Novonesis 🇩🇰 A Biosolutions Leader with Strong Growth Potential

Novonesis, born from the merger of Novozymes and Chr. Hansen in January 2024, has emerged as a world leader in biosolutions. By combining Novozymes’ expertise in enzymes with Chr. Hansen’s strengths in cultures and probiotics, Novonesis is positioned as a comprehensive player in the industry. The company is structured into two primary divisions: Food & Health Biosolutions (comprising 34% Food & Beverages and 12% Human Health of 2023 sales) and Planetary Health Biosolutions (covering Household Care, Agriculture, Energy, and Technology). With over 10,000 employees worldwide, Novonesis is well-equipped to drive sustainable growth in diverse market segments.

Strengths and Market Position

Novonesis holds a market-leading position with the strongest R&D platform in the enzymes and bacteria sectors. This R&D focus enables the company to innovate sustainable solutions, benefiting both consumers and industries across household care, food and beverage, bioenergy, and agriculture. Additionally, Novonesis has a strong presence in emerging markets, leveraging structural tailwinds from growing middle-class populations and increasing emphasis on sustainability.

The company’s recent Q2 2024 results underscore its growth momentum, reporting a 10% organic revenue increase driven by key segments like Household Care and Food & Beverage. This solid performance reflects Novonesis’ robust positioning and supports its ability to meet and even exceed growth projections.

Financial Highlights

Looking at Novonesis’ key financial metrics, the company shows promising growth and profitability:

• Revenue Growth: Net sales have shown a strong upward trend, with estimates for 2024E at EUR 3,989 million, an impressive jump from 2023.

• Profitability: EBITDA and EBIT margins remain solid, with EBITDA margin estimates rising to 38.1% by 2025E.

• Earnings Stability: The adjusted EPS and DPS indicate sustained shareholder value, with the adjusted EPS estimated to increase to EUR 2.08 by 2026E.

• Healthy Balance Sheet: Low net debt/equity ratios highlight Novonesis’ sound financial management, enabling reinvestment in growth initiatives.

Growth Drivers and Opportunities

Novonesis has a diverse range of growth drivers, including:

1. Human Health Platform: With recent acquisitions, Novonesis is expanding its reach in human health, creating opportunities for sustained revenue generation.

2. Advanced Protein Solutions: The company expects substantial growth in protein solutions, with a target of over EUR 1 billion in revenue by 2028.

3. Cost Synergies: Novonesis is strategically positioned to achieve cost efficiencies from the merger, enhancing profitability without compromising R&D.

The combination of Novozymes and Chr. Hansen also opens avenues for cross-selling across sectors, which could further drive top-line growth.

Early innings

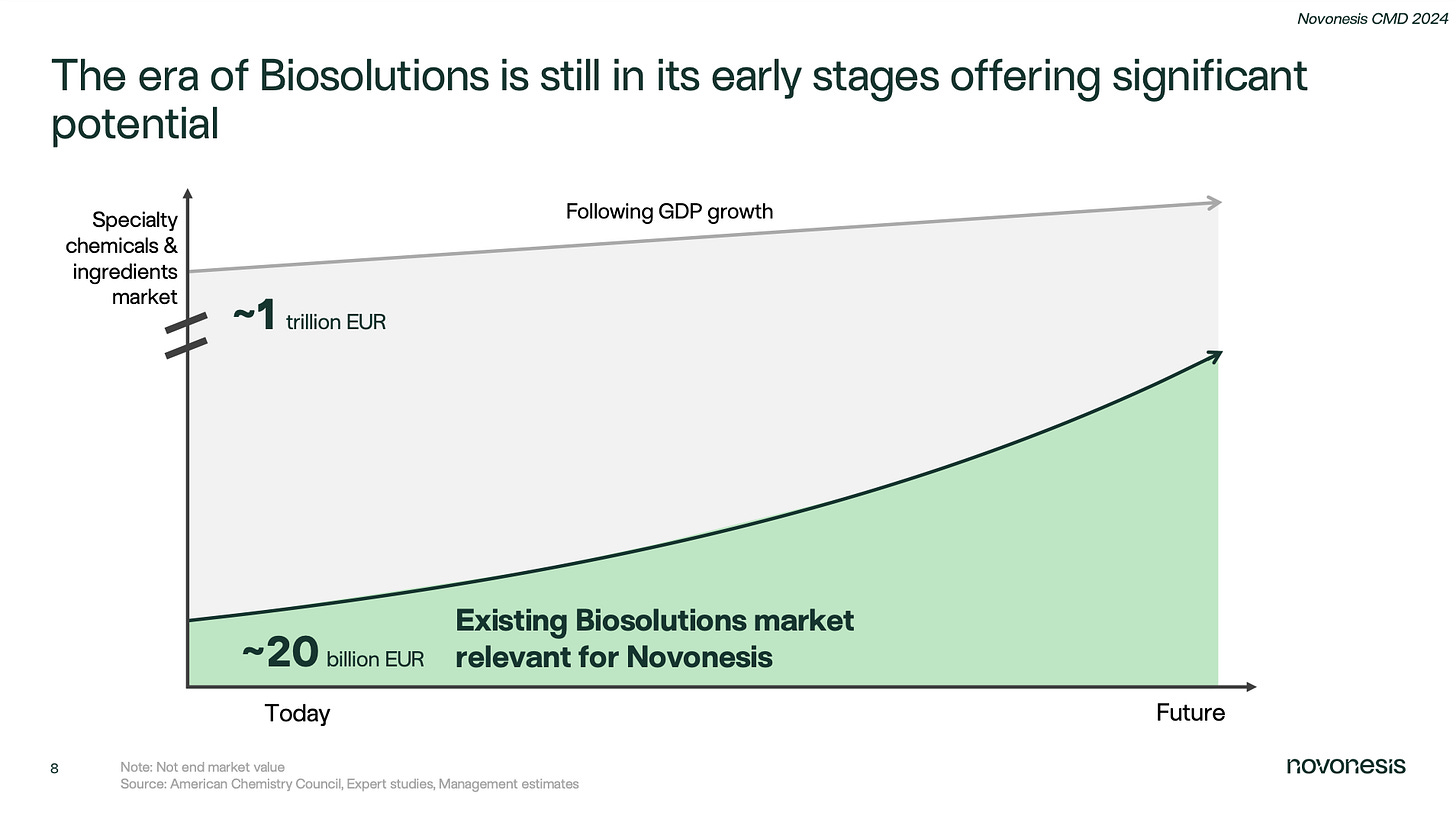

The biosolutions industry is in its early stages, with significant growth potential ahead. As seen in the chart, the current market relevant to Novonesis is valued at approximately €20 billion, a fraction of the broader specialty chemicals and ingredients market, which stands at around €1 trillion. As biosolutions increasingly gain traction, this market is projected to expand, aligning with global GDP growth. This presents a substantial opportunity for Novonesis to capture market share as demand for sustainable and innovative solutions rises, positioning the company well for long-term growth.

Addressing Weaknesses and Threats

While Novonesis shows strong potential, it faces challenges like weak historical pricing power and high dependence on commodity prices. However, management’s proactive approach in securing cost synergies and increasing operational efficiency is expected to mitigate these risks.

In terms of threats, Novonesis must successfully integrate Chr. Hansen’s operations to maximize revenue synergies. There is also the risk of underperformance in its human health and protein solutions segments. However, given the recent organic revenue growth and positive trading conditions, Novonesis is well-placed to overcome these hurdles.

Conclusion: Compelling long-term hold, with +20% upside next 12-18 months

Novonesis’ recent performance, including a 10% organic revenue increase, supports a bullish stance. The company has raised its full-year guidance to a range of 7-8% organic revenue growth, with potential to reach the upper limit, given its robust outlook in core segments. With continued strong trading and a diverse portfolio across critical industry segments, Novonesis presents a compelling investment opportunity.

With that, thanks for reading, I really appreciate the interest. Below are links to a few other items that you might find interesting.

Other readings:

The Lessons of History, Will & Ariel Durant - https://amzn.to/48vu6Di

Quality Compounders

10 Companies for the next 10 years