NVIDIA ($NVDA): Poised to continue the lead in AI revolution

The AI Superpower: Why NVIDIA could be the first $4.5 trillion tech titan

Introduction

Artificial intelligence is no longer a future possibility—it's the defining force of this decade's technological transformation. Few companies are as central to this shift as NVIDIA. With its unrivaled position at the intersection of computing power, AI software, and industrial-scale infrastructure, NVIDIA has emerged as a linchpin of the AI economy. This article explores the company’s strategy, future prospects, and valuation outlook, and highlights the broader trends and investment dynamics that could shape its trajectory through 2030 and beyond.

Strategy: From GPUs to AI infrastructure

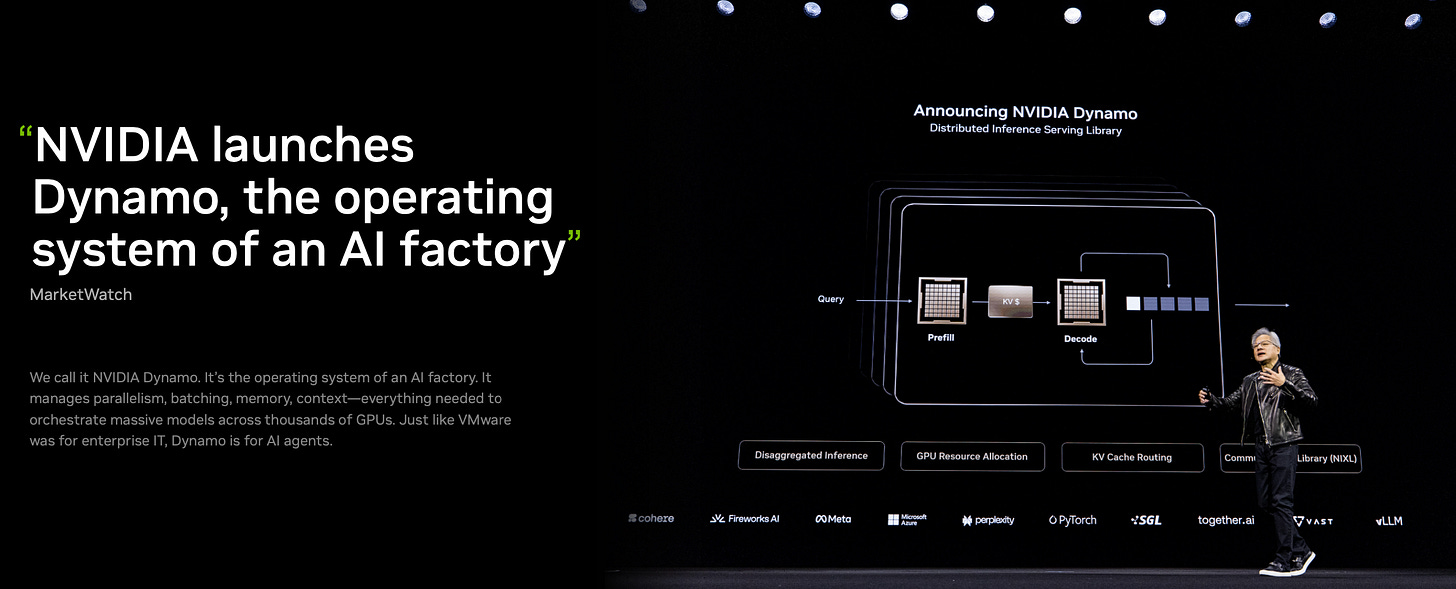

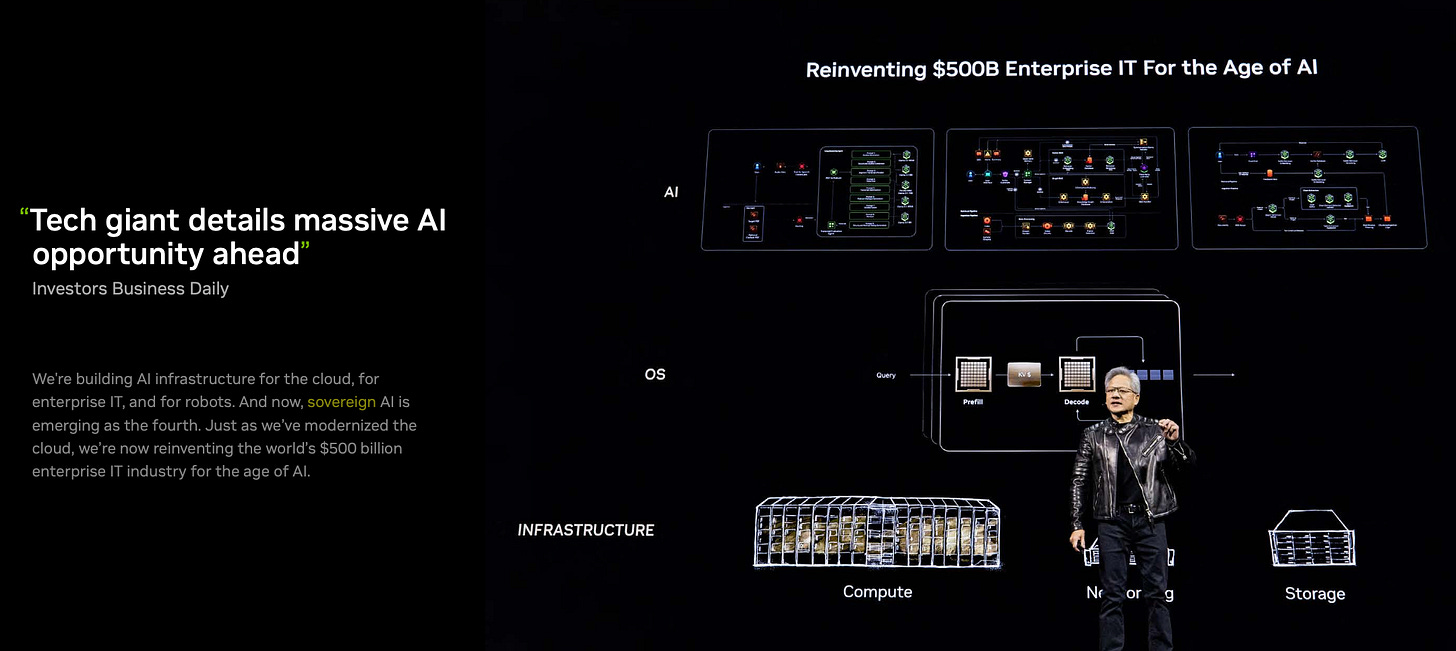

NVIDIA continues to position itself not just as a chipmaker but as an essential infrastructure provider in the AI ecosystem. Its strategy revolves around expanding beyond traditional computing and gaming markets, driving AI adoption across cloud, enterprise IT, robotics, and now, significantly, sovereign AI. The company has laid out an unprecedented, detailed roadmap extending several years ahead, emphasizing transparency and consistency to instill confidence in partners and investors alike.

The launch of Blackwell Ultra GPUs and the Dynamo operating system—designed specifically to orchestrate massive AI workloads across thousands of GPUs—reinforces NVIDIA’s ambitions to dominate AI infrastructure. Additionally, products like the RTX Pro Server represent NVIDIA’s push to integrate legacy IT with cutting-edge AI capabilities.

Valuations: A path to a $4.5 trillion market cap by 2030

By 2030, I anticipate NVIDIA achieving a market cap around $4.5 trillion. This projection assumes a share price of $185, supported by a 29x EPS multiple. NVIDIA’s aggressive growth strategy, coupled with anticipated AI infrastructure investments, particularly in sovereign states and major industries, supports this bullish valuation yet cautious valuation.

Currently, the company’s revenue trajectory underlines this optimism, with datacenter revenues potentially reaching around $400 billion per year by 2026, almost double prior estimates. This substantial growth, backed by high-margin AI infrastructure deployments, positions NVIDIA for robust earnings expansion through the decade.

Future expectations: Sovereign AI capex surge

A significant driver of NVIDIA’s future growth will be the surge in sovereign AI infrastructure investments. At the recent GTC Paris, NVIDIA highlighted visibility into approximately $1.5 trillion worth of global AI infrastructure investments over the coming years. European investments alone show GPU capacity tripling by 2025 and expanding ten-fold by 2026, including the development of at least five large-scale “gigafactories.”

Notable examples include Mistral’s 18,000 GPU deployment in France and Germany’s planned industrial AI cloud utilizing 10,000 GPUs for automotive and robotics industries. These initiatives underscore a massive shift from traditional hyperscale-driven demand to widespread national-level adoption.

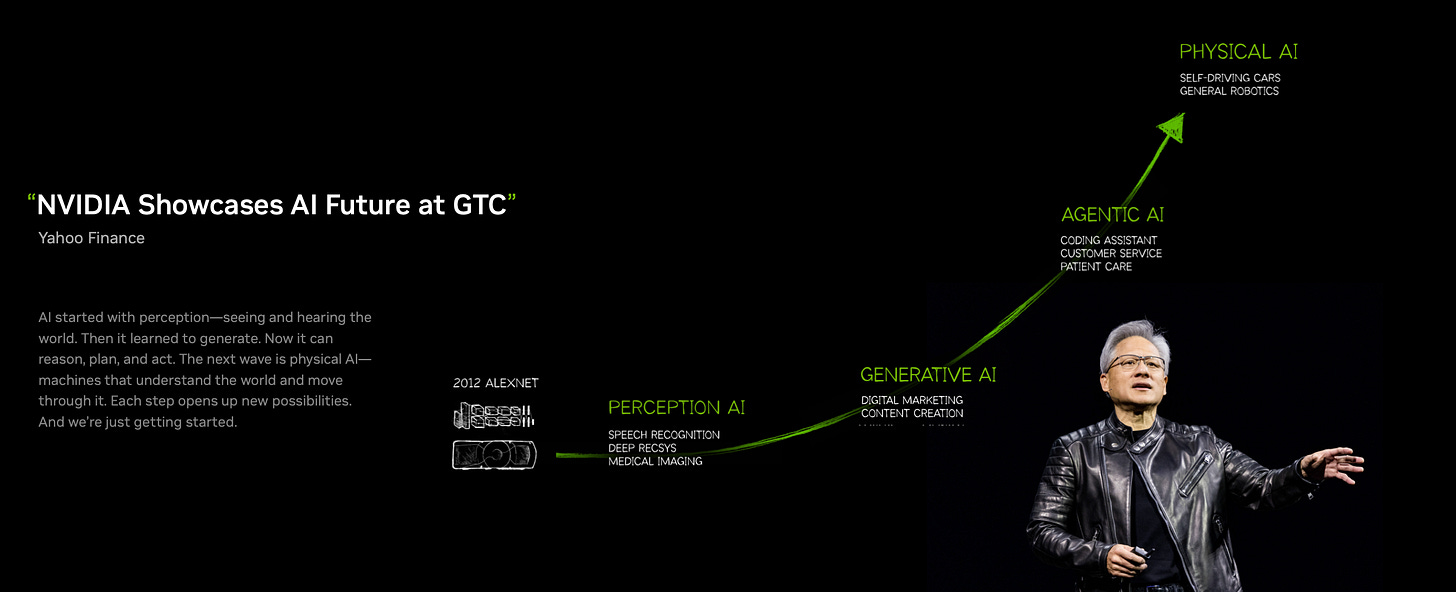

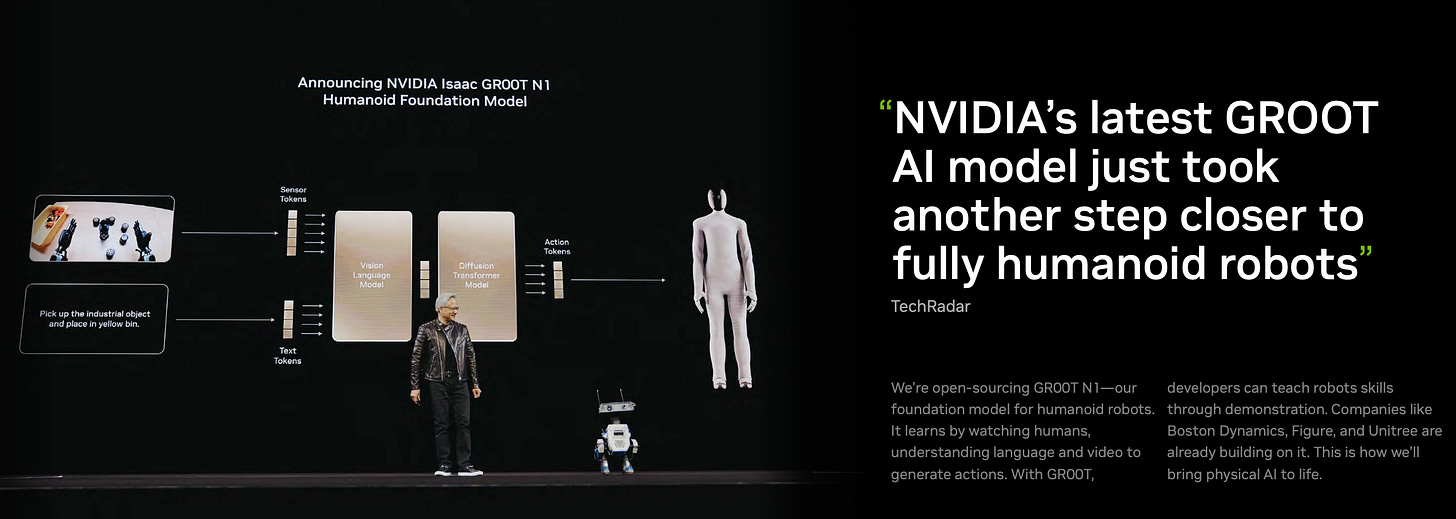

Trends in AI: Physical AI and autonomous systems

AI’s evolution from mere perception towards physical AI—machines that can understand, reason, plan, and interact physically—is one of the most critical trends shaping NVIDIA’s strategy. The integration of AI into robotics, autonomous vehicles, and industrial machinery requires sophisticated hardware and software stacks, precisely the domains NVIDIA excels in.

Partnerships such as NVIDIA’s collaboration with GM to develop autonomous vehicle fleets and its groundbreaking work with Disney and Google DeepMind on advanced robotics highlight the company’s central role in the physical AI revolution. Moreover, its new reasoning models like Llama Nemotron and platforms such as Cosmos promise revolutionary capabilities in robot training and autonomous operations.

Investment Case: Opportunities and risks

As we look to the future, the investment case for AI—and NVIDIA at the forefront—is compelling, but not without its caveats.

Opportunities:

High growth potential: The AI space is expanding rapidly, with applications set to revolutionize sectors from healthcare to finance. Companies like NVIDIA that are powering this transformation stand to benefit immensely as adoption accelerates.

Disruptive innovation: AI isn’t just enhancing existing business models; it’s creating entirely new ones. Early investors in key players could gain exposure to the next wave of industry-defining innovation.

Portfolio diversification: AI investments offer diversification benefits by spanning across industries and use cases. With its broad reach, NVIDIA offers exposure to multiple secular growth stories in one stock.

Risks:

Uncertainty and volatility: As a still-maturing field, AI remains vulnerable to swings in sentiment, regulatory shifts, and unforeseen technical challenges. This can lead to elevated volatility.

Valuation sensitivity: Given the forward-looking nature of AI investments, valuations often price in substantial growth. If execution falters or macro conditions tighten, high-multiple stocks like NVIDIA could face correction risks.

Ethical and social concerns: From job displacement to algorithmic bias and privacy issues, the ethical dimensions of AI development could impact public perception, regulatory scrutiny, and ultimately, adoption.

Conclusion

NVIDIA’s strategic shift towards comprehensive AI infrastructure, its robust valuation trajectory projecting a market cap of $4.5 trillion by 2030, and the ongoing sovereign AI capex surge firmly position the company as a cornerstone of the AI era. As AI moves into more practical, physical applications, NVIDIA’s integrated approach—from GPUs and software frameworks to expansive AI factories—ensures sustained growth and leadership in this transformative technological era.

I have a position in NVIDIA, however, the above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Teva Pharmaceuticals ($TEVA): Pivoting to sustainable growth and long-term returns

Teva held its Strategy and Innovation Day on May 29th confirming and expanding on its “Pivot to Growth” strategy as originally launched in May 2023.

Healthy Returns: 8 Stocks riding the wave of medical innovation

Introduction: Investing in the Future of Health and Wellbeing