Teva: Momentum building behind the neuroscience pipeline ($TEVA)

The narrative is shifting. This former generics giant becomes a neuroscience growth story with a blockbuster catalyst—and why it's still trading at a single-digit multiple.

Introduction

Teva has quietly been one of the most interesting turnaround stories in healthcare. Once seen primarily as a debt-heavy generics giant, the company is now reshaping itself into a focused branded and specialty player with real momentum in neuroscience. Recent market activity underscores the shift: on October 2nd, the largest change in U.S. call options open interest was in Teva, where 35,000 contracts of October 2025 $21 calls were added. That kind of flow suggests institutional investors are positioning for upside over the next 12 months.

At the same time, Teva’s stock has been showing technical strength. After bottoming earlier this year, shares have climbed back over $20, holding above both the 50-day and 200-day moving averages – a classic bullish setup. The improving chart, coupled with pipeline progress, gives me confidence that the stock is far from done.

Ajovy - A steady contributor with growth ahead

Ajovy, Teva’s anti-CGRP - anti-calcitonin gene-related peptide - therapy for migraine prevention, continues to deliver steady growth. In the latest quarterly previews, Ajovy sales are expected in the $70M range, slightly ahead of consensus. Importantly, this isn’t just about sales today – Ajovy is carving out a durable role in a large and growing migraine market.

While competitors like Lilly and Amgen also play in the CGRP space, Ajovy’s quarterly dosing option and improving access dynamics give it a long runway. Physicians and payors appear increasingly comfortable with Ajovy, and this product should remain an important branded pillar for Teva over the coming decade.

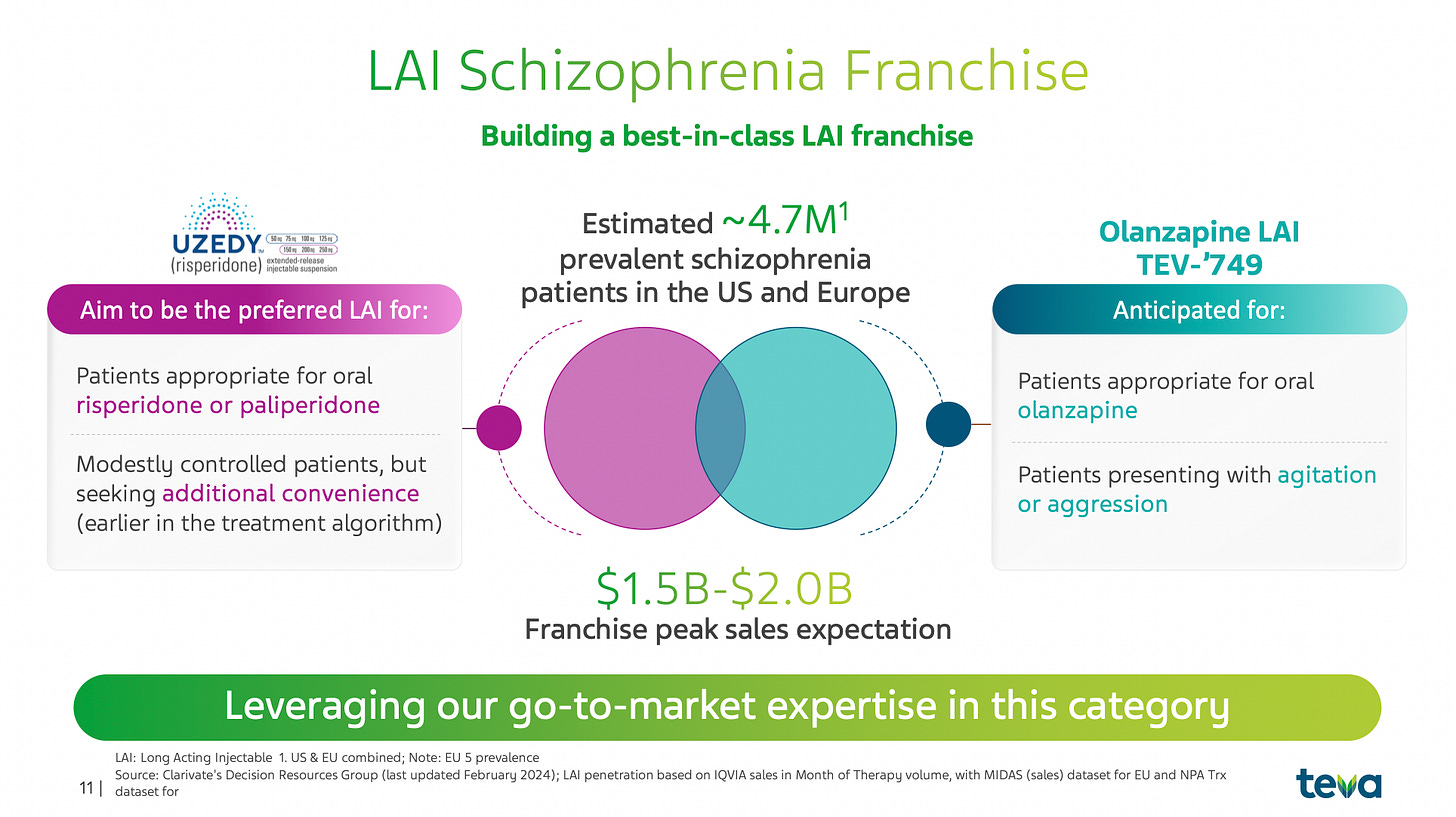

Olanzapine LAI (TEV-749) - A potential franchise maker

The real excitement today, in my view, lies with Teva’s long-acting injectable (LAI) olanzapine program. Data from the Phase 3 SOLARIS trial were presented in September, and the results are compelling.

Efficacy: TEV-749 met its primary and secondary endpoints across all three studied doses, with sustained improvements in schizophrenia symptoms (PANSS scores, CGI-S, PSP).

Safety: Crucially, no cases of post-injection delirium/sedation syndrome (PDSS) were observed across nearly 3,500 injections. This has been the major historical safety limitation for olanzapine LAIs. Teva’s SteadyTeq® formulation technology appears to have solved that issue.

Market Opportunity: The schizophrenia market is vast, with ~4.7M prevalent patients across the U.S. and EU. LAIs remain underpenetrated, with only ~20–30% of patients on long-acting injectables today. A safe and effective olanzapine LAI could become a true blockbuster. Teva itself estimates a $1.5–2.0B peak sales potential across its LAI franchise (UZEDY and TEV-749 combined).

Taken together, TEV-749 has the potential to redefine Teva’s position in psychiatry and build a durable branded revenue stream.

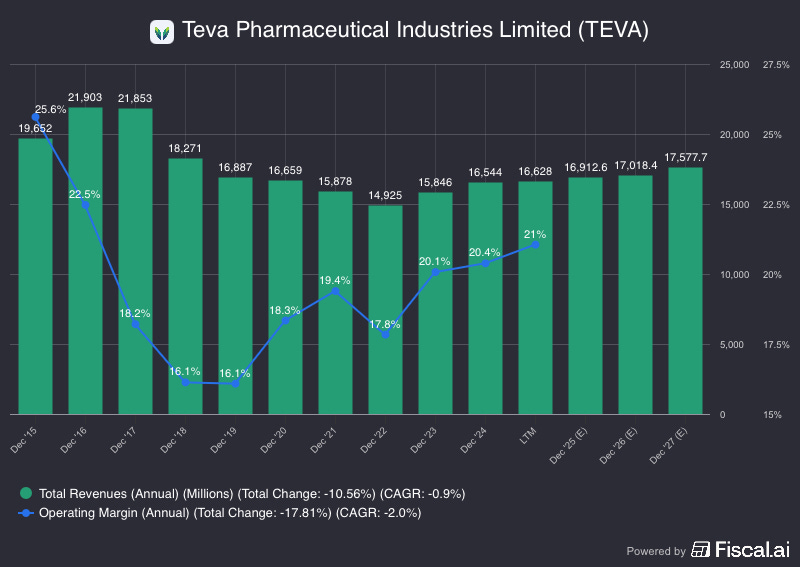

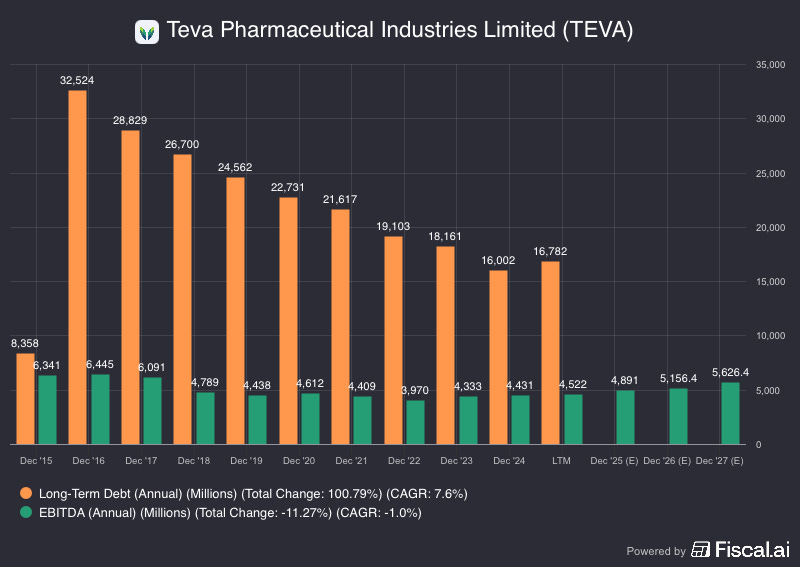

Financial Context - From overhangs to upside

Teva’s broader fundamentals are improving as well:

Revenue in 2025 is expected at ~$17B, with EPS around $2.60.

Margins are expanding, with EBIT margins approaching 27%+ and free cash flow generation strengthening.

Net debt has been coming down steadily, from over $18B two years ago to ~$11B expected by year-end 2025, with further deleveraging ahead, continuing down to 1x Net Debt to EBITDA.

For a company still trading at just ~7x 2025 earnings, this represents a combination of value and growth.

Conclusion

For years, Teva was a “show me” stock – weighed down by litigation, debt, and the perception that it was just another generic manufacturer. That narrative is shifting. With Ajovy steadying the branded base, Austedo continuing to perform, and Olanzapine LAI emerging as a potential franchise-maker, Teva finally has a specialty pipeline that commands attention.

The recent surge in call option activity is not accidental. Institutions are beginning to see what retail investors may have missed: Teva is no longer simply a deleveraging story. It’s a neuroscience growth story trading at a deep value multiple.

From here, I remain optimistic. TEVA at $20 may just be the start of a re-rating toward the mid-to-high $20s, with pipeline catalysts to push even further.

I have a position in Teva and find the current levels interesting for accumulation, however, the above is not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.

Teva Pharmaceuticals ($TEVA): Pivoting to sustainable growth and long-term returns

Teva held its Strategy and Innovation Day on May 29th confirming and expanding on its “Pivot to Growth” strategy as originally launched in May 2023.