Update on Teva Pharmaceuticals ($TEVA): Still a value opportunity while the company is rebuilding

Background

After years of underperformance and litigation overhang, Teva is turning a corner. In my view, the company is still mis-priced, trading at a deeply discounted valuation approximately 5.8x 2025 EPS estimate, the market is largely still overlooking the structural improvements the company is undergoing. With a clear cost optimization roadmap, a rebounding branded portfolio, and new clinical catalysts on the horizon, Teva holds a lot of potential to unlocking shareholder value. Let´s dive in!

Recent developments: Margin expansion in focus

Much of the market’s recent concern has centered around the anticipated loss of exclusivity (LOE) for g-Revlimid starting in 2026. Revlimid and its generic version is an oral cancer drug primarily used to treat multiple myeloma, myelodysplastic syndromes (MDS), and mantle cell lymphoma. It works by affecting the immune system and slowing the growth of cancer cells.It was developed by Celgene (acquired by Bristol-Myers Squibb in 2019) and became one of the highest-selling oncology drugs globally. At its peak, Revlimid generated over $12 billion in annual revenue for BMS.

Teva expects this LOE to result in a ~$1 billion revenue decline and ~$750 million EBITDA hit by 2027. This has pressured sentiment, especially with parallels drawn to past LOE events like Copaxone in 2018.

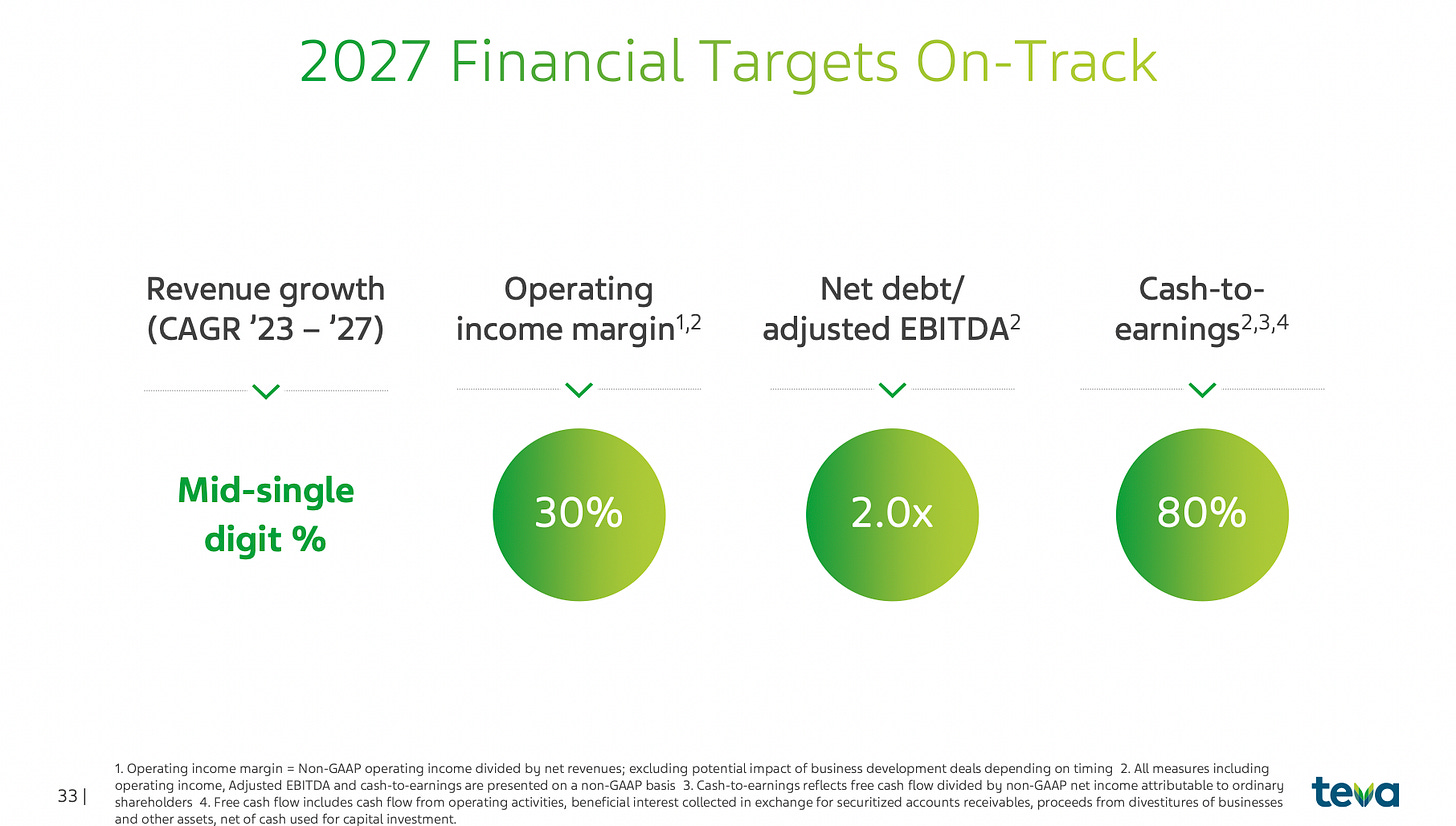

However, Teva’s management appears ready to offset these headwinds with a robust cost optimization plan expected to be unveiled in full during the Q1 2025 earnings call (takes place on May 7th). It appears that the company aims to cut ~$750 million in costs, with $580–600 million in COGS and ~$150 million in SG&A. If successful, this initiative could drive a significant operating margin expansion of more than 4% points by 2027 — lifting the EBIT margin to 30%.

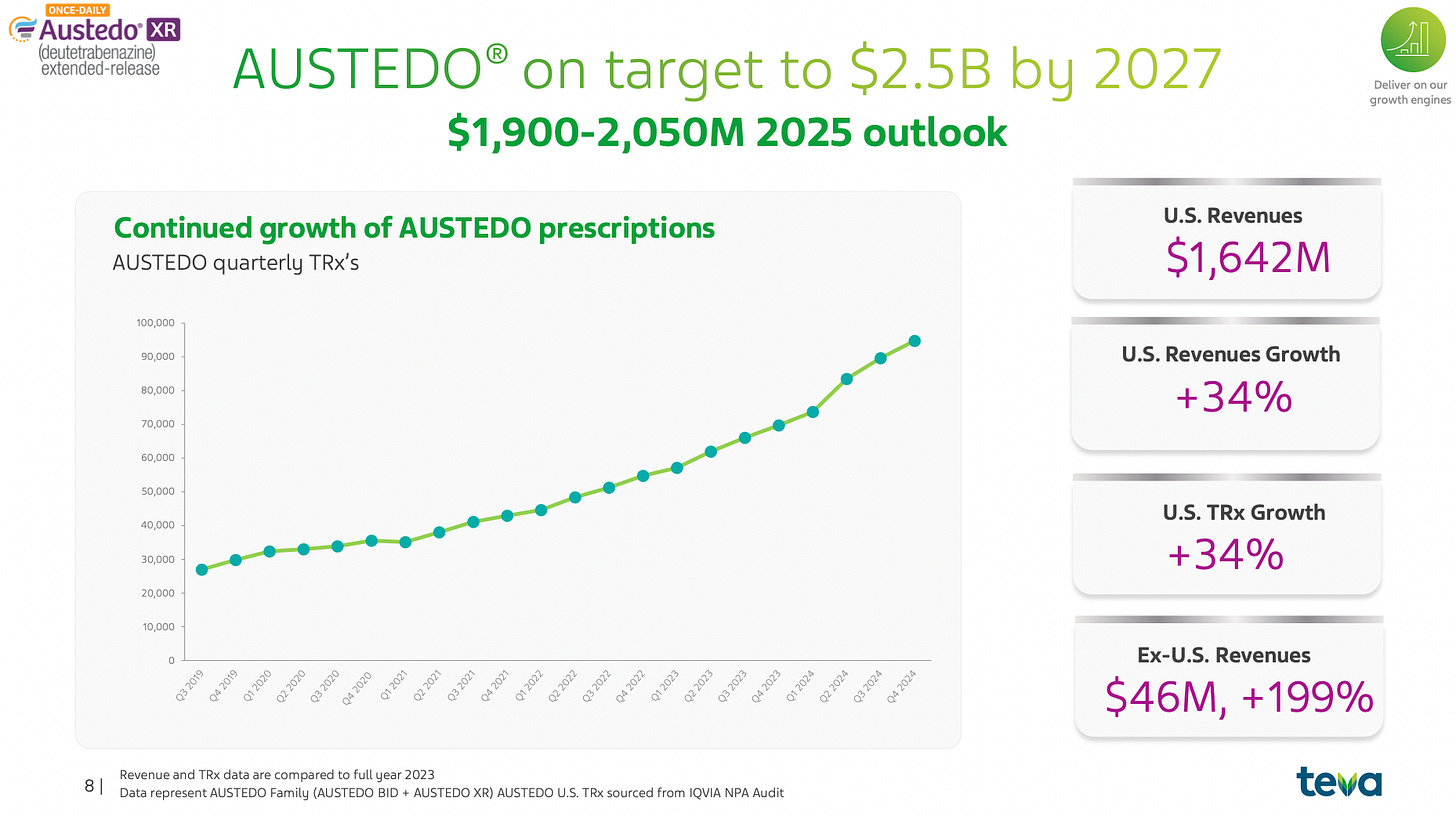

Meanwhile, the product mix continues to shift in Teva’s favor. The branded CNS portfolio (Austedo, Ajovy, and Uzedy) is growing strongly and especially Austedo is positioned well to continue to beat consensus estimates. The company also benefits from a tailwind in revenues outside USA due to FX movements, further supporting top-line stability.

Financials: Signs of a real turnaround

Teva reported revenues of $16.5 billion in 2024, and consensus projects $17.3 billion in 2025 — a 4.7% increase year over year. We can reasonably estimate 2025 EBITDA at $5.2 billion, representing an EBITDA margin of 30%. Importantly, gross margins are stabilizing in the 54–55% range despite generic Revlimid’s tapering, thanks in large part to the strength of Austedo, which boasts a 96% gross margin profile.

Looking further ahead, the company projects a modest 1% revenue step-down in 2026 due to the full Revlimid LOE. However, this decline is expected to be short-lived as operating leverage kicks in. EBIT margins are forecast to rise to 31.4% by 2029, and net earnings could grow from $3 billion in 2025 to $4.2 billion in 2029 — implying a CAGR of ~8.7%.

On valuation, Teva still looks attractively priced. The stock trades at just 5.8x 2025 EPS estimate and 4.4x 2029 EPS estimate. Free cash flow yield is expected to rise from 3.3% in 2025 to 16.7% by 2029. With net debt set to fall below 2.0x EBITDA by 2027 (from 2.4x in 2025), the improving balance sheet provides additional confidence.

None of this margin expansion or earnings growth seems priced into the stock. Teva remains one of the most discounted names in the pharma universe — yet the business is structurally improving.

Pipeline and growth drivers: From generic heavyweight to innovation-driven

Teva’s branded portfolio is becoming an increasingly important pillar of its growth story.

Austedo, used in treating tardive dyskinesia and Huntington’s chorea, is the standout performer. 2024 sales are expected to approach $1.9 billion, with projections of $2.4 billion in 2026 and more than $2.5 billion by 2027. Teva has launched the once-daily Austedo XR and is planning European expansion by 2026, both of which should support continued momentum.

Ajovy, the migraine prevention injection, is seeing modest U.S. growth but stronger traction in Europe and international markets. Teva expects mid-teens CAGR over the next few years.

Uzedy, an extended-release injectable antipsychotic, was launched in 2023 and is gaining commercial traction. Management expects $100 million in 2024 sales and sees meaningful upside as it penetrates the schizophrenia market.

But perhaps the most exciting pipeline asset is duvakitug (anti-TL1A), a novel immunology candidate in partnership with Sanofi. In December 2024, Teva announced encouraging Phase 2b data in both Crohn’s disease and ulcerative colitis — reporting best-in-class placebo-adjusted response rates among the TL1A class. This could become a meaningful value driver in the years ahead, particularly as the TL1A category gains traction in inflammatory bowel disease (a $20B+ global market).

Teva also has a robust biosimilar pipeline, with upcoming launches of Simlandi (Humira biosimilar) and Selarsdi (Stelara biosimilar) in 2025. Between now and 2027, the company expects six biosimilar launches — a key growth lever to supplement branded revenues and defend against generic erosion.

Risks and the road ahead

The biggest known risk remains the generic Revlimid LOE in 2026. While the company has laid out a path to offset the EBITDA loss through cost savings and product mix, execution will be critical. Failure to deliver on margin targets or commercial underperformance of key drugs like Austedo or duvakitug could dampen the upside case.

Litigation is no longer the overhang it once was. Teva has settled nationwide opioid claims, agreeing to pay up to $4.25 billion over 13 years — including both cash and product contributions. Importantly, this removes a significant source of uncertainty and frees up management to focus on operational execution. This is now a non-issue but is sometimes still brought into discussions about the company´s future.

Conclusion: A strong re-rate on the horizon

At current levels, Teva trades like a company in permanent decline. But the fundamentals tell a different story. Branded growth is real, biosimilar tailwinds are on the horizon, and cost discipline is improving margins. With a growing free cash flow profile, Teva looks increasingly like a misunderstood turnaround.

I use a DCF model for the valuation of Teva and use a discount rate of 8.5%, a Terminal Growth rate of 2%, and an EV/EBITDA multiple of 7.0x and get to a substantial upside.

I am long Teva and has been since late 2017, and find the price very attractive at the current level. The above is however not intended as investment advice.

With that, thanks for reading I truly appreciate the interest. Below are a few ideas for further readings and inspirations.