Introduction

Eli Lilly & Co. has delivered a strong performance in Q4 2024, with revenue surging 45% year-over-year to $13.53 billion. This growth was primarily driven by its blockbuster drugs, Mounjaro and Zepbound, which continue to dominate the GLP-1 receptor agonist market. The company’s net income doubled compared to Q4 2023, reinforcing its strong financial standing and competitive position.

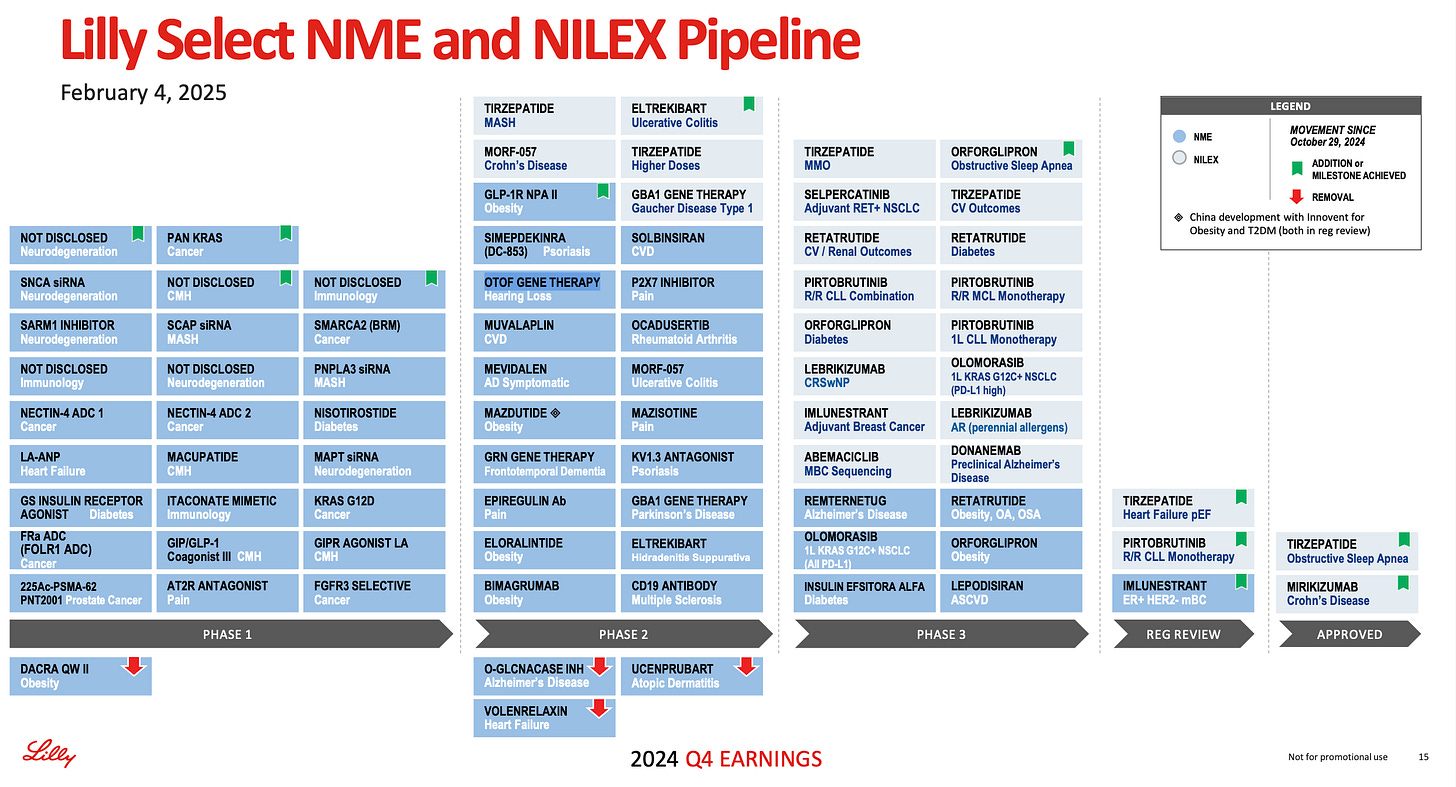

With its 2025 guidance projecting revenue between $58.0 billion and $61.0 billion, Eli Lilly is on a trajectory of sustained growth, capitalizing on expanding obesity and diabetes treatment markets. However, the market reaction remains mixed, as investors focus on potential risks, including competition, regulatory pressures, and upcoming data readouts from its Orforglipron (designed to be taken as a once-daily pill) pipeline.

Novo Nordisk’s CEO announced last week plans to submit a new Wegovy weight loss pill for U.S. regulatory approval, aiming for a launch next year. The move positions Novo to compete directly with Orforglipron, which is expected to receive approval by early 2026.

Financial performance overview

Q4 2024 Highlights (YoY Growth)

• Revenue: $13.53B (+45%)

• Gross Margin: $11.13B (+47%)

• Net Income (GAAP): $4.41B (+101%)

• EPS (GAAP): $4.88 (+102%)

The EPS outperformance reflects the operational leverage achieved through higher sales volumes and improved gross margins. The obesity market is huge and very lucrative, and while Eli Lilly and Novo Nordisk has enjoyed a duopoly in Diabetes care, Obesity is so much bigger that it has and will attract much more competition. More on that in another article.

Revenue and growth drivers

Eli Lilly’s revenue growth is driven by its incretin franchise, consisting of Mounjaro (tirzepatide) and Zepbound (tirzepatide for weight management). The company is strategically expanding its presence in obesity management, where it competes with Novo Nordisk’s Wegovy and Ozempic.

Key products performance (Q4 2024)

Product Revenue ($M) YoY growth:

Mounjaro 3,530 +60%

Zepbound 1,907 N/A

Verzenio 1,555 +36%

Trulicity 1,250 -25%

Jardiance 1,198 +50%

Taltz 952 +21%

Humalog 620 +69%

Geographic revenue split

• U.S. Market: $9.03B (+40%)

• International Markets: $4.50B (+55%)

The company saw a 56% volume increase in International markets, primarily from Mounjaro’s penetration into new markets.

Future growth catalysts

• Regulatory approvals: FDA approved Zepbound for Obstructive Sleep Apnea (OSA), a market with 30 million U.S. patients.

• Pipeline expansion: Upcoming Orforglipron (oral GLP-1) readouts in Q2 and Q3 2025 will be critical to long-term valuation.

• Manufacturing expansion: $3B investment in Wisconsin for parenteral (injectable) products.

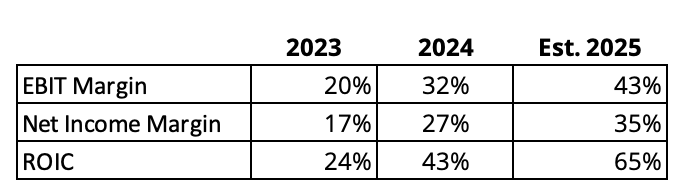

Profitability and margins

Gross margin analysis

• Q4 2024 Gross Margin: 82.2% (vs. 80.9% in Q4 2023)

The 1.3% points margin expansion was driven by:

• A favorable product mix (higher sales from high-margin products).

• Operational efficiencies offsetting price reductions in Mounjaro.

Operating expenses & cost control

• R&D Expenses: $3.02B (+18%) – Driven by Phase 3 trials and obesity drug development.

• SG&A Expenses: $2.42B (+26%) – Marketing spend increased for Mounjaro & Zepbound awareness campaigns.

Operating profitability trends

Eli Lilly’s Return on Invested Capital (ROIC) of 43.3% in 2024 reflects its superior capital efficiency, compared to the pharmaceutical sector median of ~15%.

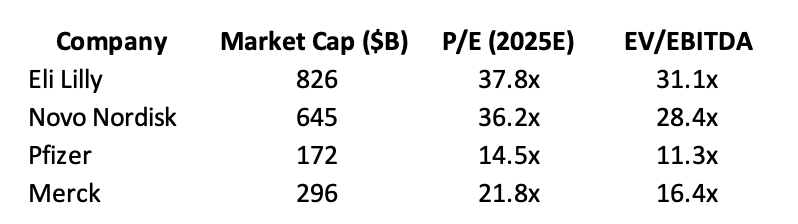

Market valuation as of February 9, 2025

• Share Price: $878

• Market Cap: $793B

• P/E Ratio (2025E): 37.8x

• Enterprise Value (EV): $801B

• EV/EBITDA: 31.1x, using estimates for 2025, although I am more conservative when applying it for valuation

Comparison to Industry Peers

Valuation: Looking through the DCF lens

Using a Discounted Cash Flow approach, with the following assumptions:

• Revenue CAGR (2024-2029): 15%

• Terminal growth rate: 2.5%

• WACC: 7.5%

• EV/EBITDA multiple: 25x (I am probably conservative here, but margin of error is needed at this level)

The DCF-derived intrinsic value per share is $1,020. That gives an upside of 16% and and IRR of 11%.

Risks & Considerations

Key Risks

1. Regulatory & Pricing Pressure – Government scrutiny on drug pricing and reimbursement policies could impact margins.

2. Pipeline Execution – The upcoming Orforglipron readouts (Q2 & Q3 2025) carry risk of disappointment.

3. Competitive Dynamics – Novo Nordisk’s Ozempic & Wegovy expansion remains a challenge.

4. Manufacturing & Supply Constraints – Scaling up production to meet GLP-1 demand remains a logistical challenge.

Mitigating Factors

• Strong financial position: Net debt to EBITDA of 0.3x suggests low financial risk.

• Diversified R&D pipeline: Expanding into oncology, immunology, and cardiovascular treatments.

The company´s pipeline is very interesting and targeting large, established therapeutic areas and also new areas with unserved needs.

Case for Eli Lilly

✅ Market Leader in Obesity & Diabetes: GLP-1 dominance supports high revenue growth.

✅ Robust Financial Performance: Margins, ROIC, and cash flow trends outperform the industry.

✅ Future Catalysts: New drug approvals, Orforglipron data, and manufacturing scale-up.

✅ Valuation Upside: DCF & market multiples suggest $1,020+ per share.

Conclusion

Eli Lilly’s strong fundamentals, dominant market position, and promising pipeline justify its premium valuation. The stock remains a compelling long-term case. Competition will intensify but it is again also important to point out that Eli Lilly (and Novo Nordisk) will expand its current and near-term technology platforms in new / additional therapeutic areas, that will enable them to find growth outside diabetes and obesity.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Great analysis as usual! - Correct me if I am wrong, but Novo holds an edge with its first-mover advantage in oral GLP-1s, stronger supply chain scalability, and higher gross margins. If its oral Wegovy launches ahead of Lilly’s Orforglipron, it could dominate the next wave of obesity treatment. With a more cost-efficient pipeline expansion and faster global rollout, Novo may offer better near-term upside and risk-adjusted returns than Lilly. I still prefer Novo over Lilly, for this and other things, specially their more we could say humanistic approach, not only in leadership, but also socially.