Teva Pharmaceuticals Q1 Update ($TEVA): Innovation and Generics drive 9th consecutive quarter of growth

Well-positioned for sustained multiple expansion.

Introduction

Teva Pharmaceuticals, the world’s largest manufacturer of generic drugs, is confidently powering ahead, demonstrating once again that its pivot to innovation is paying off significantly. With a robust Q1´25 performance, marked by its 9th consecutive quarter of revenue growth, the company is showcasing impressive momentum that solidifies its strategic transformation and long-term growth potential.

Solid Financial Performance – Ninth Straight Quarter of Growth

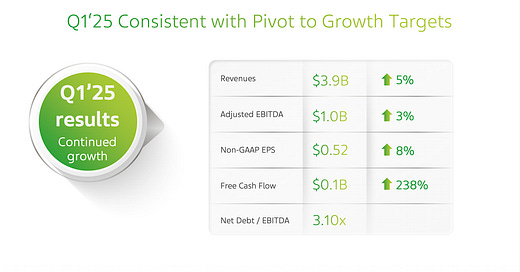

Teva reported robust financial results for the first quarter of 2025, signaling continued strength across its diversified portfolio. Quarterly revenues climbed 2% year-over-year to $3.89 billion, a milestone driven by significant contributions from both its generics business and increasingly powerful innovative medicine segment. This consistent revenue growth reflects Teva’s strategic clarity and management’s successful execution.

Adjusted earnings per share rose to 52 cents, surpassing analysts’ forecasts of 46 cents. The EBITDA margins continue to strengthen, reflecting disciplined cost management and successful implementation of efficiency initiatives. Free cash flow also saw an increase of 238% YoY, indicating strong underlying operational momentum and prudent financial management.

Strategic pivot to innovation bearing fruit

Under the guidance of CEO Richard Francis, Teva has made decisive strides towards innovative medicines, complementing its historically strong generic foundations. Francis confidently stated, “Two years ago, nobody thought Teva could do anything in innovation. What we’re seeing now shows whether it’s the US, Europe, or international markets, we’re really good at innovative R&D and innovative commercialization.”

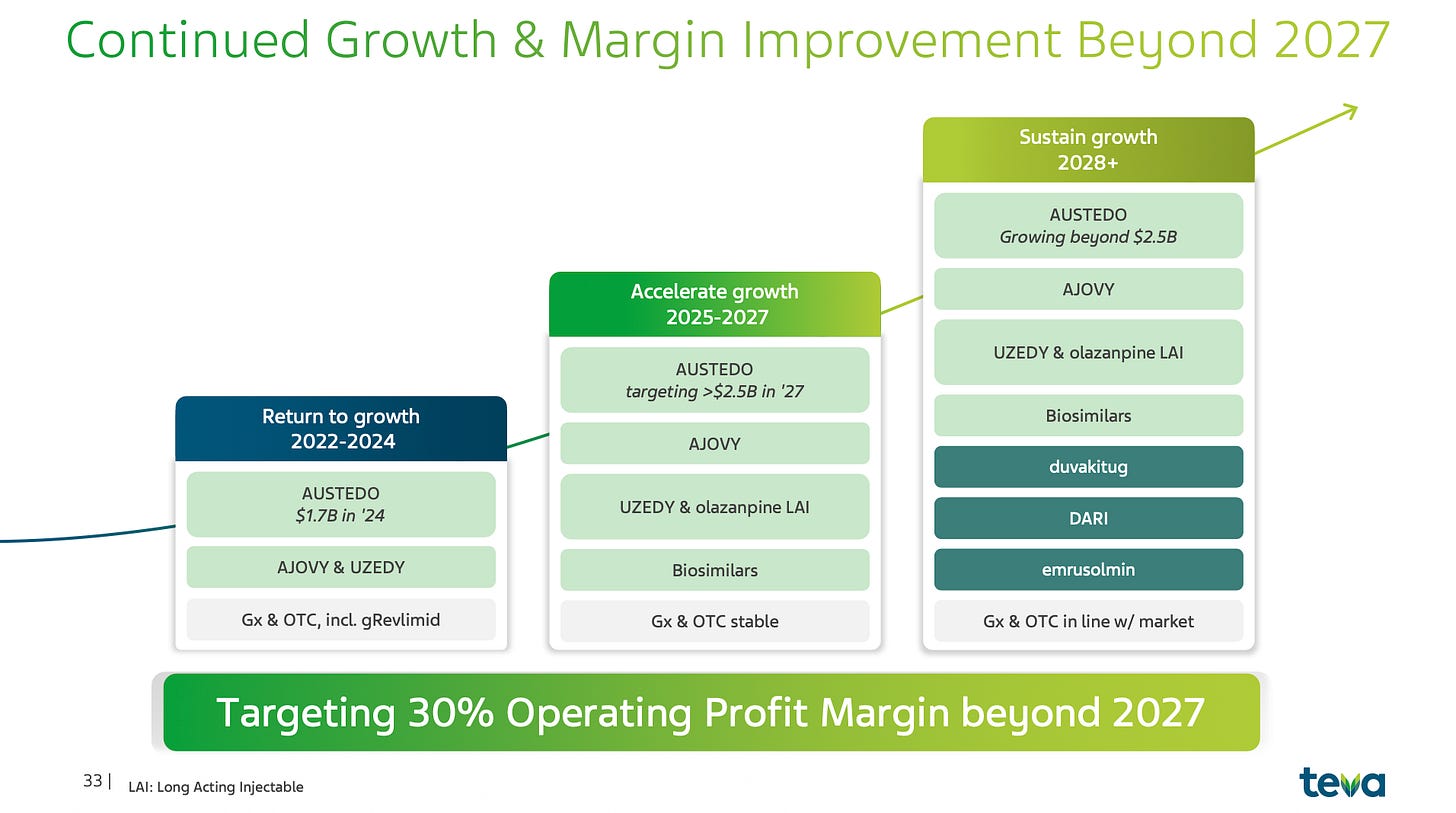

This newfound confidence is supported by tangible results. Teva’s innovative products Austedo, Ajovy, and Uzedy have been strong performers. Austedo, a treatment for Huntington’s disease, reported sales growth of 39% in Q1 alone, and Teva now anticipates revenues of approximately $2 billion from this single product by 2025. Ajovy, a migraine prevention medication, surged by 26%, and the schizophrenia treatment Uzedy grew by 156%, indicating robust uptake and strong market adoption.

Teva expects Austedo sales to continue thriving, aiming for $1.95–$2.05 billion in annual revenue by 2025, while Ajovy and Uzedy are anticipated to reach about $600 million and $160 million respectively. These milestones demonstrate the effective execution of Teva’s strategic pivot, positioning the company solidly within the innovative pharmaceutical sector.

Generics still driving stability and growth

Despite its notable push into innovation, generics remain a cornerstone of Teva’s strategy, providing stability and dependable revenue streams. With planned launches of biosimilars and other drugs over the next two years, Teva continues to solidify its position as a global generics powerhouse. The generics segment alone saw a healthy 3% growth year-over-year, reaffirming the robustness of this business line.

Teva’s generics portfolio is expansive and significant, covering treatments valued at approximately $55 billion in originator product terms, promising substantial growth through complex generics and biosimilars launches. This diversified approach enables the company to mitigate risks, including those associated with patent expirations and price competition in key markets.

Cost optimization and streamlining for future growth

Teva has also unveiled a decisive restructuring and optimization strategy designed to boost profitability and operational efficiency. By targeting net savings of roughly $700 million by 2027, Teva plans to raise its operating profit margin substantially to 30%. Part of this initiative involves reducing headcount by approximately 8%, or around 2,400 employees, excluding certain units like the active pharmaceutical ingredient (API) business, which is set for divestment.

The restructuring, labeled the “Acceleration Phase,” emphasizes streamlining operations, optimizing procurement networks, and leveraging technology such as artificial intelligence. By simplifying its manufacturing network and reducing the number of production sites from 35 to below 30 by 2027, Teva is positioning itself for enhanced efficiency and greater profitability.

Debt reduction and financial stability

An important aspect of Teva’s transformation is its disciplined approach to debt reduction. The company has successfully reduced net debt significantly and maintains a solid trajectory toward a net debt-to-EBITDA ratio of below 2x in the coming years, providing greater financial flexibility and stability for strategic investments and potential acquisitions.

At the conference call, Teva’s CFO Eli Kalif highlighted ongoing improvements in working capital management and leverage, which, combined with strong free cash flow generation, reinforces the company’s financial resilience and its capability to navigate potential macroeconomic challenges, such as tariffs, with minimal disruptions. This has been a very consistent talk-track.

Mitigating risks and strategic clarity

One significant concern has been the anticipated impact of generic competition, particularly with products like Revlimid. However, Teva’s management has clearly communicated that cost-saving measures and operational efficiencies will fully offset any expected revenue losses from such impacts by 2027, calming down the negative sentiment around this event.

Moreover, Teva has indicated minimal anticipated effects from U.S. import tariffs on its operations, thanks to its strong domestic manufacturing capabilities, which further assures investors of the company’s strategic preparedness and adaptability in challenging market conditions.

Conclusion: A Bullish Outlook

Teva Pharmaceuticals has successfully repositioned itself from being perceived merely as a generics producer to becoming a strong player in innovative drug markets. The 9th consecutive quarter of revenue growth underlines the company’s revitalized trajectory, driven by a powerful combination of strategic innovation, generics excellence, operational optimization, and disciplined financial management.

Given the evident momentum in innovative medicines, substantial generics business strength, aggressive cost management, and steadily improving financial health, Teva remains a compelling opportunity with significant upside potential. I believe we will see Teva at around $25-27 during the next 9-12 months.

I have a position in Teva and also find the current level attractive. The above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Healthy Returns: 8 Stocks riding the wave of medical innovation

Introduction: Investing in the Future of Health and Wellbeing

I linked to your piece in my Monday links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-may-12-2025

Seeking Alpha will also have a bit of coverage on the stock... The Israel connection might temper some investor enthusiasm for the stock BUT friendshoring or the US getting more pharma stuff from Israel (instead of China etc) might help performance...