Moncler ($MONC.MI) Q1 2025: Solid core, Seasonal uncertainty

Introduction

As Moncler steps into 2025, the luxury outerwear group has delivered a modest but respectable Q1 performance amid a challenging macroeconomic backdrop. Group revenues rose 1% year-over-year to €829 million, with Moncler-branded sales growing 2% and Stone Island contracting by 5%. While the result beat muted market expectations, the picture across geographies and sales channels was mixed—inviting a more cautious view on the rest of the year.

Financial snapshot: Margins intact, growth tepid

Moncler continues to demonstrate operational strength. For FY24, the group achieved gross margins of 78.1% and an EBIT margin of 29.5%—figures expected to remain broadly stable in FY25. The net result for FY24 came in at €640 million, with a projected rise to €647 million this year. EPS is similarly expected to grow modestly, from €2.35 to €2.37.

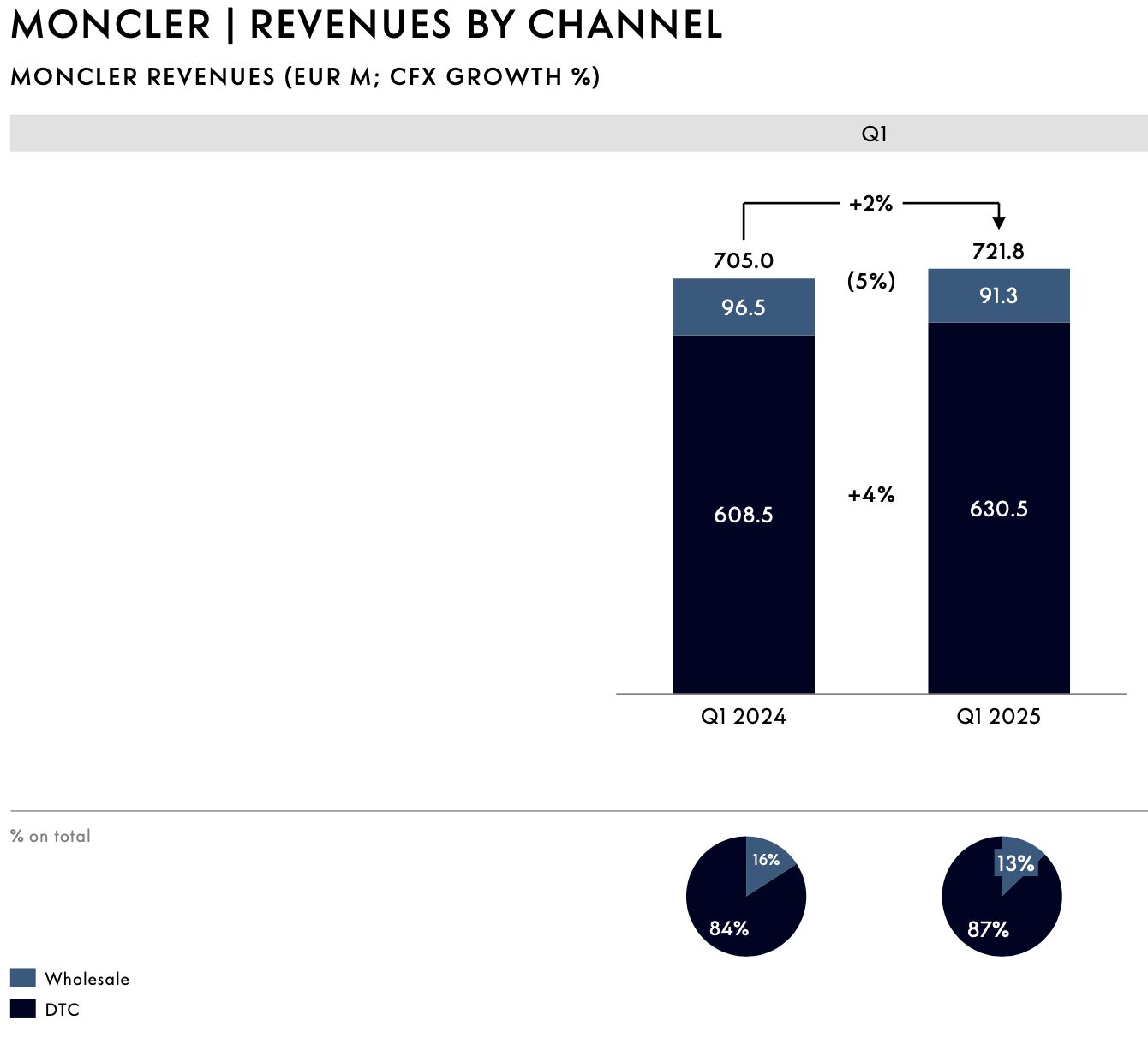

In Q1 2025, Moncler brand sales increased 2%, largely driven by a 4% rise in direct-to-consumer (DTC) revenue. Physical retail stores continued to outperform, while the online DTC channel—especially in EMEA—remained under pressure, albeit with sequential improvement. Wholesale revenue for the Moncler brand fell 5% year-over-year, reflecting ongoing distribution channel optimization efforts.

Stone Island presented a more challenging picture. Total revenue for the brand declined 5%, weighed down by a 19% drop in wholesale. While DTC grew by 12%, this was not sufficient to offset the wholesale softness. Timing effects in deliveries played a role, particularly as Q1 is traditionally a large quarter for Stone Island. However, the structural reliance on wholesale remains a key soft spot for the company.

Group EBIT for the full year is forecast at €944 million in 2025, rising gradually toward €1.0 billion in 2026. Operating cash flow remains robust, supported by disciplined cost management, although top-line momentum appears to be fading relative to the high-growth years of 2022 and 2023.

Geographic trends: Asia leads, Western markets lag

Geographic performance continues to be uneven. Asia was again the growth engine, with Moncler brand sales in the region up 6% year-over-year. China delivered a solid performance, even as the shift toward overseas consumption continued. Japan also showed sequential improvement, buoyed by inbound tourism. South Korea lagged the rest of the region, posting soft trends after a relatively stable Q4 2024.

The EMEA region saw a 1% revenue decline, weighed down by weak wholesale trends. DTC remained resilient in-store but continued to be challenged online. Meanwhile, Americas revenue dipped 2%, primarily due to wholesale pressure, while physical retail held up on a year-over-year basis.

Stone Island followed a similar regional trajectory. The brand posted 15% growth in Asia, thanks to strong results in Japan and China, but EMEA declined by 11% and the Americas by 18%. Notably, France and the UK performed better than continental Europe, and the U.S. continues to present challenges for wholesale distribution.

Brand strength vs Seasonal exposure

Moncler remains one of the most recognizable names in luxury outerwear, with a distinct identity anchored in alpine heritage, high-performance design, and a city-meets-mountain aesthetic. However, this strength is also its Achilles heel. The brand’s seasonal concentration in colder months raises questions about its ability to generate growth in the spring and summer quarters.

Moncler has attempted to mitigate seasonality through lighter collections and expanded lifestyle offerings. The Grenoble Spring/Summer 2025 line emphasizes lightweight technical pieces suited for outdoor pursuits, while the Moncler Ēquipements capsule by Salehe Bembury blends performance and fashion-forward appeal. Campaigns such as the New York-set Spring 2025 collection featuring actor Penn Badgley aim to inject year-round urban relevance.

Still, these initiatives remain relatively early in their lifecycle. Whether they can significantly shift Moncler’s seasonal revenue curve remains to be seen. For now, winter continues to carry the commercial weight.

Stone Island: Strategic patience required

For Stone Island, Q1 marked another step in a slow transition. The brand’s 12% growth in DTC is a clear positive and reflects early traction from improved brand control and consumer engagement. Flagship projects such as the new Milan showroom and Paris store are key pillars in its repositioning.

Stone Island’s recent campaigns—including the evolution of its Raso Gommato fabric and the continuation of its “Community as a Form of Research” platform—speak to its focus on innovation and grassroots authenticity. However, with limited store expansion planned for FY25 and continued volatility in wholesale, topline consistency may remain elusive in the short term.

The brand’s ability to build deeper retail relationships and reduce wholesale reliance will be critical if it’s to unlock its full commercial potential.

Capital position: Strength and optionality

Moncler remains in a strong financial position. The company ended FY24 with €231 million in net cash, a figure expected to nearly double to €458 million by year-end 2025. Free cash flow is projected to grow 14% this year to €596 million. This provides ample room to maintain shareholder returns—currently pegged at a roughly 50% payout ratio—and still support internal investments.

CapEx remains disciplined at ~12% of revenue, primarily directed toward store upgrades, marketing, and digital. The company has flexibility to consider share buybacks or selective M&A should opportunities arise.

Valuation: A quality name at a fair price

Moncler currently trades at around 23x 2025 earnings and just under 12x forward EBITDA—reasonable for a business with high margins and strong brand equity, but not compelling in a market with increased macro risks. The company’s EPS CAGR through 2027 is estimated at just over 6%, while ROIC remains comfortably above 28%.

Its free cash flow yield is estimated at 4.0%, and dividend yield at 2.1%, suggesting stability but limited upside. In relative terms, the company may appear slightly expensive compared to peers with broader seasonal relevance or faster topline growth.

Conclusion: Quality intact, catalysts needed

Moncler’s Q1 performance reaffirms its status as a high-quality operator in the global luxury landscape. DTC strength, disciplined cost management, and solid profitability underpin the business model. Yet the core issue—seasonality—is not going away.

Moncler’s efforts to expand relevance beyond winter are credible, but they are work in progress. The same applies to Stone Island’s retail transition. With currency pressures, macro headwinds, and consumer uncertainty continuing to mask visibility, topline acceleration in Q2 and Q3 may prove difficult.

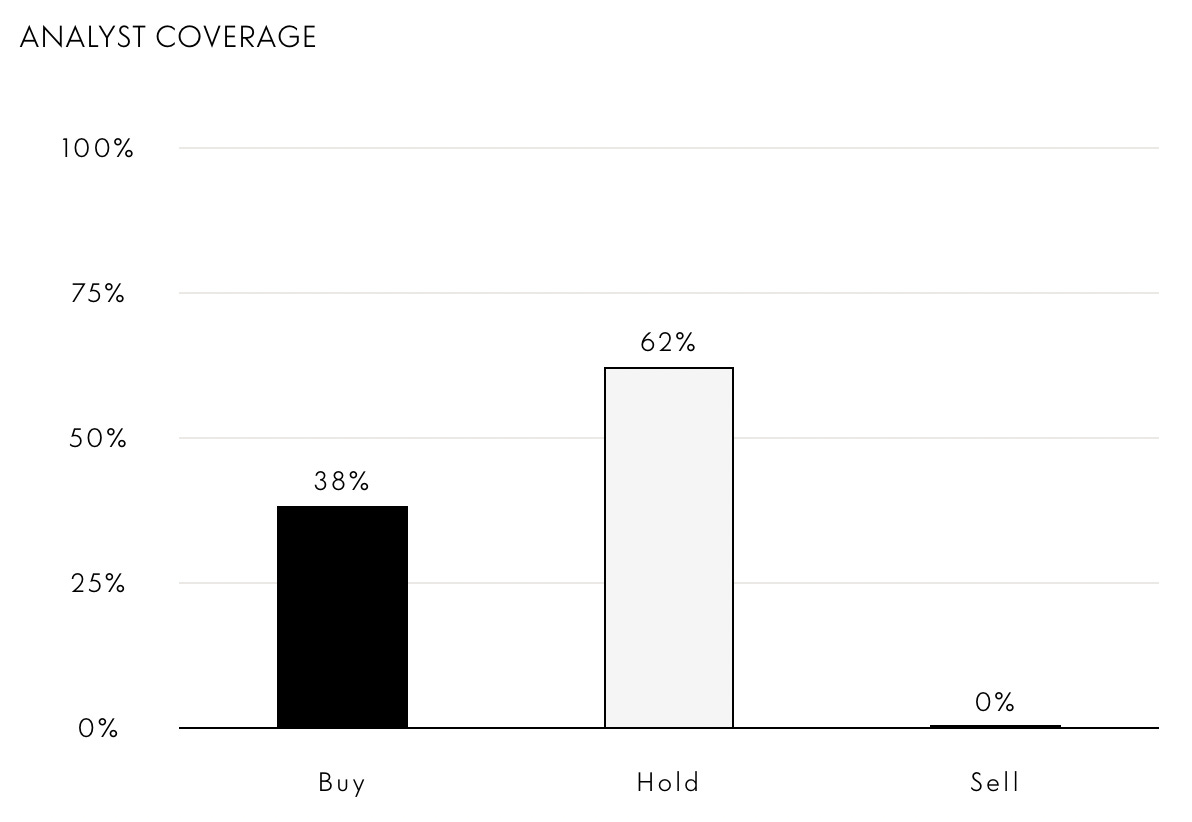

For investors, Moncler remains a well-run business with a premium brand and enviable financials. But until it shows more consistent year-round growth, the stock may trade in a holding pattern and I stay on the sideline for this one but keep it on the watchlist.

Analyst coverage also suggests that price is fair but with limited headroom in the current situation.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.