Introduction

The latest earnings reports from Eli Lilly and Novo Nordisk left no doubt—the market for weight-loss medications is on fire, and the two giants remain firmly in the lead. Their blockbuster drugs, Zepbound and Wegovy, pulled in staggering revenues of $5 billion and $8 billion, respectively.

But this is just the beginning. A wave of next-generation weight-loss treatments is on the horizon, and keeping track of all the contenders is becoming a challenge. Below, we break down the key drugs set to make headlines in the coming years.

A Multi-Drug Future

The weight-loss market of the future will not be dominated by a single drug but rather a portfolio of medications tailored to different patient needs as some patients respond better to one formulation over another, this is also clearly evidenced by the clinical trial where tolerability and side-effects is a huge focus area.

While Novo Nordisk and Eli Lilly are leading the charge with the most advanced pipelines, other major players are rapidly closing in. Amgen, Roche, AstraZeneca, and Boehringer Ingelheim are all making moves, and smaller biotech firms are emerging as potential disruptors.

The current heavyweights

Wegovy (Novo Nordisk) – A weekly semaglutide injection, also used in diabetes treatment under the name Ozempic. Clinical trials have shown weight loss of 14%.

Zepbound (Eli Lilly) – A weekly tirzepatide injection, also sold as Mounjaro for diabetes. Demonstrated weight loss of 20% in trials.

The next wave: Likely Market Entrants by 2026

These treatments are in late-stage development and could be approved within the next two years.

• Semaglutide (Oral) – Novo Nordisk: A daily pill form of semaglutide, showing 17% weight loss in trials. Regulatory submission expected soon.

• High-Dose Semaglutide – Novo Nordisk: A more potent weekly injection (7.2 mg), with weight loss of 21% in trials.

• Orforglipron – Eli Lilly: A daily pill with a new active ingredient, showing 15% weight loss in early trials.

• Cagrisema – Novo Nordisk: A combination of semaglutide and cagrillintide. While initial results (22-23% weight loss) disappointed investors, further trials are ongoing.

• Mazdutid – Innovent & Eli Lilly: A weekly injection that delivered 14% weight loss in a pivotal Chinese trial. Chinese approval is pending, while Eli Lilly continues Western development.

The Longer-Term Bets: Post-2026 Approvals

Several promising candidates are now in Phase 3 trials but likely won’t hit the market until after 2026.

• Retatrutide (Eli Lilly) – A next-gen weekly injection with results expected in late 2025.

• Servodutid (Boehringer Ingelheim & Zealand Pharma) – Another weekly injection with final trial data due by year-end 2025.

• Maritide (Amgen) – A monthly injection with trials beginning this year.

• Pemvidutid (Altimmune) – A weekly shot that made waves when early trial data sent its stock soaring 40% in a single day.

Early-Stage Innovations: The Future Beyond

While some of these drugs are years away, early results are already creating buzz.

• Amycretin (Novo Nordisk) – A weekly injection that spiked Novo’s stock 7% in January following promising early trial results.

• Bimagrumab (Eli Lilly) – A monthly, antibody-based injection acquired in a biotech buyout.

• CT-388 (Roche) – A weight-loss candidate from Roche’s 2023 acquisition of Carmot Therapeutics.

• Gela (Novo Nordisk & GE) – An entirely new approach: an ultrasound-based weight-loss treatment that doesn’t involve drugs.

• VK2735 (Viking Therapeutics) – A weekly injection also being tested in pill form.

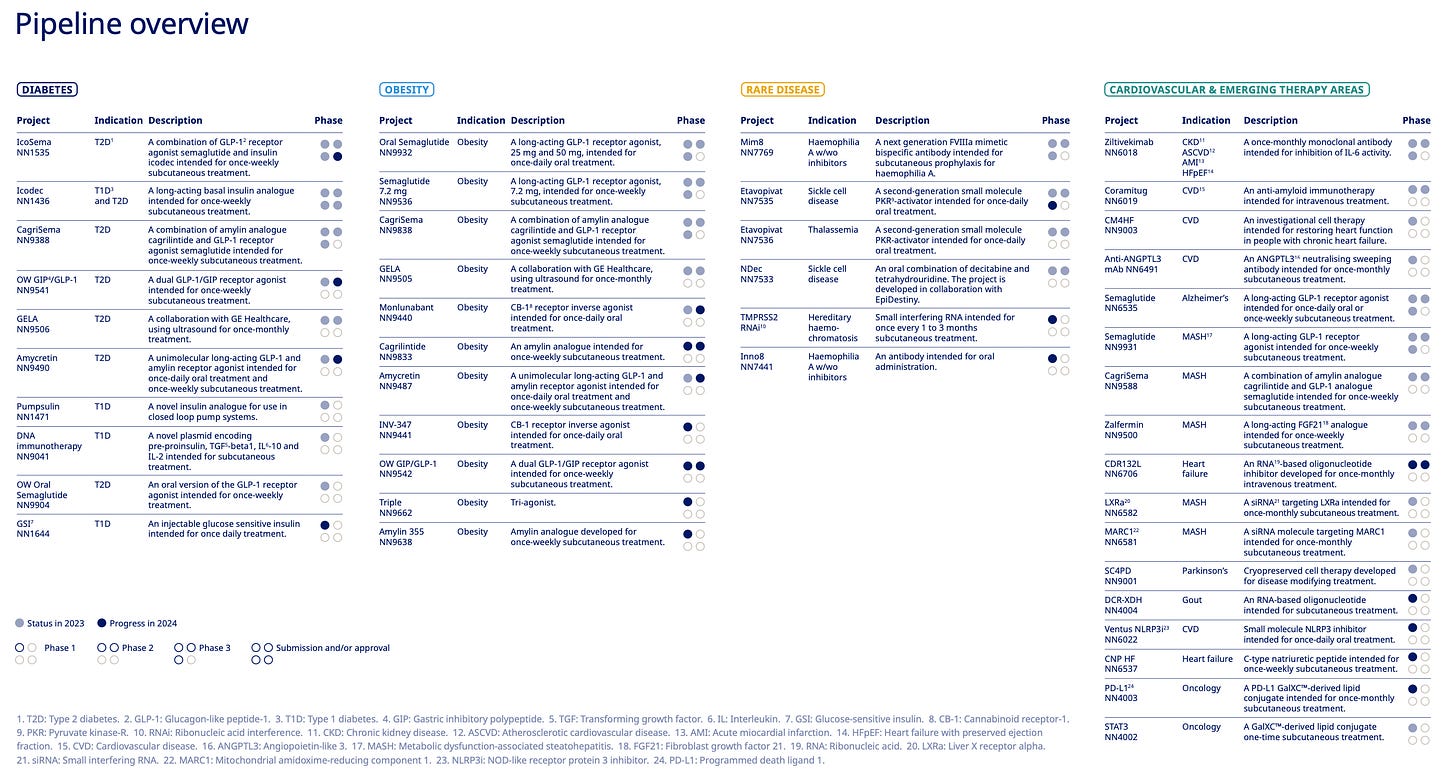

Pipeline overview Novo Nordisk and Eli Lilly

Building up these pipelines are multi-year journey and not something that other companies can do in short and medium term which tells us about the strength Eli Lilly and Novo Nordisk is operating from.

However, there are other participants as we also saw above, and especially one has garnered much interest due to its current drug candidate.

The Outsider: Viking Therapeutics

Viking Therapeutics is gaining serious attention in the obesity treatment space, with its drug candidate VK2735 showing strong potential. This dual GLP-1/GIP receptor agonist is designed to enhance weight loss while improving tolerability, positioning it as a serious competitor to established treatments.

Early trial results are promising, with phase 2 data suggesting up to approximately 15% weight loss after 13 weeks. This puts VK2735 in direct competition with Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, which as we know currently dominate the market. What sets VK2735 apart is its safety profile—most reported side effects have been mild, with no severe gastrointestinal issues that have plagued some competing drugs. This could become a competitive advantage, and that is always worth paying attention to. However, Viking does not have a strong track record of moving its development programs into phase 3, so this is a watch out.

Another key advantage is Viking’s plan to develop both subcutaneous and oral formulations, which could drive broader adoption. An effective obesity pill remains a massive opportunity, as patient preference leans toward easier, non-injectable options.

The road ahead isn’t without risks—regulatory hurdles, eventual market acceptance, and competition remain challenges. VK2735 could emerge as a best-in-class treatment, unlocking significant market potential. With obesity treatment demand surging, Viking is a stock to watch closely. Search for “VK2735” on X and it is clear that there is much attention and high expectations.

A $100 Billion market in the making?

With an ever-growing list of players and drug candidates, the weight-loss market is evolving at rapid speed. There is potential for this market to exceed $100 billion annually, and we are still early.

The obesity epidemic is massive, and the demand for effective treatments is only increasing. With multiple major pharmaceutical companies investing heavily, the next decade will likely see a flood of new drugs hitting the market, each promising better efficacy, fewer side effects, and more convenient dosing options.

Highlighting a couple of observations that help underscore the size of the market (and problem):

More than 1 billion people worldwide are classified as obese, including 650 million adults, 340 million adolescents, and 39 million children (source: WHO).

In the United States, 42.4% of adults were classified as obese in 2017-2018, up from 30.5% in 1999-2000. (source: CDC).

Obesity contributes to approximately 4 million deaths annually, primarily due to cardiovascular disease, diabetes, and certain cancers (source: The Lancet). This also gives us a hint about the other therapeutic areas being pursued by especially Eli Lilly and Novo Nordisk.

The economic impact of obesity is estimated at $2 trillion per year, or 2.8% of global GDP, including healthcare costs and lost productivity (source: McKinsey Global Institute).

Children with obesity have a 70% likelihood of becoming obese adults, increasing their risk for chronic diseases like type 2 diabetes and heart disease (source: Harvard T.H. Chan School of Public Health).

This is a very interesting space that I will continue to follow closely and provide updates on.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

First time I’ve seen the full pipeline laid out—thanks for sharing, really encouraging. Still, I’m biased. On one hand, I invest in some of these companies. On the other, I’m in the trenches—coaching, parenting, and fighting to prevent the very diseases that fuel their growth. It’s a strange position to be in, but the reality is clear: there’s financial upside in people not planning ahead—which is why, since 2008-2009, I’ve consistently invested in some of these companies while doing my best to help people avoid needing them. Two realities. One truth: Long-term thinking always wins.