Rheinmetall ($RHM.DE): A defence powerhouse in Europe

Significant beneficiary of expanding military budgets.

Introduction

Germany headed to the polls today, and while election days can be a bit of a spectacle, this one had me thinking beyond just politics. With everything happening on the geopolitical stage—rising tensions, alliances challenged, and military budgets going into overdrive—I can’t help but wonder what all of this could mean for investors. Defence spending is soaring across Europe, and with NATO members stepping up their commitments, there’s a massive flow of capital heading into the sector.

This also raises an interesting question: could a German company once again become a powerhouse for European growth? Enter Rheinmetall—Germany’s largest defence supplier and a company that has been riding the wave of increased military procurement. As global power dynamics continue to evolve, Rheinmetall looks well-positioned to benefit. But is the company still a buy at these levels? And just how much runway does this defence boom really have? Let’s break it down.

Rheinmetall

Rheinmetall has cemented itself as Germany’s largest defence company and a leading supplier of land-based military systems in Europe. With a well-diversified business model—spanning defense and automotive components—the company is poised to benefit from the structural growth in European defense spending. Given the geopolitical landscape and rising NATO budgets, Rheinmetall’s defence segment is set for sustained growth, supported by ammunition restocking, vehicle modernization, and air defence programs.

Despite its significant share price appreciation over the last three years (out-performing NVIDIA!), I believe there is further upside potential. The long-term earnings trajectory remains robust, underpinned by European defence modernization and Rheinmetall’s key role in supplying Germany and NATO.

Business overview and Strategic Positioning

Rheinmetall operates through two primary divisions:

1. Defense (70% of revenue) – Supplies armored vehicles, weapons, ammunition, air defense systems, and electronic warfare solutions. The segment benefits from:

• Increased European defence spending post-Russia-Ukraine war.

• Germany’s €100 billion military modernization fund.

• NATO’s European Sky Shield Initiative (focused on integrated air defense).

• Strong demand for ammunition, with planned production scaling from 100,000 rounds in 2022 to 700,000 by 2025.

2. Civil Business (30% of revenue) – Produces engine-related components, including emission control systems and heat pump parts. Growth in this segment is driven by stricter emissions regulations and the energy transition.

Global presence and Market Share

Rheinmetall enjoys a well-balanced geographical revenue mix:

• Germany (30%) – As the country’s top defense supplier, Rheinmetall is integral to military modernization.

• Rest of Europe (36%) – Supplies multiple NATO and EU countries.

• Asia-Pacific (16%) – A key player in Australia, with opportunities in India and South Korea.

• North America & Other Markets (18%) – Expanding footprint, particularly through U.S. military contracts.

The company’s Lynx Infantry Fighting Vehicle is a contender for the U.S. Army’s XM30 program, a potential $45 billion opportunity to replace Bradley vehicles.

Financial performance and valuation analysis

Revenue and Profitability Trends

Rheinmetall has demonstrated impressive top-line growth, with revenues expanding from €5.6 billion in 2021 to an estimated €10 billion in 2024 (+77%). The key driver has been defence, with orders surging due to geopolitical tensions and NATO rearmament.

• EBIT margins are expected to improve from 12.1% in 2023 to 16.4% for full year 2024, reflecting higher defence margins and operating leverage. I model the margins to increase to 18% by 2026.

What might surprise many is that Rheinmetall´s returns have outpaced NVIDIA over the last three years. Of course you can object that the timeline is cherry-picked but going back to 2022 is relevant as this is when the political discourse on future military spending became more real than it had previously been.

Valuation: Is Rheinmetall Still Attractive?

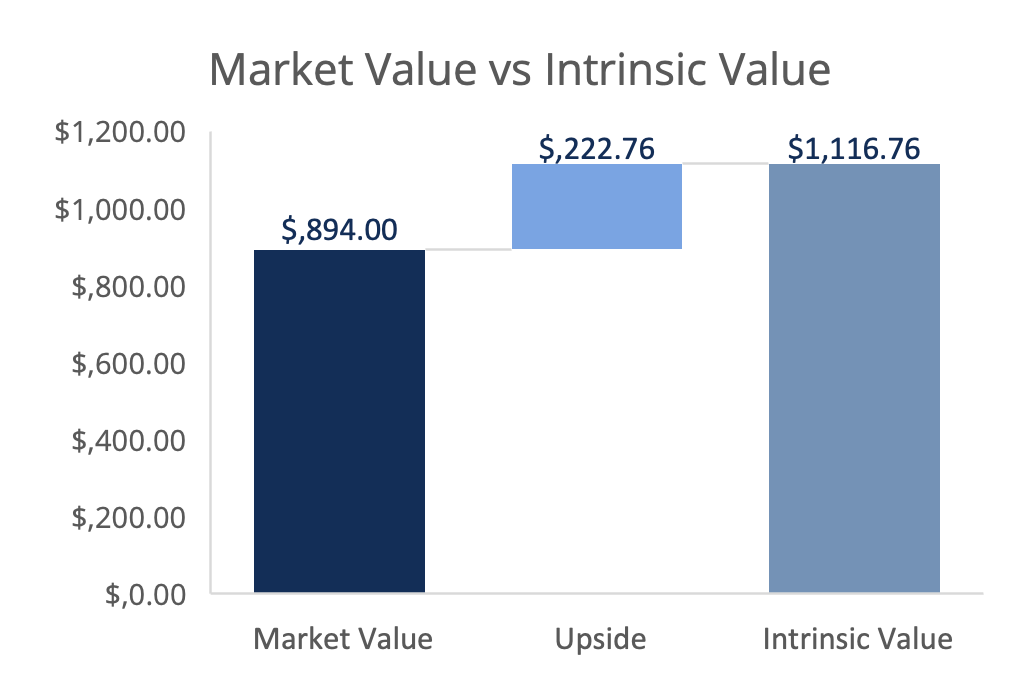

I have assessed Rheinmetall´s valuation using DCF analysis. The key assumptions are

WACC of 8.5%

Perpetual growth rate of 3%

EV/EBITDA multiple of 10x

EBIT CAGR of 34% from 2024 to 2028

The DCF-derived value range suggests a target price of 1,117 per share, indicating 25% upside from current levels.

Rheinmetall currently trades at a premium to its peers, but this is justified by its higher growth potential and expanding European defence budgets. The valuation above is a bit ahead of the current price targets by analysts:

Key Investment Catalysts

1. European Defence Spending Acceleration

• NATO’s 2% of GDP defense spending floor could rise to 2.5-3% (potentially even more, approach 4-5%), providing €500 billion in additional spending for the EU over the next decade.

• Germany’s €100 billion military fund is focused on land systems, air defense, and digital warfare, all core to Rheinmetall’s offerings.

As we can see from below, there is plenty of headroom for most NATO countries if they raise military spending to 3% of GDP.

2. U.S. Market Expansion

• The XM30 Infantry Fighting Vehicle contract is a huge opportunity, with Rheinmetall’s Lynx competing for a $45 billion program.

• Success in the U.S. market would significantly de-risk its revenue concentration in Europe.

If you are curious about what the Lynn is, check out this video:

3. Order Backlog and Production Ramp-Up

• The current order backlog is at an all-time high, ensuring revenue visibility until 2028.

• Rheinmetall is increasing ammunition production sevenfold through 2025, capturing a key supply-chain bottleneck in Europe.

Risks and Considerations

While Rheinmetall offers compelling growth, several risks warrant attention:

1. Geopolitical and Policy Risks – Defense spending relies on political decisions, which can shift with government changes.

2. Competition from U.S. Firms – NATO allies may increasingly favour U.S. military contractors due to political pressure.

3. Execution and Supply Chain Constraints – Scaling up production to meet demand is complex and capital-intensive.

If the 2020´s have taught us anything, it is that risk has been exceptional difficult to forecast. I am reminded once again that “Risk is what's left over when you think you've thought of everything".

Conclusion: A strong growth story with manageable risks

Rheinmetall stands out as a high-quality defence company in Europe’s growing military budget. While the stock has already appreciated, its strong earnings trajectory, expanding margins, and geopolitical tailwinds support further upside.

Given the DCF valuation of €1,117 per share, there is potentially a 25% upside. However, volatility will persist due to election outcomes, current geopolitical dynamics and NATO funding negotiations.

For investors seeking exposure to European defence expansion, Rheinmetall remains a compelling investment—but one that requires monitoring for macroeconomic and political developments. For an industrial sector, this is also interesting as it is not cyclical. As always, this is not advice but my view on the company and the sector. I do not own any shares in Rheinmetall but have it on my watchlist.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Excellent analysis! Your valuation approach is particularly interesting given the geopolitical backdrop. I haven’t invested in this sector before, but I’ve been following it for the last two decades. A couple of questions: With European defense budgets surging, do you see a risk of overspending leading to inefficiencies or eventual pullbacks? Also, how do you assess Rheinmetall’s chances of securing major U.S. contracts, given the strong political influence of American defense firms? Appreciate your insights and looking forward to more of your analysis!

Thank you! I am also new to the sector but given everything that is going on, I wanted to know more about it and see if there are relevant companies to watch. As for the questions, here is how I see it:

1) Risk of overspending? Yes, there will be for sure be overspending here, but that will be on the parts of governments that are looking to drive rearmament fast and wide. The (European) defence companies could very well be supply constraint for several years. As the defence companies are ramping up to meet demand there is of course also a risk that they over-investment and overpay for their own supplies. Still, a company like Rheinmetall will more than double both top and bottom line in 3-4 years. Most likely, 2030 annual revenues could be in the €30-40 billion range. Rheinmetall becomes the primary industrial engine for Germany. More on revenue and profit targets in a separate update.

2) Likelihood of securing U.S. contracts? The main opportunity here that I know of is the XM30 Infantry Fighting Vehicle contract that Rheinmetall’s Lynx is competing for and that is a $45 billion program. Rheinmetall is in it as it is very much its core competence to develop and build these vehicles. As you rightly point, there is a chance that spending in U.S. will towards U.S. based companied and European spending towards its own companies. However, the whole sector - Europe and U.S. - will be supply constraint and in order to secure capabilities, I believe Western governments (U.S. Europe, Eastern hemisphere allies) will need to use the full landscape of suppliers. It is very difficult to assign a probability of winning / be included in the contract for XM30. If the German €150 billion special fund (Rheinmetall will take around 35% of this) for rearmament goes to some U.S. based companies, there could be a higher chance of reciprocity

I hope this give a bit more perspective. I gave me more to think about, so thank you very much for the questions