Novo Nordisk ($NVO): Robust momentum despite US market challenges – Q1´25 update

Novo currently dominates the global GLP-1 market, holding two-thirds share of all patients currently prescribed a GLP-1 medication.

Introduction

Novo continues to impress investors with robust performance and a clear strategic direction, despite facing near-term headwinds in the U.S. market. The Q1 2025 financial results underline Novo’s strength as a global leader in diabetes and obesity care, marked by substantial revenue growth, effective cost control, strategic innovation, and expansive global reach.

Solid financial performance in Q1

Novo delivered a robust financial quarter, reporting sales of DKK 78.1 billion, representing an impressive 19% growth in Danish kroner and 18% at constant exchange rates (CER). Operating profit for the quarter increased to DKK 38.8 billion, a notable improvement of 22% reported and 20% CER, underpinned by tight cost management and strong product demand .

Net earnings for Q1 grew by 14%, reaching DKK 29.0 billion, reinforcing Novo’s robust financial health. Free cash flow generation remained strong at DKK 9.5 billion, enabling the company to return a substantial DKK 36.7 billion to shareholders through dividends and share buybacks .

Segment analysis: Diabetes and Obesity Care

Novo’s primary growth driver remains its diabetes and obesity care segments, generating combined revenues of DKK 73.5 billion, up 21% CER. The obesity care division notably surged 65% CER, with sales reaching DKK 18.4 billion. This significant growth underscores the sustained global demand for Wegovy, despite challenges related to compounded GLP-1 alternatives in the U.S. market .

Wegovy delivered a strong performance, with global sales of DKK 17.4 billion in Q1, although U.S. sales experienced some softness due to compounded GLP-1s, leading to a short-term negative impact from prescription destocking and rebate timing adjustments. Novo has explicitly addressed these issues, highlighting expectations for a rebound through new patient access strategies, particularly via the NovoCare cash-pay model and preferred formulary status secured with CVS Health from July 2025 .

Novo´s recent revenue development:

And here specifically for Ozempic and Wegovy:

Strategic execution: US market dynamics

Compounded semaglutide continues to create challenges in the U.S., representing roughly one-third of all GLP-1 prescriptions. The pricing gap remains substantial—approximately $499 per month for Wegovy compared to around $200 for compounded alternatives. Nevertheless, Novo expects a significant market shift back to Wegovy, driven by increased regulatory scrutiny against compounded drugs and new patient acquisition initiatives .

The preferred access arrangement with CVS Health starting mid-2025 is expected to accelerate prescription growth significantly in the second half of the year. Novo sees this agreement as validation of Wegovy’s superior clinical profile in treating obesity-related comorbidities, further bolstering its long-term growth outlook .

International expansion continues

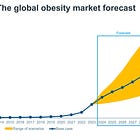

Outside the U.S., Wegovy’s rollout is accelerating rapidly, now available in 25 international markets, up from 20 at the start of the year. This global strategy allows Novo to diversify revenue streams and mitigate regional market fluctuations. With obesity a rising global health concern, Novo´s strategic focus on expanding international obesity care significantly enhances its growth potential .

Leadership in the GLP-1 market

Novo continues to dominate the global GLP-1 market, holding approximately a two-thirds share of all patients currently prescribed a GLP-1 medication. Its products—Ozempic for diabetes and Wegovy for obesity—remain category leaders, contributing to sustained growth and patient adoption globally .

Ozempic: This GLP-1 product remains a cornerstone of diabetes management with significant adoption due to its effective glucose control and notable secondary benefits in weight reduction.

Wegovy: Continues to exhibit exceptional clinical results in obesity management, delivering around 15% average weight loss in patients, significantly outperforming many existing treatments and further cementing its market-leading position.

Innovation driving future growth

Novo´s pipeline remains impressively robust, highlighted by notable developments such as CagriSema and oral semaglutide formulations:

CagriSema: The REDEFINE 2 trial demonstrated remarkable efficacy, achieving an average weight loss of 15.7%. Filing for regulatory approval is planned for early 2026, positioning it as a potentially transformative obesity treatment option .

Oral Semaglutide 25mg: Submitted for U.S. FDA approval, oral semaglutide showed efficacy comparable to Wegovy, delivering approximately 16.6% weight loss. This oral formulation may significantly enhance market access, potentially attracting patients who prefer a non-injectable medication .

Novo also expanded its therapeutic horizons by submitting Wegovy for the treatment of metabolic dysfunction-associated steatohepatitis (MASH), further broadening the therapeutic potential of its GLP-1 products.

Strong commercial execution and scalability

Novo continues significant investments in manufacturing and product scalability, totaling nearly DKK 140 billion since 2021. The integration of acquired fill-finish facilities and strategic product portfolio optimization support global patient demand growth, particularly for GLP-1 products. This positions Novo well to sustain and expand its leadership in both diabetes and obesity care segments .

Financial outlook and management confidence

Novo adjusted its 2025 financial outlook due to near-term U.S. market dynamics but still anticipates robust annual growth. Management now forecasts sales growth at CER of between 13-21%, and operating profit growth between 16-24%. These revised projections reflect confidence in their commercial strategy and anticipated improvements in the market environment, especially during the second half of 2025.

Cost management and margin Iimprovement

In Q1, effective cost management strategies resulted in lower-than-expected growth in selling, general and administrative (SG&A), and research and development (R&D) expenditures relative to sales growth. Operating margin notably expanded to 49.7%, showcasing Novo´s disciplined operational approach and efficiency improvements across its business lines.

Novo is solidly growing EPS and with current outlook and what we know of the market development today, I believe it is reasonable that we will see EPS of $50 by 2029.

ESG commitments and societal impact

Novo remains strongly committed to its sustainability goals, notably achieving a 42% share of women in senior leadership roles and significantly increasing medical treatment access globally to over 43 million diabetes patients and 2.6 million individuals with obesity. Although CO2 emissions increased due to operational expansion, sustainability remains a core strategic priority, with clear targets for environmental improvements moving forward.

Strategic analysis: Novo Nordisk and Porter’s Five Forces

Understanding Novo´s strategic positioning using Porter’s Five Forces framework can provide a good understanding of the company’s competitive advantage and potential challenges. Novo´s dominant position in diabetes and obesity care, combined with its robust innovation pipeline, enables it to effectively navigate industry forces.

1. Threat of New Entrants – Moderate to Low

Pharmaceutical markets, particularly those involving complex biologics such as GLP-1 receptor agonists, are characterized by high entry barriers. The development of new drugs requires significant investment, prolonged R&D processes, extensive regulatory scrutiny, and sophisticated manufacturing capabilities. Novo’s substantial investment in manufacturing capacity (almost DKK 140 billion since 2021) and its extensive global supply chain further solidify these barriers. Additionally, patent protections on Novo’s proprietary molecules like semaglutide (Ozempic and Wegovy) secure a competitive advantage, significantly mitigating the threat from new entrants.

2. Bargaining Power of Suppliers – Low

Novo holds considerable bargaining power relative to suppliers due to its size, global presence, and vertically integrated operations. The pharmaceutical industry generally sources raw materials and manufacturing components from multiple suppliers, reducing dependency on any single source. Novo’s strategic acquisitions of fill-finish facilities and comprehensive manufacturing infrastructure investments have reinforced its independence from suppliers, effectively limiting their negotiating leverage.

3. Bargaining Power of Buyers – Moderate

Buyers—primarily government health programs, insurers, pharmacy benefit managers (PBMs), and patients—do hold significant bargaining power in terms of pricing and access. In the U.S., Novo Nordisk faces pressures on net pricing due to large-volume payers and managed care entities like CVS. The recent preferred formulary access agreement with CVS highlights both the influence of buyers and Novo’s strategic adaptability. However, the unique clinical efficacy and strong patient preference for Novo’s GLP-1 products, such as Wegovy’s superior weight-loss profile, partially offset buyer power. Novo’s ability to demonstrate real-world health improvements also strengthens its negotiating position with large payers.

4. Threat of Substitute Products – Moderate to High

The threat of substitutes in pharmaceuticals is always present, especially from alternative treatments or lower-cost compounded products. The rise of compounded semaglutide in the U.S., despite its questionable legality, clearly demonstrates this threat. However, Novo Nordisk actively counters substitutes through legal measures, market education, regulatory advocacy, and competitive pricing strategies such as NovoCare cash-pay programs. Moreover, Novo Nordisk’s continual innovation—such as the upcoming oral semaglutide 25 mg and combination therapies like CagriSema—aims to further mitigate this threat by broadening the scope of its offerings and capturing more patient segments.

5. Competitive Rivalry – High

The competitive environment in diabetes and obesity treatment is intense, notably due to strong competition from pharmaceutical giants like Eli Lilly, particularly in the GLP-1 category. Eli Lilly’s tirzepatide (Mounjaro) competes directly with Novo’s semaglutide-based treatments. However, Novo maintains market leadership, controlling roughly two-thirds of global GLP-1 prescription volumes. Continuous strategic innovation, geographic expansion (now present in over 25 markets with Wegovy), and superior clinical data underpin Novo Nordisk’s competitive strength. Despite the competitive intensity, Novo’s established leadership, brand reputation, and global patient trust significantly bolster its market position.

Conclusion of Porter’s Five Forces Analysis

Novo Nordisk demonstrates resilience and strategic clarity across all dimensions of Porter’s Five Forces. High barriers to entry, strong control over supplier relationships, proactive management of buyer power, innovative responses to substitutes, and effective navigation of competitive rivalry position Novo Nordisk exceptionally well for sustainable long-term growth. This strategic robustness contributes significantly to investor confidence and underscores the optimistic long-term outlook for the company.

Future Growth Opportunities: Beyond Obesity and Diabetes

Looking ahead, Novo Nordisk also highlights potential applications of GLP-1 treatments beyond metabolic disorders, including emerging research suggesting positive impacts on mental health conditions such as depression, anxiety, and even schizophrenia. Preliminary evidence indicates possible dose-dependent effects, where higher GLP-1 dosages used in obesity treatments could yield notable mental health benefits, opening new therapeutic opportunities in mental health care .

Conclusion: A high quality company with strong EPS growth ahead

Novo Nordisk’s Q1 2025 results reaffirm its solid strategic footing, robust financial health, and significant long-term growth potential. Despite short-term market pressures in the U.S., particularly regarding compounded alternatives, Novo Nordisk’s proactive market strategies, innovative product pipeline, international expansion, and operational scalability continue to underpin its optimistic growth trajectory.

My updated model provides the following, based on discount rate of 8.5%, terminal groth of 2.5%, and EV/EBITDA multiple of 19x:

I have a position in Novo Nordisk and also find the current level attractive. The above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Kontra,

Share deep respect for what you have built here.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Warmly,

The 100x Farmer