Eli Lilly ($LLY): Robust growth fueled by the Obesity Therapeutics revolution

This thing will grow bigger

Introduction

Eli Lilly continues to demonstrate exceptional financial strength and strategic foresight, particularly in the fast-growing therapeutic area of obesity. The Q1´25 report reaffirm Lilly's robust position and underscore its impressive trajectory, underpinned by its innovative portfolio, particularly the obesity-focused treatments. The outlook for Eli Lilly is bullish and is further enhanced by ongoing positive developments within the GLP-1 therapeutic class, positioning the company to maintain duopolistic leadership together with Novo Nordisk in a market experiencing significant expansion.

Strategic Overview

Lilly’s strategy revolves around an aggressive innovation pipeline and significant capital investments designed to bolster its market-leading portfolio (and drive patent applications). The company's strategic direction is clearly evident in its recent results, marked by impressive revenue growth and the successful expansion of its obesity and diabetes franchises, notably Zepbound and Mounjaro. Lilly has also decisively positioned itself in the oral GLP-1 market with its promising drug candidate, orforglipron, which has shown strong efficacy and tolerability in recent Phase 3 trials.

In the quarter, Lilly completed its acquisition of Scorpion Therapeutics’ PI3Kα inhibitor program, further diversifying its oncology pipeline and enhancing its long-term growth prospects. The commitment to innovation and rapid commercialization remains central to Lilly's growth strategy, ensuring the sustained delivery of high-value therapeutics.

Financial overview Q1´25

Eli Lilly's financial performance in Q1´25 was as expected impressive, achieving a revenue increase of 45% year-over-year, totaling $12.7 billion. This substantial growth was primarily driven by its key products, particularly within the obesity and diabetes segments, such as Mounjaro and Zepbound, which together significantly bolstered Lilly's financial outlook.

Non-GAAP earnings per share (EPS) rose by 29% to $3.34, clearly indicating robust operational execution. The company maintained a healthy gross margin of 83.5%, a slight improvement compared to previous periods, reflecting disciplined cost management and the high-margin nature of its key products. Lilly's strong profitability is further underlined by its Non-GAAP performance margin, which improved significantly, reaching 42.6%.

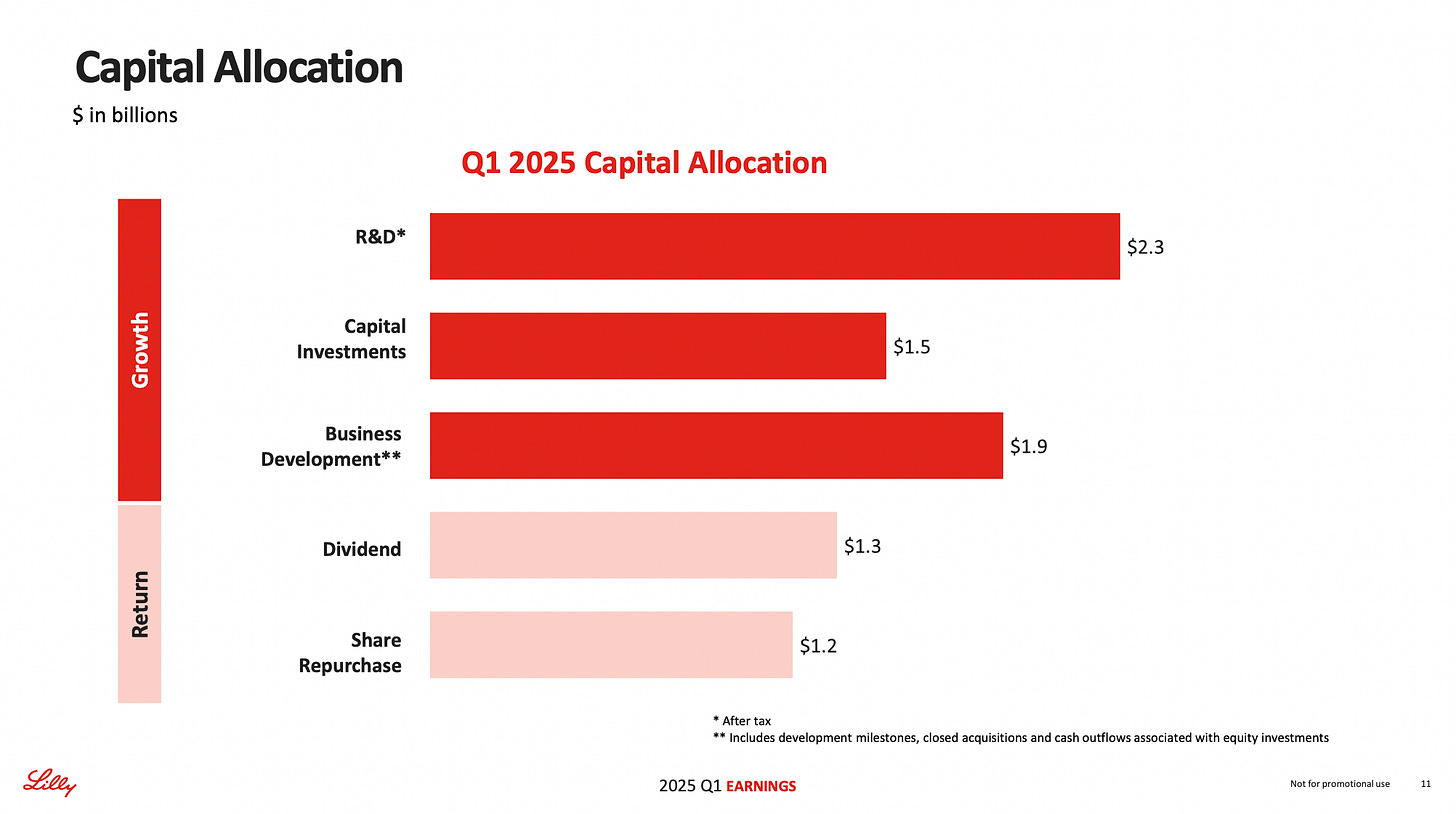

Lilly continues to demonstrate prudent financial management with substantial capital returns to shareholders, distributing approximately $1.3 billion via dividends and $1.2 billion through share repurchases. Moreover, the strategic capital investments, with commitments totaling $50 billion since 2020, reflect Lilly’s determination to scale manufacturing capacity, particularly in the U.S., to meet growing global demand.

Portfolio and pipeline strength

Lilly's key products, notably Zepbound and Mounjaro, continue to drive market leadership in obesity and diabetes care. Zepbound, particularly, has solidified its dominance with over 60% total prescription share in the U.S. branded anti-obesity market and an impressive 74% share of new prescriptions, underscoring robust demand dynamics.

Orforglipron, Lilly’s oral GLP-1 candidate, is particularly noteworthy. Recent ACHIEVE-1 Phase 3 trials indicated significant body weight reduction (an average of 7.3 kg or 7.9%) and substantial improvement in glycemic control, comparable to injectable GLP-1s. Its favorable safety profile and convenience as an oral medication make orforglipron a potential superstar in the obesity and diabetes therapeutic spaces.

Market dynamics and competitive positioning

Despite recent developments, such as CVS Caremark designating Wegovy as a preferred GLP-1 medication for obesity, Lilly's positioning remains strong. The company’s diversified therapeutic offerings and ongoing positive clinical results provide a resilient competitive edge. While formulary adjustments might pose near-term headwinds, Lilly's innovative pipeline and aggressive market expansion strategies are likely to mitigate these impacts effectively.

Additionally, Lilly's global incretin analog market share has impressively expanded to 53.3%, marking consistent gains over competitors, indicating a robust market presence and effective commercial strategies. The continued growth trajectory is supported by robust prescription volume increases, illustrating the strong underlying demand.

I continue to believe that Eli Lilly and Novo Nordisk will sit on 70-80% combined market share in the obesity space long-term. There is not only one winner here.

Catalysts and future outlook

Looking ahead, several promising catalysts support an optimistic outlook. The Phase 3 trials of tirzepatide for cardiovascular outcomes, and orforglipron’s upcoming submissions for obesity and diabetes indications, present significant near-term opportunities. The anticipated launch strategy for orforglipron and the broader rollout of higher-dose tirzepatide formulations for additional indications such as heart failure further enhance Lilly’s growth potential.

Given these dynamics, Lilly reiterated its 2025 revenue guidance of $58.0 billion to $61.0 billion, so confidence in sustained market performance and continued execution.

Risks and considerations

Although the outlook remains highly positive, potential risks include increased pricing pressure due to formulary decisions and competition, particularly from other leading GLP-1 therapies. Additionally, operational risks around capacity expansion and regulatory uncertainties could impact timelines.

Conclusion

Eli Lilly is a high quality company in general and stands out within the healthcare sector, driven by its exceptional performance in obesity and diabetes therapeutics. Its robust financial health, strategic foresight, and strong product pipeline, particularly in high-growth therapeutic areas, justify a bullish outlook. For investors looking for a combination of innovation, growth, and resilience could consider Eli Lilly as a cornerstone healthcare investment, particularly given its joint leadership in addressing the global obesity challenge. The company will grow its revenues, profits and EPS for the foreseeable future.

I have no position in Eli Lilly but I do in Novo Nordisk and keep following Lilly to better understand the business and implications for Novo. The above is also not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.