clinical studies, Kisunla has shown promise in slowing the progression of Alzheimer's, reducing cognitive decline by 35% over 18 months compared to a placebo. It also lowered the risk of the disease progressing to a more severe stage by 39%. This approval brings the number of Alzheimer’s treatments available in the U.S. to two, the other being Eisai’s Leqembi. Despite this positive development, Eli Lilly's stock fell by 1.3% on the same day, influenced by public criticism from President Joe Biden and Senator Bernie Sanders regarding the pricing of their obesity medications Mounjaro (the senator has also criticised Novo Nordisk on numerous occasions).

About Eli Lilly

Eli Lilly, founded in 1876, is a global leader in biotechnology, chemistry, and genetic medicine. With over 44,000 employees, including 10,000 in R&D, Eli Lilly focuses on solving significant health challenges. Its diverse portfolio includes products marketed in over 105 countries, with significant investments in novel treatments and technologies. In 2023, Lilly reported revenues of $34.1 billion, with a robust pipeline aimed at addressing the world’s most urgent health needs, and addressing two huge therapeutic areas in Obesity and Alzheimers and later on potentially cardiovascular.

Zealand Pharma: A rising star

Goldman Sachs has recently raised its price target for Danish Zealand Pharma's stock to 872 DKK from 835 DKK and Zealand has blown through these estimates as evidenced by the graph below. Goldman Sachs continues to recommend the stock with “buy” and has done so since December 2022..

Ten financial institutions have issued recommendations for Zealand Pharma’s stock, with nine being positive and one neutral. The share price development for Zealand the last two years has put the company into a new league in terms of size and attention.

Fresh obesity data from Zealand Pharma

Zealand Pharma has recently released new obesity data that has generated significant excitement among the company and analysts alike. Investors responded positively, pushing the stock up further.

Zealand Pharma’s CEO Adam Steensberg described the data as "extremely good," expressing that the company couldn't have hoped for more. Both Goldman Sachs and Kempen have subsequently raised their price targets for the stock, which has already performed well this year, to say the least.

Kempen analyst Suzanne van Voorthuizen noted that the new data presents a "clear winner" in terms of both safety and side effects. She highlighted the study's inclusion of a significant proportion of men, who typically achieve less weight loss than women, and noted that the baseline BMI for the group was relatively low, providing a challenging starting point.

Jefferies echoed these sentiments, suggesting that future results could be even more favorable. The preliminary results from Zealand’s phase 1b study of the drug candidate Petrelintid for treating severe obesity showed weight loss at the upper end of the company’s expectations, with mild side effects compared to the nausea-related issues associated with market leaders Wegovy from Novo Nordisk and Zepbound from Eli Lilly.

In terms of side effects, Petrelintid distinguished itself with a mild profile, except for two moderate cases of nausea and vomiting reported by a single patient who subsequently discontinued the treatment. None of the other 47 patients stopped the treatment, highlighting a significant advantage over GLP-1-based products like Wegovy and Zepbound, where 20-30% of patients discontinue due to intolerance.

Jefferies raised its Zealand target to 1100 DKK after the phase 1 obesity data with its Amylin Petrelintide. The new target is an increase with $3 Billion market cap to $7.8 Billion.

About Zealand Pharma

Zealand Pharma is an international biotechnology company headquartered in Denmark, focused on the discovery, design, and development of innovative peptide-based medicines. Since its founding in 1998, Zealand Pharma has built a core expertise in therapeutic peptides, leading to an R&D pipeline addressing obesity, rare diseases, chronic inflammation, and type 1 diabetes. The company's strategy involves global co-development and commercialisation partnerships to deliver new peptide therapies to those in need.

Sidebar: Advances in treating liver disease

Eli Lilly has presented promising data on tirzepatide, a diabetes and obesity molecule, which could also become a treatment for liver disease (NASH).

Meanwhile, Zealand Pharma and its partner Boehringer Ingelheim have unveiled detailed results from a phase 2 study of their drug candidate survodutid for treating fatty liver disease. The results show that up to 83% of patients experienced positive outcomes compared to 18.2% in the placebo group. Additionally, survodutid demonstrated effectiveness in treating liver fibrosis, with significant improvements in up to 64.5% of patients with moderate to advanced fibrosis.

Viking Therapeutics: New contender in obesity treatment

Viking Therapeutics is another notable player in the market, developing novel therapeutics for patients suffering from metabolic and endocrine disorders. Viking is a clinical-stage biopharmaceutical company with several compounds in clinical trials. Their lead program, VK2809, a selective thyroid hormone receptor beta agonist, is being evaluated for NASH and fibrosis, showing significant promise in reducing liver fat content. Viking's pipeline also includes VK2735, a dual agonist for GLP-1 and GIP receptors, which has demonstrated an encouraging safety and tolerability profile in early trials for obesity.

Price Target and Market analysis

According to a recent analysis by Morgan Stanley, Viking Therapeutics has a price target of $105. The consensus price target distribution ranges from $90 to $138, with Morgan Stanley placing it at $105. Viking's potential for success, especially with VK2735 in obesity and VK2809 in NASH, is estimated in a bull case scenario to reach peak sales of ~$9 billion by 2035. The base case assumes peak sales of ~$4.9 billion. Viking´s share price has risen 2x over the last 12 months and have also become speculative stock favourite on social media.

Comparative data and market perception

A comparison with other weight loss agents shows VK2735's competitive efficacy, even with shorter trial durations. Long-term data will be crucial for determining maximal efficacy. Additionally, despite perceptions of pharma disinterest, analysts argue that large pharmaceutical companies cannot afford to ignore the obesity market. Recent acquisitions by AstraZeneca and Roche underline the competitive landscape and the strategic importance of having an obesity franchise. This is definitely worth paying attention to.

About Viking Therapeutics

Viking Therapeutics develops novel therapeutics for metabolic and endocrine disorders. The clinical-stage biopharmaceutical company has three compounds in clinical trials, leveraging its metabolism expertise to improve patients’ lives. VK2809, their selective thyroid hormone receptor beta agonist, is in Phase 2b trials for NASH, showing significant reductions in liver fat and LDL-C. VK2735, a dual agonist for GLP-1 and GIP receptors, has shown promising safety and clinical benefits in early trials for obesity. Viking is also developing VK0214 for X-linked adrenoleukodystrophy, currently in Phase 1b trials.

Recent developments and market movements

Novo Nordisk recently achieved a significant milestone with the approval of their weight loss drug Wegovy in China. This approval opens up a massive market, with over 200 million overweight individuals, projected to grow to nearly 500 million by 2045. The company's experience with diabetes treatment in China, where their drug Ozempic has already seen substantial sales, positions them well to capture this new market segment.

Eli Lilly has also made headlines with detailed results for Zepbound, showing it effectively treated sleep apnea in over 50% of patients. This promising data not only boosts Zepbound's market potential but also puts pressure on companies like Resmed, which produces sleep apnea treatment devices.

Zealand Pharma has leveraged its recent stock surge to raise nearly $1 billion by selling shares at a slight discount. The funds will be used to advance the development of their obesity treatments, particularly Petrelintid, and further research in related diseases.

Conclusion

The obesity medication market is on the cusp of monumental growth, driven by leading players Novo Nordisk, Eli Lilly, Zealand Pharma, and Viking Therapeutics. With innovative treatments like Wegovy, Zepbound, and emerging candidates like Cagrisema, Petrelintid, and VK2735, the industry is set to revolutionize obesity and liver disease treatment. Companies like Zealand Pharma and Viking Therapeutics are also well-positioned to capitalize on these opportunities.

Health systems prioritize cardiovascular outcomes over weight loss alone. Demonstrating the cardiovascular benefits of weight management is essential for expanding access, reimbursement, and changing clinical practices. As of February 2024, the EMA is evaluating Wegovy for reducing cardiovascular events, a key factor for coverage in many European health systems, including Germany, which currently do not cover it for weight loss alone. Competitors like Eli Lilly must also provide evidence of cardiovascular benefits for their obesity treatments to secure coverage and usage. If the companies become successful in showing outcomes in cardiovascular, this will catapult them further up the ranks of the most valuable companies in the world.