Update on Novo Nordisk ($NVO): Study results leaves open questions, but company is still strong and attractive.

Before we dive into Novo Nordisk and the study results that came out December 20, I want to show the results from the small poll I did on X. I reached out to the community and asked which company should have first rank in the publication pipeline. Here are the results:

The other three companies will follow during January, so sit tight while I wrap up the research. Now, let us get into the topic at hand and have a look at the latest developments effecting Novo Nordisk and what it might mean for the future.

Study headlines: CagriSema Delivers 22.7% Weight Loss at 68 Weeks

On December 20th, Novo Nordisk announced it awaited results from the Phase 3 REDEFINE 1 study. Results showed limited differentiation for CagriSema on efficacy compared to Lilly’s Zepbound. CagriSema achieved a weight loss of 22.7% at 68 weeks, slightly higher than Zepbound’s 22.5%. In the intention-to-treat (ITT) population, the weight loss was 20.4% compared to Zepbound’s 20.9%. While these results are decent, they fell short of the company and market expectations of 25%. The market overreacted to this and send the share price down 26% on the day.

Interestingly, only 57.3% of patients were on the highest dose of CagriSema at 68 weeks, compared to 70.2% for Wegovy. This may point to two key factors: (1) challenges in tolerability at the highest dose, or (2) patients reducing their dose after reaching their target weight. The next trial will likely shed light on this aspect, which is critical as poor tolerability at higher doses could be a disadvantage versus Lilly’s Zepbound.

Novo’s extensive pipeline targeting dual GLP-1/Amylin agonism provides room for growth, but the REDEFINE 1 results may prompt questions about the potential for incremental efficacy in next-generation treatments. Novo’s upcoming trials with less dose flexibility might address these concerns.

CagriSema vs. Retatrutide: Weight Loss Comparison

Let´s dig a bit into the two key drugs of the near future for Obesity, Cagrisema from Novo Nordisk and Retatrutide from Eli Lilly.

1. Initial Weight Loss Rate:

• Retatrutide demonstrates a steeper initial weight loss, indicating faster onset compared to CagriSema.

• CagriSema shows a slower but steady rate of weight loss in the early weeks.

2. Maximum Weight Loss:

• Retatrutide achieves higher peak weight loss (~25-30%), surpassing CagriSema’s 20-22%.

• CagriSema, while effective, does not reach the same level of peak efficacy as Retatrutide.

3. Stability and Sustained Weight Loss:

• Retatrutide maintains its weight loss benefits over time, with minimal rebound.

• CagriSema shows a slight plateau earlier, which might impact long-term outcomes.

4. Treatment Duration:

• Retatrutide stands out for its consistency over a longer duration.

• CagriSema also performs well but may need extended trials to fully evaluate its sustained benefits.

5. Clinical Relevance:

• Retatrutide is ideal for patients seeking rapid, significant weight loss.

• CagriSema provides a steady and well-rounded option, making it attractive for those prioritizing a balanced approach.

Key Takeaways:

While CagriSema’s 22.7% weight loss result aligns with the efficacy of Lilly’s Zepbound, it does not surpass expectations. Retatrutide, on the other hand, shows stronger efficacy, suggesting it could lead the obesity management space in the future. However, CagriSema offers meaningful advantages such as fewer safety concerns and potential dose optimization, which could resonate with patient needs.

Financial Overview

Novo Nordisk demonstrates strong performance across multiple dimensions of operational efficiency, financial health, and profitability. The company’s revenue growth, both year-over-year and over longer time horizons, showcases its ability to sustain impressive expansion, with a 5-year growth exceeding 100%. Remember, Obesity is still early and we will see Novo Nordisk´s technology platforms utilised in other therapeutic areas. The growth is supported by consistent increases in net income and earnings per share, so management does an effective job at cost management and the ability to capitalize on market opportunities. The company´s net margin of 35% shows exceptional profitability, reflecting robust pricing power and operational discipline.

On the financial health side, Novo Nordisk maintains a conservative leverage profile, with a low debt-to-equity ratio and a debt-to-operating cash flow ratio that means the company generates ample cash to service its obligations. In fact, Novo Nordisk, has become a cash flowing machine, and Free Cash Flow is up 123% since 2020.

In terms of profitability, Novo Nordisk’s return on assets of 27% signals outstanding asset utilization, which, when paired with an 85% gross margin, highlights a highly efficient and scalable business model. This is especially significant for an industry characterized by high R&D and manufacturing costs, suggesting Novo Nordisk is not only growing but doing so with remarkable efficiency.

Strategic Perspective: Novo Nordisk vs. Lilly – The Weight Loss Race

The REDEFINE 1 results firmly position Novo Nordisk’s CagriSema as at least on par with Lilly’s best-in-class drug, Zepbound. While the expectation was that CagriSema would surpass Lilly’s offering, particularly for at least a year until Retatrutide’s results are released in early 2026, the gap between 22.7% and 25% weight loss is less significant from a practical patient perspective. Factors such as the quality of weight loss, additional health benefits, safety, tolerability, and supply capacity are likely to weigh more heavily in the long-term competitive dynamics.

It’s also worth noting that the study design allowed significant dose flexibility, and only 57.3% of patients used the maximum dose throughout the trial. Notably, all of those patients achieved over 25% weight loss. Novo Nordisk plans to conduct follow-up studies with less dose flexibility, which could potentially deliver more consistent and higher weight loss results across the population.

The market’s initial reaction to the REDEFINE 1 results appears to have been overly negative. Despite the mixed reception, Novo remains a high-quality company trading at what could be an attractive entry point or accumulation price. I consider Novo Nordisk a long-term play and expect it to be in the 900-1000 DKK range in 12 months.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Other Readings:

30 Lessons for Living: https://amzn.to/4gTBBag

The Growth Equation Podcast: https://thegrowtheq.com/farewell-podcast/

Obesity, Novo Nordisk, and Eli Lilly:

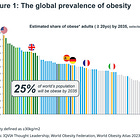

As Nick Maggiulli says, "Just keep buying." I appreciate the strong focus on free cash flow and the innovative approach to addressing a pressing societal issue, offering a distinct perspective compared to EL. I also like that it’s a European company rather than an American one, even though North America currently dominates the market for obesity solutions. With obesity likely to become the top health challenge in our comfort-driven world, the growth potential in this sector is immense, especially over the next decade. For me, this represents a strategic equity in my portfolio—one I consistently build over time.