LVMH 2024 Annual Results: Resilience Amid Global Challenges

Topline weakness puts pressure on bottom line

Introduction

2024 was a test of resilience for LVMH in the global leader luxury goods sector. Despite macroeconomic headwinds, geopolitical uncertainties, and currency pressures, the company delivered stable financial results and maintained strong profitability. Here we will dive into the financial performance and strategic positioning of LVMH to evaluate its market positioning and investment appeal following the 2024 annual results.

Financial Performance: Key Metrics

Revenue Analysis

• Total Revenue: €84.7 billion, reflecting a modest 1% organic growth year-over-year (YoY). The revenue decline on a reported basis (-2%) underscores the significant impact of currency fluctuations (-2%) and consolidation adjustments (-1%).

Segment Performance:

• Fashion & Leather Goods: €41.1 billion (-1% organic), maintaining its position as the largest contributor (48% of revenue).

• Selective Retailing: €18.3 billion (+6% organic), led by Sephora’s strong momentum.

• Wines & Spirits: €5.9 billion (-8% organic), reflecting demand normalization post-COVID.

• Perfumes & Cosmetics: €8.4 billion (+4% organic), buoyed by Dior’s leading fragrances.

• Watches & Jewelry: €10.6 billion (-2% organic), with standout contributions from Tiffany and Bulgari.

Profitability Highlights

• Gross Margin: €56.8 billion, representing a 67.1% gross margin, compared to 68.8% in 2023. The margin compression reflects higher input costs and unfavorable currency impacts.

• Operating Margin: Despite a 14% decline in recurring operating profit (to €19.6 billion), the operating margin remained robust at 23.1%, exceeding pre-pandemic levels. The strongest contributors were:

• Fashion & Leather Goods: €15.2 billion profit, with a segment margin of 37.1% (down from 39.9% in 2023).

• Selective Retailing: Flat operating profit (€1.4 billion) but improved operational efficiency.

• Net Profit: €12.6 billion, a 17% YoY decline, driven by higher tax costs (€5.2 billion) and exchange rate effects. Net profit margin compressed to 14.8%, compared to 17.6% in 2023.

Free Cash Flow and Capital Efficiency

• Free Cash Flow: €10.5 billion, a significant 29% increase YoY, highlighting robust cash generation from operations. The FCF margin expanded to 12.4%, reflecting improved working capital management and capital discipline.

• Return on Invested Capital: ROIC fell to 21.9% (from 26.1% in 2023), indicating the impact of lower earnings on efficiency. Despite this, LVMH remains well above its cost of capital, showcasing its value-creation capability.

• Net Debt/EBITDA: Improved to 0.9x from 1.3x in 2023, signaling better leverage control. Net debt was reduced by €1.5 billion to €9.2 billion.

Shareholder Returns

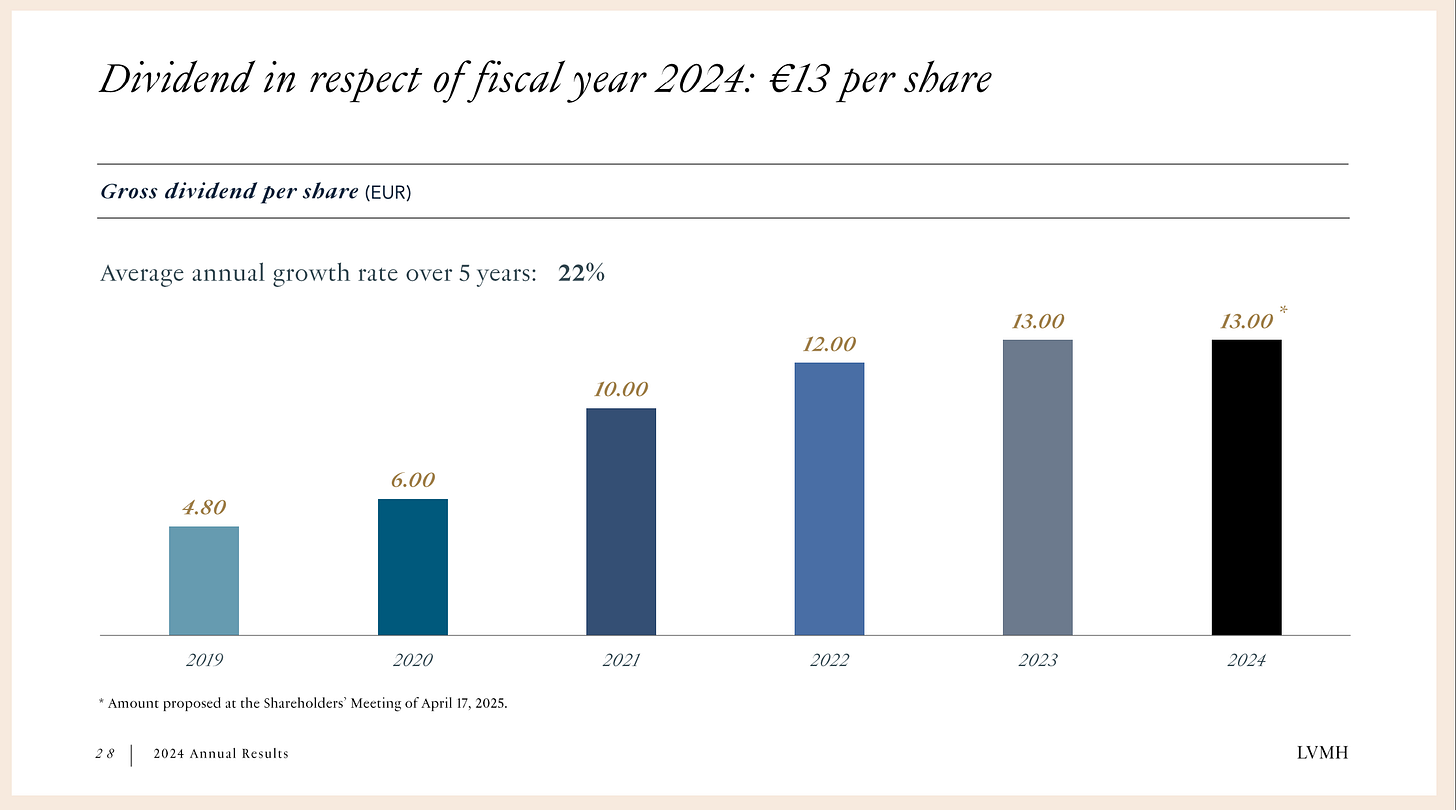

• Dividend: A proposed dividend of €13 per share for 2024 (flat YoY), resulting in a dividend yield of 1.7% at the current share price of €750.60.

• Earnings Per Share: €25.13, down from €30.34 in 2023, reflecting the decline in net profit.

Segment Insights and Financial Drivers

Fashion & Leather Goods:

• Revenue Contribution: 48% of total revenue.

• Growth Factors: Resilient demand for Louis Vuitton and Christian Dior despite subdued consumer sentiment.

• EBIT Margin: Declined 2.6% points to 37.1%, reflecting margin compression from unfavourable FX and higher operating costs.

• Outlook: The segment’s innovation pipeline (e.g. new flagship stores) positions it to drive future growth.

Wines & Spirits:

• Revenue Decline: -8% organic due to demand normalization in champagne and cognac, coupled with a weaker Chinese market.

• Margin Pressure: Operating margin dropped to 19.0%, below expectations.

Selective Retailing:

• Top Performer: Sephora delivered double-digit growth in both revenue and profit, consolidating its leadership in global beauty retail.

• Strategic Expansion: Investments in store openings and partnerships (e.g., Kohl’s in the U.S.) supported growth.

Strategic Investments and Sustainability Progress

LVMH’s commitment to long-term growth is reflected in its capital investments:

• Capital Expenditure: €5.5 billion, primarily for retail and production facilities, with €1.7 billion allocated to France.

• Sustainability Achievements:

• GHG Emissions: Achieved a 55% reduction compared to 2019, surpassing its 2026 target.

• Circular Economy: 31% of materials now sourced from recycled processes.

Valuation Analysis and Peer Comparison

At a share price of €750.60, LVMH trades at:

• P/E Ratio: 27x trailing EPS, in line with industry peers, but much below Hermes (at 63x).

• EV/EBITDA: 15.1x, reflecting a premium valuation supported by its strong brand portfolio.

• Dividend Yield: 1.7%. LVMH has grown its dividend at an annual CAGR of 22% since 2019. Strong dividend growth that adds another reason why LVMH is attractive to hold.

Despite a contraction in margins, LVMH’s valuation premium is justified by its strong cash flow generation, industry leadership, and brand equity.

Risks and Outlook

Key Risks:

1. Geopolitical and Economic Uncertainty: Continued headwinds from weak demand in key markets like China.

2. Currency Fluctuations: Significant FX impacts on profitability.

3. Competitive Pressure: Peers outperforming in certain segments could challenge market share.

Outlook:

LVMH remains confident in its growth strategy, driven by innovation, geographic diversification, and premium positioning. While the macroeconomic environment remains uncertain, the company’s financial position and strategic focus provide a solid foundation for maintaining its luxury market leadership. I expect LVMH will remain highly acquisitive and the group has the financial means to execute even large deals.

Conclusion: A Resilient Titan in Luxury

LVMH’s 2024 results showcase its ability to adapt and perform under challenging conditions. While the year reflected margin pressures and moderated growth, the company’s cash flow strength, strategic investments, and sustainability achievements reinforce its long-term investment appeal. Entering 2025, LVMH’s focus on desirability and operational excellence positions it as the most desirable company in the luxury goods industry.

As I wrote in the recent update on LVMH there is limited upside in the short term but I also consider the company a strong long-term hold. Price target remains in the same area with a fair value estimate of €715, representing a -5% downside from today´s price.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Other Readings:

Great read from Inaki on four year cycles, long-term planning and thinking: https://substack.com/@inakidelaparra/p-154530365

Recent post on Netflix

Recent post on LVMH.